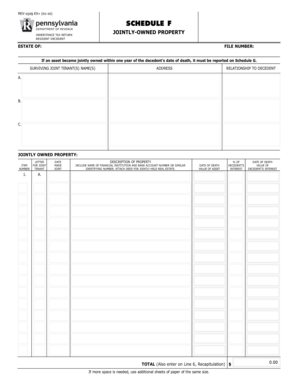

Pa Rev 1509 Schedule F Form

What is the Pa Rev 1509 Schedule F

The Pa Rev 1509 Schedule F is a form used in Pennsylvania for reporting income from farming activities. This schedule is essential for individuals and businesses engaged in agricultural operations, allowing them to detail their income, expenses, and net profit or loss from farming. It is typically filed alongside the Pennsylvania personal income tax return. Understanding the specifics of this form is crucial for accurate reporting and compliance with state tax regulations.

How to use the Pa Rev 1509 Schedule F

Using the Pa Rev 1509 Schedule F involves several steps to ensure accurate completion. First, gather all necessary financial records related to farming activities, including income statements and expense receipts. Next, fill out the form by detailing income sources, such as sales of crops or livestock, and listing allowable expenses, such as feed, equipment, and maintenance costs. After completing the form, review it for accuracy before submission to ensure compliance with Pennsylvania tax laws.

Steps to complete the Pa Rev 1509 Schedule F

Completing the Pa Rev 1509 Schedule F requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents related to your farming activities.

- List all sources of income derived from farming on the form.

- Document all allowable expenses, ensuring you have supporting receipts.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Legal use of the Pa Rev 1509 Schedule F

The legal use of the Pa Rev 1509 Schedule F is governed by Pennsylvania tax law. This form must be filled out accurately to reflect true income and expenses from farming activities. Misreporting can lead to penalties or audits. It is essential to adhere to the guidelines set forth by the Pennsylvania Department of Revenue to ensure that the form is used legally and effectively in tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Pa Rev 1509 Schedule F align with Pennsylvania's personal income tax return deadlines. Typically, the deadline is April 15 of each year, unless it falls on a weekend or holiday. It is crucial for filers to be aware of these dates to avoid late fees and ensure timely compliance with state tax regulations.

Required Documents

To complete the Pa Rev 1509 Schedule F, specific documents are required. These include:

- Income statements from farming activities.

- Receipts for all farming-related expenses.

- Previous tax returns, if applicable, for reference.

- Any additional documentation that supports claims made on the form.

Quick guide on how to complete pa rev 1509 schedule f

Complete Pa Rev 1509 Schedule F seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the essential tools needed to create, edit, and eSign your documents promptly and without interruptions. Manage Pa Rev 1509 Schedule F across any platform with airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

The simplest method to edit and eSign Pa Rev 1509 Schedule F effortlessly

- Find Pa Rev 1509 Schedule F and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, cumbersome form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Pa Rev 1509 Schedule F and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa rev 1509 schedule f

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rev 1509 in airSlate SignNow?

Rev 1509 refers to a specific version of the airSlate SignNow platform that includes enhanced features and improvements for document management. This version aims to improve user experience and streamline processes for businesses looking to eSign documents efficiently.

-

How does pricing work for the rev 1509 version of airSlate SignNow?

Pricing for the rev 1509 version of airSlate SignNow varies based on the plan you choose, including options for individuals and businesses. You can opt for monthly or annual billing, with competitive rates designed to fit a range of budgets.

-

What key features are included in rev 1509?

Rev 1509 offers several key features such as customizable templates, real-time tracking, and advanced security options. These features are designed to make the eSigning process seamless and efficient for all users.

-

What are the benefits of using rev 1509 for businesses?

Businesses can benefit from rev 1509 through increased efficiency in document workflows and reduced turnaround times for obtaining signatures. The user-friendly interface also allows employees to adopt eSigning without extensive training.

-

Does rev 1509 integrate with other software?

Yes, rev 1509 is designed to integrate with a variety of software applications, including popular tools for CRM, project management, and cloud storage. This compatibility enhances workflow and ensures smooth documentation processes across platforms.

-

Is there a free trial available for rev 1509?

Yes, airSlate SignNow offers a free trial of the rev 1509 version, allowing prospective customers to explore its features and benefits without any commitment. This trial period is an excellent opportunity to determine how well the service meets your needs.

-

How does rev 1509 ensure document security?

Rev 1509 prioritizes document security by employing advanced encryption methods and secure access protocols. This ensures that all eSigned documents are protected, reducing the risk of data bsignNowes and boosting user confidence.

Get more for Pa Rev 1509 Schedule F

- Self certification checklist of items city of chicago form

- Adams national historical park u s national park service form

- Easy permit application city chicago form

- Assignment and consent to assignment of sublease sec gov form

- Usgs form 9 3010 sm 403 2 figure 1 open market simplified acquisition memorandum usgs

- Up to date please contact your agency or service to update your tsp address of record before you apply for the loan form

- Permit applications amp forms city of arlington

- Fixed asset form project name project location d

Find out other Pa Rev 1509 Schedule F

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template