Alberta Small Business Deduction At1 Schedule 1 Alberta Finance Finance Alberta 2012

Understanding the Alberta Small Business Deduction At1 Schedule 1

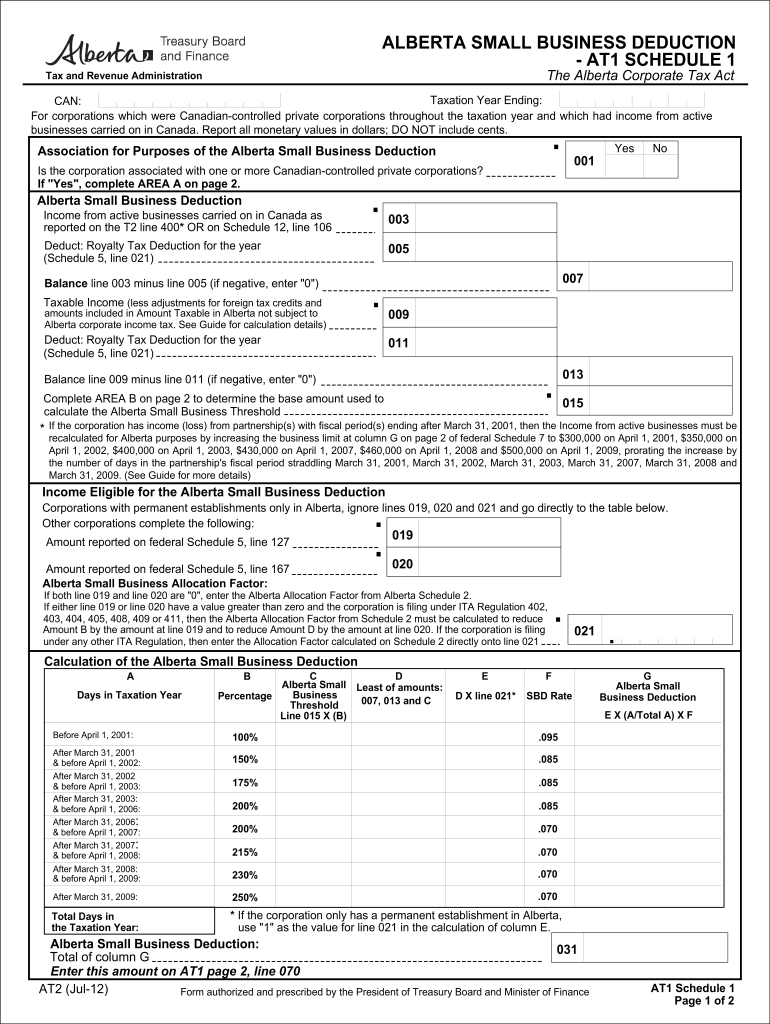

The Alberta Small Business Deduction At1 Schedule 1 is a crucial form for small business owners in Alberta, designed to help them claim a reduction in their corporate income tax. This deduction applies to active business income earned by Canadian-controlled private corporations. The form is essential for ensuring that businesses can benefit from lower tax rates, which can significantly impact their financial health and growth potential.

Steps to Complete the Alberta Small Business Deduction At1 Schedule 1

Completing the Alberta Small Business Deduction At1 Schedule 1 requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill in your business's identification information, ensuring it matches your corporate records.

- Calculate your active business income accurately, as this is the basis for your deduction.

- Complete all required fields on the form, double-checking for any errors or omissions.

- Review the completed form for compliance with current regulations before submission.

Eligibility Criteria for the Alberta Small Business Deduction At1 Schedule 1

To qualify for the Alberta Small Business Deduction, certain eligibility criteria must be met. Primarily, your business must be a Canadian-controlled private corporation. Additionally, the corporation must earn active business income, which excludes investment income and certain other types of revenue. Understanding these criteria is vital to ensure that your business can take full advantage of the deduction.

Required Documents for the Alberta Small Business Deduction At1 Schedule 1

When preparing to submit the Alberta Small Business Deduction At1 Schedule 1, ensure you have the following documents ready:

- Financial statements for the tax year, including income statements and balance sheets.

- Previous tax returns, if applicable, to provide context for your current submission.

- Any supporting documentation that verifies your business's active income.

Form Submission Methods for the Alberta Small Business Deduction At1 Schedule 1

The Alberta Small Business Deduction At1 Schedule 1 can be submitted through various methods. Businesses may choose to file online through the Alberta Finance website, which offers a streamlined process. Alternatively, forms can be mailed directly to the appropriate tax office or submitted in person. Each method has specific guidelines, so it is essential to follow the instructions carefully to avoid delays.

Penalties for Non-Compliance with the Alberta Small Business Deduction At1 Schedule 1

Failure to comply with the regulations surrounding the Alberta Small Business Deduction can result in significant penalties. These may include fines or interest charges on unpaid taxes. Additionally, incomplete or inaccurate submissions can lead to the denial of the deduction, which could adversely affect your business's financial situation. It is crucial to ensure all information is accurate and complete to avoid these consequences.

Quick guide on how to complete alberta small business deduction at1 schedule 1 alberta finance finance alberta

A brief guide on how to prepare your Alberta Small Business Deduction At1 Schedule 1 Alberta Finance Finance Alberta

Locating the correct template can be difficult when you need to produce formal international paperwork. Even if you possess the necessary form, it might be inconvenient to swiftly complete it according to all the specifications if you use printed versions instead of managing everything digitally. airSlate SignNow is the web-based electronic signature platform that assists you in overcoming all of that. It enables you to select your Alberta Small Business Deduction At1 Schedule 1 Alberta Finance Finance Alberta and effortlessly fill out and sign it on-site without needing to reprint documents whenever you make an error.

Here are the steps you should follow to prepare your Alberta Small Business Deduction At1 Schedule 1 Alberta Finance Finance Alberta with airSlate SignNow:

- Click the Get Form button to add your document to our editor right away.

- Begin with the first blank field, input your information, and move on with the Next tool.

- Complete the empty fields using the Cross and Check options from the toolbar above.

- Select the Highlight or Line features to emphasize the most crucial information.

- Click on Image and upload one if your Alberta Small Business Deduction At1 Schedule 1 Alberta Finance Finance Alberta requires it.

- Utilize the right-side panel to add extra fields for yourself or others to complete if necessary.

- Review your responses and finalize the template by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it with a camera or QR code.

- Conclude editing the form by clicking the Done button and selecting your file-sharing preferences.

Once your Alberta Small Business Deduction At1 Schedule 1 Alberta Finance Finance Alberta is prepared, you can share it as you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely save all your completed paperwork in your account, organized in folders according to your preferences. Don’t spend time on manual form filling; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct alberta small business deduction at1 schedule 1 alberta finance finance alberta

Create this form in 5 minutes!

How to create an eSignature for the alberta small business deduction at1 schedule 1 alberta finance finance alberta

How to make an eSignature for your Alberta Small Business Deduction At1 Schedule 1 Alberta Finance Finance Alberta in the online mode

How to create an electronic signature for the Alberta Small Business Deduction At1 Schedule 1 Alberta Finance Finance Alberta in Google Chrome

How to create an electronic signature for putting it on the Alberta Small Business Deduction At1 Schedule 1 Alberta Finance Finance Alberta in Gmail

How to make an eSignature for the Alberta Small Business Deduction At1 Schedule 1 Alberta Finance Finance Alberta right from your smartphone

How to generate an eSignature for the Alberta Small Business Deduction At1 Schedule 1 Alberta Finance Finance Alberta on iOS

How to generate an electronic signature for the Alberta Small Business Deduction At1 Schedule 1 Alberta Finance Finance Alberta on Android

People also ask

-

What is the Alberta Small Business Deduction At1 Schedule 1 and why is it important?

The Alberta Small Business Deduction At1 Schedule 1 is a crucial tax form for small businesses in Alberta, allowing them to benefit from reduced tax rates. This deduction is vital for enhancing cash flow and reinvesting in business growth. Understanding this form helps owners maximize their deductions and compliance with Alberta Finance regulations.

-

How can airSlate SignNow assist with managing the Alberta Small Business Deduction At1 Schedule 1?

airSlate SignNow simplifies the process of managing documents related to the Alberta Small Business Deduction At1 Schedule 1, allowing businesses to easily eSign and send necessary forms. With its user-friendly interface, you can streamline the documentation process, ensuring that your submissions to Alberta Finance are timely and efficient. This saves you time and reduces the risk of errors.

-

What features does airSlate SignNow offer for small businesses in Alberta?

airSlate SignNow provides essential features for small businesses, including document eSigning, templates, and secure storage. These features help you efficiently manage paperwork related to the Alberta Small Business Deduction At1 Schedule 1. Additionally, the platform integrates seamlessly with other tools to enhance productivity and organization.

-

Is airSlate SignNow a cost-effective solution for small businesses focusing on Alberta Finance?

Yes, airSlate SignNow is designed as a cost-effective solution for small businesses, especially those engaged with Alberta Finance. By reducing paper-related costs and expediting the signing process, businesses can save money and time ensuring compliance with the Alberta Small Business Deduction At1 Schedule 1. This affordability allows small businesses to focus resources on growth initiatives.

-

What are the benefits of using airSlate SignNow for the Alberta Small Business Deduction?

Using airSlate SignNow for managing the Alberta Small Business Deduction At1 Schedule 1 offers numerous benefits, such as enhanced efficiency and automated workflows. The ability to track document status and integrate with accounting software optimizes your operations. Additionally, it ensures your business remains compliant with Alberta Finance requirements.

-

Can airSlate SignNow integrate with accounting software for easier management of Alberta Finance documentation?

Absolutely! airSlate SignNow can integrate with various accounting software, making it easier to manage your Alberta Finance documentation. This integration enhances the tracking of expenses and deductions related to the Alberta Small Business Deduction At1 Schedule 1. By having everything connected, your workflow becomes more cohesive and streamlined.

-

What types of businesses can benefit from the Alberta Small Business Deduction?

Small businesses that operate in Alberta and meet specific criteria set by Alberta Finance can benefit from the Alberta Small Business Deduction At1 Schedule 1. This deduction primarily applies to companies with income limits and those looking to reduce their taxable income. Leveraging this deduction is critical for maintaining financial health and promoting growth.

Get more for Alberta Small Business Deduction At1 Schedule 1 Alberta Finance Finance Alberta

- Mdes affidavit form

- First article inspection report template excel form

- Community development district addendum form

- Mie report example 95215042 form

- Weekly math review q3 7 answer key form

- City of peoria ride along form

- Civ 010fl 935 application for appointment of guardian ad litem civil and family law judicial council forms

- Career and student employment services slcc form

Find out other Alberta Small Business Deduction At1 Schedule 1 Alberta Finance Finance Alberta

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself