It 214 Form

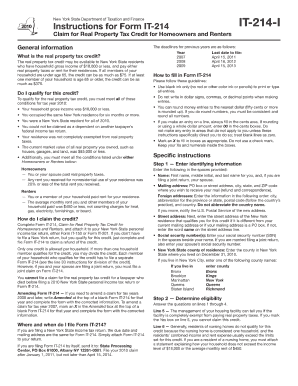

What is the IT 214 Form?

The IT 214 form, also known as the IT-214 Claim for the New York State School Tax Relief (STAR) exemption, is a crucial document for homeowners in New York. This form allows eligible homeowners to apply for a reduction in their school property taxes. The exemption is aimed at providing financial relief to those who qualify, thereby making homeownership more affordable. Understanding the specific requirements and benefits associated with the IT 214 form is essential for homeowners looking to reduce their tax burden.

How to Obtain the IT 214 Form

Homeowners can obtain the IT 214 form from several sources. The most straightforward method is to visit the official New York State Department of Taxation and Finance website, where the form is available for download. Additionally, local tax offices may provide physical copies of the form. It is important to ensure that you are using the correct version of the form for the relevant tax year, as updates may occur annually.

Steps to Complete the IT 214 Form

Completing the IT 214 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including proof of income and property ownership.

- Fill out personal information, such as your name, address, and Social Security number.

- Provide details about your property, including its location and type.

- Indicate your eligibility for the STAR exemption by answering the relevant questions.

- Review the form for accuracy before submission.

Completing the form accurately is crucial to ensure that your application is processed without delays.

Legal Use of the IT 214 Form

The IT 214 form is legally binding and must be filled out truthfully. Misrepresentation or providing false information can lead to penalties, including the denial of your exemption claim. It is vital to understand the legal implications of submitting this form, as it is used by the New York State government to assess eligibility for tax relief. Homeowners should keep a copy of the completed form for their records.

Filing Deadlines / Important Dates

Filing deadlines for the IT 214 form are critical for homeowners seeking the STAR exemption. Typically, the application must be submitted by a specific date each year, often in March or April, to be eligible for the upcoming tax year. Homeowners should check the New York State Department of Taxation and Finance website for the exact dates and any updates that may affect the filing timeline.

Examples of Using the IT 214 Form

There are various scenarios in which homeowners might use the IT 214 form. For instance, first-time homebuyers can apply for the STAR exemption to reduce their school taxes. Additionally, seniors or individuals with disabilities may also qualify for enhanced exemptions under the STAR program. Understanding these examples can help homeowners identify their eligibility and take advantage of the benefits provided by the IT 214 form.

Quick guide on how to complete it 214 form

Effortlessly Prepare It 214 Form on Any Device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without issues. Handle It 214 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and eSign It 214 Form Effortlessly

- Find It 214 Form and then click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight important sections of the documents or obscure sensitive data using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Alter and eSign It 214 Form while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 214 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 214 form 2014 and why is it important?

The it 214 form 2014 is a tax-related form used to request certain deductions or credits during the filing process. Understanding this form is essential for maximizing your tax benefits and ensuring compliance with state tax regulations.

-

How can airSlate SignNow streamline the completion of the it 214 form 2014?

With airSlate SignNow, you can easily complete the it 214 form 2014 electronically, eliminating the hassle of printing and mailing documents. Our platform allows users to fill out the form digitally and send it for eSignature, ensuring a faster, more efficient process.

-

What features does airSlate SignNow offer for handling the it 214 form 2014?

AirSlate SignNow provides various features to assist you with the it 214 form 2014, such as customizable templates, secure eSignature options, and document tracking. These features enable you to manage your forms with ease and confidence.

-

Is there a cost associated with using airSlate SignNow for the it 214 form 2014?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, which include features specifically designed for managing forms like the it 214 form 2014. You can choose a plan that fits your business requirements and budget.

-

Can I integrate airSlate SignNow with other software to manage the it 214 form 2014?

Absolutely! AirSlate SignNow supports integrations with many popular software applications, allowing you to streamline the management of the it 214 form 2014 within your existing workflow. This integration simplifies document sharing and enhances overall productivity.

-

What benefits can I expect from using airSlate SignNow for the it 214 form 2014?

By utilizing airSlate SignNow for the it 214 form 2014, you gain access to a user-friendly interface, enhanced security features, and the ability to complete and sign documents from anywhere. This helps businesses save time and reduce the risk of errors.

-

Is airSlate SignNow secure for handling sensitive information in the it 214 form 2014?

Yes, airSlate SignNow prioritizes security, utilizing encryption protocols to protect sensitive information within the it 214 form 2014. Your documents are stored securely, ensuring that only authorized users can access them, thus safeguarding your data.

Get more for It 214 Form

Find out other It 214 Form

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy