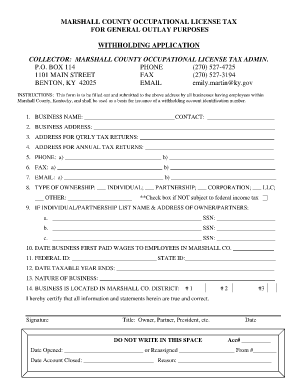

Marshall County Occupational License Tax Form

What is the Marshall County Occupational License Tax?

The Marshall County Occupational License Tax is a tax imposed on individuals and businesses operating within Marshall County, Kentucky. This tax is designed to fund local schools and essential services. It applies to various professions and business activities, ensuring that those who earn income within the county contribute to the community's educational resources. Understanding this tax is crucial for compliance and financial planning for both employees and business owners.

Steps to Complete the Marshall County Occupational License Tax

Completing the Marshall County Occupational License Tax involves several key steps to ensure accurate filing. Begin by gathering necessary information, such as your business details, income records, and any relevant identification numbers. Next, obtain the appropriate form, which may be available online or through the local tax office. Fill out the form carefully, ensuring all sections are completed accurately. Once completed, review the form for any errors before submitting it to the Marshall County Tax Administrator. Finally, keep a copy for your records and note any deadlines for payment to avoid penalties.

Required Documents

When filing the Marshall County Occupational License Tax, specific documents are required to support your application. These typically include:

- Proof of income, such as pay stubs or business financial statements

- Your Social Security number or Employer Identification Number (EIN)

- Completed occupational license tax form

- Any additional documentation requested by the tax office

Having these documents ready can streamline the filing process and ensure compliance with local regulations.

Form Submission Methods

The Marshall County Occupational License Tax form can be submitted through various methods to accommodate different preferences. You may choose to file online using a secure portal provided by the county, which allows for quick processing. Alternatively, you can mail the completed form to the Marshall County Tax Administrator's office. In-person submissions are also accepted during business hours, providing an opportunity to ask questions or clarify any concerns directly with staff. Each method has its own processing times, so consider your timeline when choosing how to submit.

Penalties for Non-Compliance

Failing to comply with the Marshall County Occupational License Tax requirements can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to understand the deadlines for filing and payment to avoid these consequences. Regularly reviewing your tax obligations and maintaining accurate records can help mitigate the risk of non-compliance and ensure that you meet your financial responsibilities.

Who Issues the Form?

The Marshall County Occupational License Tax form is issued by the Marshall County Tax Administrator's office. This office is responsible for overseeing the collection of occupational license taxes and ensuring compliance with local tax laws. If you have questions about the form or the filing process, the tax administrator's office can provide guidance and assistance. They are a valuable resource for understanding your obligations and navigating the tax system effectively.

Quick guide on how to complete marshall county occupational license tax

Complete Marshall County Occupational License Tax seamlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents promptly without delays. Handle Marshall County Occupational License Tax on any platform using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to edit and eSign Marshall County Occupational License Tax effortlessly

- Find Marshall County Occupational License Tax and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Generate your signature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Recheck the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require new copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Marshall County Occupational License Tax and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the marshall county occupational license tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the marshall county occupational license tax for schools, and how does it affect businesses?

The marshall county occupational license tax for schools is a tax levied on businesses operating in Marshall County to fund local schools. The tax is calculated based on your business’s revenue and ensures that educational institutions receive necessary financial support. Understanding this tax is crucial for compliance and to avoid penalties.

-

How can I determine my marshall county occupational license tax for schools?

To determine your marshall county occupational license tax for schools, you need to review your business’s annual revenue and consult the local tax authority for specific rates. You can also find calculators and guidelines on their website to obtain precise figures. Keeping detailed financial records can simplify this process.

-

What are the penalties for not paying the marshall county occupational license tax for schools?

Failure to pay the marshall county occupational license tax for schools can result in signNow penalties, including fines and interest on unpaid taxes. In severe cases, it may lead to the suspension of your business license. To avoid these issues, ensure timely payments and stay informed about your tax obligations.

-

How does airSlate SignNow help manage documents related to the marshall county occupational license tax for schools?

airSlate SignNow streamlines the process of managing documents related to the marshall county occupational license tax for schools by allowing businesses to eSign and send essential documents securely. This eliminates the hassle of paper forms and enables easy tracking of submissions to local authorities. Our platform enhances your document workflow efficiency.

-

Are there any software integrations with airSlate SignNow that assist with tax management?

Yes, airSlate SignNow offers integrations with various accounting and tax management software that can assist in handling the marshall county occupational license tax for schools. These integrations ensure that your documentation is tied to your financial records, creating a seamless workflow. This can be especially helpful during tax season.

-

What are the key benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those for the marshall county occupational license tax for schools, provides numerous benefits such as enhanced document security, reduced processing time, and easier compliance tracking. Our user-friendly platform makes it accessible and efficient for businesses of all sizes. Further, it reduces the risk of errors associated with traditional paper methods.

-

How much does airSlate SignNow cost for businesses looking to manage tax documents?

airSlate SignNow offers a variety of pricing plans, allowing businesses to choose based on their needs for managing documents related to the marshall county occupational license tax for schools. Plans are competitively priced and include essential features that enhance document management and eSignature capabilities. A free trial is also available to assess our services.

Get more for Marshall County Occupational License Tax

Find out other Marshall County Occupational License Tax

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online