Employee Loan Agreement Form

What is the Employee Loan Agreement

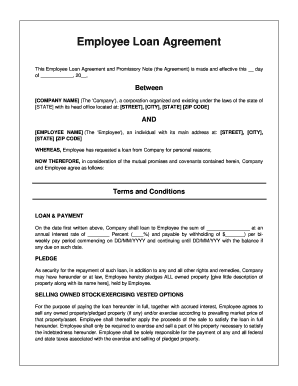

An employee loan agreement is a formal document that outlines the terms and conditions under which an employer lends money to an employee. This agreement serves as a promissory note, detailing the amount borrowed, interest rates, repayment terms, and any collateral involved. It is essential for protecting both the employer's and employee's rights and ensuring clarity in the loan process. The employee loan agreement promissory note template provides a structured format to facilitate this process, making it easier for both parties to understand their obligations.

Key Elements of the Employee Loan Agreement

When drafting an employee loan agreement, several key elements should be included to ensure its effectiveness and legal validity:

- Loan Amount: Specify the total amount being loaned to the employee.

- Interest Rate: Outline the interest rate applicable to the loan, if any.

- Repayment Schedule: Detail the timeline for repayments, including due dates and frequency.

- Consequences of Default: Explain the repercussions if the employee fails to repay the loan as agreed.

- Signatures: Ensure both parties sign the agreement to validate it legally.

Steps to Complete the Employee Loan Agreement

Completing an employee loan agreement involves several important steps to ensure accuracy and compliance:

- Gather necessary information, including the employee's details and loan amount.

- Choose the appropriate employee loan agreement promissory note template.

- Fill in the template with the relevant details, including terms and conditions.

- Review the document with the employee to ensure mutual understanding.

- Obtain signatures from both the employer and employee to finalize the agreement.

Legal Use of the Employee Loan Agreement

The employee loan agreement must comply with federal and state laws to be considered legally binding. It is crucial to adhere to the guidelines set forth by the ESIGN Act and UETA, which govern electronic signatures and documents. Additionally, understanding state-specific regulations regarding loans and employment is vital to ensure the agreement's enforceability. Utilizing a reliable platform for eSigning, such as signNow, can help maintain compliance and security throughout the process.

How to Use the Employee Loan Agreement

Using the employee loan agreement involves several practical steps to facilitate the lending process. First, employers should clearly communicate the purpose of the loan and any specific requirements. Next, they can provide the employee with the completed agreement for review. Once both parties are satisfied with the terms, they can proceed to sign the document electronically or in person. It is advisable to keep a copy of the signed agreement for record-keeping and future reference.

Examples of Using the Employee Loan Agreement

Employee loan agreements can be utilized in various scenarios, including:

- Funding employee education or training programs.

- Assisting employees with medical expenses.

- Providing financial support for home purchases or repairs.

- Facilitating the purchase of company equipment, such as laptops.

These examples illustrate the versatility of the employee loan agreement and its potential to support employees in achieving their financial goals.

Quick guide on how to complete employee loan agreement

Complete Employee Loan Agreement effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as a perfect environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Employee Loan Agreement on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Employee Loan Agreement seamlessly

- Find Employee Loan Agreement and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign Employee Loan Agreement and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employee loan agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an employee loan agreement promissory note template?

An employee loan agreement promissory note template is a legal document that outlines the terms of a loan extended to an employee by their employer. It typically includes information such as the loan amount, repayment schedule, interest rates, and any penalties for late payment. Using a template simplifies the process, ensuring both parties understand their obligations.

-

How can I customize an employee loan agreement promissory note template with airSlate SignNow?

With airSlate SignNow, you can easily customize your employee loan agreement promissory note template by adding your company's branding, modifying terms, and including specific clauses as needed. Our user-friendly interface allows you to make adjustments quickly, ensuring your document meets your business requirements while remaining compliant with legal standards.

-

Is the employee loan agreement promissory note template legally binding?

Yes, the employee loan agreement promissory note template becomes legally binding once both the employer and employee sign the document. It serves as proof of the loan agreement and protects the interests of both parties. To ensure enforceability, it's crucial to adhere to local laws and regulations when drafting the agreement.

-

What are the benefits of using an employee loan agreement promissory note template?

Using an employee loan agreement promissory note template offers several benefits, including saving time and reducing legal risks. It ensures consistency in loan agreements and eliminates the need to start from scratch. Moreover, it helps clarify the expectations and responsibilities of both the employer and employee, fostering a transparent working relationship.

-

How much does an employee loan agreement promissory note template cost with airSlate SignNow?

The cost of using an employee loan agreement promissory note template with airSlate SignNow typically includes a subscription fee that varies based on the features you choose. We offer flexible pricing plans to accommodate businesses of all sizes, providing access to a range of document management tools. For specific pricing details, visit our website or contact our sales team.

-

Can I integrate the employee loan agreement promissory note template with other software?

Yes, airSlate SignNow allows you to integrate your employee loan agreement promissory note template with various third-party applications such as CRMs, HR systems, and payment processors. This integration helps streamline your workflow, making it easier to manage and track loans provided to employees. Check our integration options to see what's available.

-

Are there any security features for the employee loan agreement promissory note template?

Absolutely! airSlate SignNow prioritizes security, offering features such as encryption, secure access controls, and audit trails for your employee loan agreement promissory note template. These security measures protect sensitive information and ensure that documents are accessed only by authorized personnel, fostering trust between employers and employees.

Get more for Employee Loan Agreement

- F a a form 5100 109 project evaluation review and development analysis faa form 5100 109 faa

- Ia renewal activity record ia renewal form

- Ac43 9c form

- Subject guide for developing and form

- Ac 145 5 repair station internal evaluation programs chg 1 repair station internal evaluation programs form

- Part 391 driver qualification missouri department of form

- Out of state instructors form

- Form 6 atf new

Find out other Employee Loan Agreement

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document