Application for a Refund of the Fuel Tax Paid by a First 2023-2026

What is the Application For A Refund Of The Fuel Tax Paid By A First

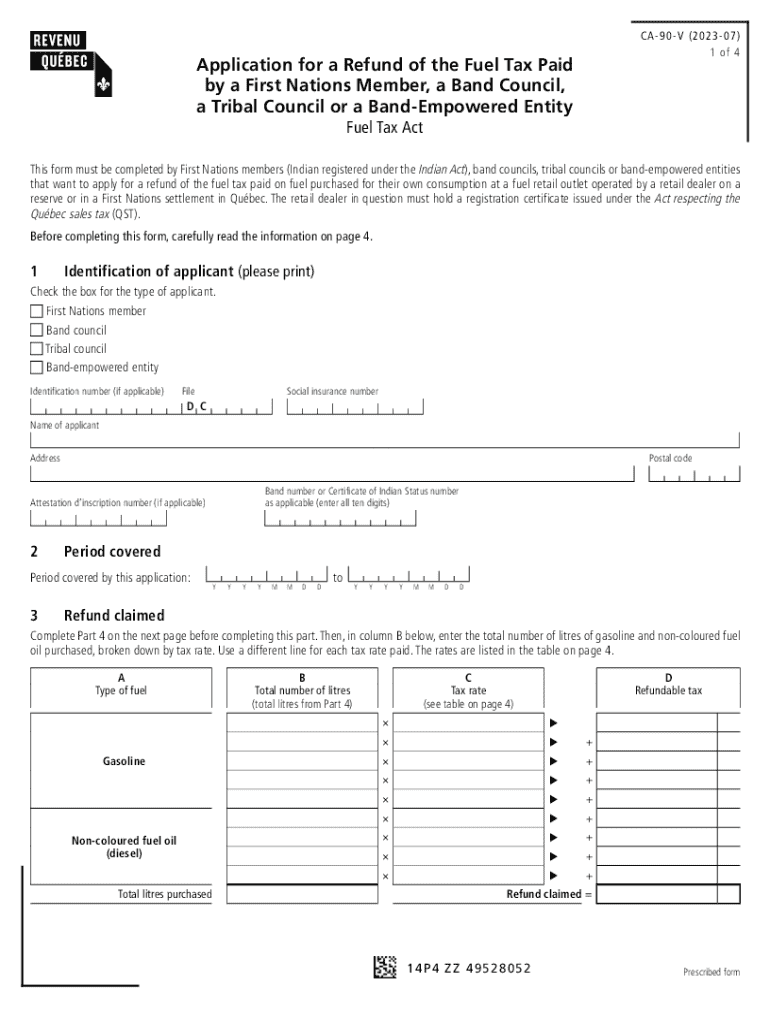

The Application For A Refund Of The Fuel Tax Paid By A First is a formal request submitted by individuals or businesses seeking reimbursement for fuel taxes they have paid. This application is particularly relevant for first-time applicants who may be eligible for a refund due to specific circumstances, such as using fuel for non-taxable purposes. Understanding the purpose of this application is crucial for those looking to recover funds that may have been overpaid or incorrectly assessed.

Key elements of the Application For A Refund Of The Fuel Tax Paid By A First

Several key elements are essential when completing the Application For A Refund Of The Fuel Tax Paid By A First. These include:

- Applicant Information: This section requires the name, address, and contact details of the individual or business submitting the application.

- Fuel Tax Details: Applicants must provide information regarding the type and amount of fuel tax paid, including relevant invoices or receipts.

- Reason for Refund: A clear explanation of why the refund is being requested must be included, detailing the non-taxable use of the fuel.

- Signature: The application must be signed by the applicant or an authorized representative to validate the request.

Steps to complete the Application For A Refund Of The Fuel Tax Paid By A First

Completing the Application For A Refund Of The Fuel Tax Paid By A First involves several steps to ensure accuracy and compliance:

- Gather all necessary documentation, including receipts and invoices related to the fuel tax paid.

- Fill out the application form, ensuring all required fields are completed accurately.

- Provide a detailed explanation for the refund request, citing specific non-taxable uses of the fuel.

- Review the application for completeness and accuracy before submission.

- Submit the application through the designated method, whether online, by mail, or in person.

Required Documents

When submitting the Application For A Refund Of The Fuel Tax Paid By A First, certain documents are required to support the claim. These typically include:

- Invoices or receipts that detail the fuel purchases and the taxes paid.

- Any relevant documentation that outlines the non-taxable use of the fuel.

- Identification or business registration documents, if applicable.

Eligibility Criteria

To qualify for a refund through the Application For A Refund Of The Fuel Tax Paid By A First, applicants must meet specific eligibility criteria. Generally, applicants should:

- Have paid fuel taxes on fuel used for non-taxable purposes.

- Provide adequate documentation to support their claim.

- Submit the application within the required timeframe set by the relevant tax authority.

Form Submission Methods

The Application For A Refund Of The Fuel Tax Paid By A First can be submitted through various methods, depending on the preferences of the applicant and the requirements of the tax authority. Common submission methods include:

- Online Submission: Many tax authorities offer an online portal for applicants to submit their forms electronically.

- Mail: Applicants can print the completed form and send it via postal mail to the designated office.

- In-Person: Some applicants may choose to deliver their application in person at a local tax office.

Create this form in 5 minutes or less

Find and fill out the correct application for a refund of the fuel tax paid by a first

Create this form in 5 minutes!

How to create an eSignature for the application for a refund of the fuel tax paid by a first

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Application For A Refund Of The Fuel Tax Paid By A First'?

The 'Application For A Refund Of The Fuel Tax Paid By A First' is a formal request that allows eligible individuals or businesses to reclaim fuel taxes that have been paid. This application is essential for those who qualify under specific criteria, ensuring they receive the refunds they are entitled to.

-

How can airSlate SignNow assist with the 'Application For A Refund Of The Fuel Tax Paid By A First'?

airSlate SignNow streamlines the process of completing and submitting the 'Application For A Refund Of The Fuel Tax Paid By A First'. Our platform allows users to easily fill out the necessary forms, eSign them, and send them directly to the relevant authorities, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for my refund application?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you're a small business or a large enterprise, you can choose a plan that fits your budget while efficiently managing your 'Application For A Refund Of The Fuel Tax Paid By A First'.

-

Are there any features specifically designed for the 'Application For A Refund Of The Fuel Tax Paid By A First'?

Yes, airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning that are particularly beneficial for the 'Application For A Refund Of The Fuel Tax Paid By A First'. These tools enhance efficiency and ensure compliance with regulatory requirements.

-

What benefits can I expect from using airSlate SignNow for my refund application?

Using airSlate SignNow for your 'Application For A Refund Of The Fuel Tax Paid By A First' provides numerous benefits, including faster processing times, reduced paperwork, and enhanced security. Our platform simplifies the entire process, allowing you to focus on your core business activities.

-

Can I integrate airSlate SignNow with other software for my refund application?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to incorporate the 'Application For A Refund Of The Fuel Tax Paid By A First' into your existing workflows. This integration capability enhances productivity and ensures a smooth user experience.

-

Is there customer support available for assistance with my refund application?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions or issues related to your 'Application For A Refund Of The Fuel Tax Paid By A First'. Our support team is available to guide you through the process and ensure you have a positive experience.

Get more for Application For A Refund Of The Fuel Tax Paid By A First

- Pdf section 8 application form

- Global assessment functioning gaf form

- Application for export certificate food safety and inspection service fsis usda form

- I 9 form 100304848

- Modelo sc 6042 departamento de hacienda de puerto rico hacienda gobierno form

- Dodd frank certification requirement select mediation llc form

- Ins5210 form

- Counseling intake forms samples

Find out other Application For A Refund Of The Fuel Tax Paid By A First

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile