Form 10f

What is the Form 10F

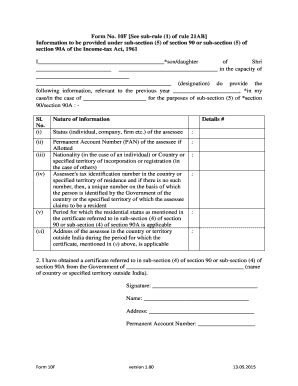

The Form 10F is a document used primarily for tax purposes in India, designed for non-resident taxpayers. It serves as a declaration of the tax residency status of individuals or entities claiming benefits under the Double Taxation Avoidance Agreement (DTAA) between India and their country of residence. This form is essential for those who wish to avail themselves of reduced withholding tax rates on income sourced from India, such as dividends, interest, and royalties.

How to Obtain the Form 10F

To obtain the Form 10F, individuals or entities can download it from the official website of the Indian tax authority or request it from their financial advisor or tax consultant. The form is typically available in a PDF format, which can be printed and filled out. It is important to ensure that the latest version of the form is used to comply with current regulations.

Steps to Complete the Form 10F

Completing the Form 10F involves several key steps:

- Provide personal information, including the name, address, and country of residence.

- Indicate the taxpayer identification number (TIN) or equivalent in the country of residence.

- Specify the nature of the income for which the form is being submitted.

- Declare the period for which the residency is applicable.

- Sign and date the form to authenticate the information provided.

Legal Use of the Form 10F

The Form 10F is legally binding when completed accurately and submitted to the appropriate Indian tax authorities. It is crucial for non-residents to ensure that all information is correct to avoid issues with tax compliance. The form must be submitted along with other relevant documentation to claim tax benefits under the DTAA.

Key Elements of the Form 10F

Key elements of the Form 10F include:

- Name and address: Details of the taxpayer claiming the benefits.

- Country of residence: Must be clearly stated to establish eligibility for tax treaty benefits.

- Tax identification number: Essential for verification of residency status.

- Nature of income: Clearly specify the type of income being reported.

- Period of residency: Indicate the duration for which the residency claim is valid.

Form Submission Methods

The Form 10F can be submitted through various methods, including:

- Online submission: Some taxpayers may be able to submit the form electronically through the Indian tax department's portal.

- Mail: The completed form can be mailed to the relevant tax office in India.

- In-person: Taxpayers may also choose to submit the form in person at designated tax offices.

Quick guide on how to complete form 10f 78594417

Complete Form 10f effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the necessary form and securely archive it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly without hold-ups. Manage Form 10f on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 10f without difficulty

- Find Form 10f and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 10f and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 10f 78594417

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 10f and how can airSlate SignNow help?

Form 10f is an essential document for tax purposes that allows non-residents to claim benefits under tax treaties. airSlate SignNow streamlines the process of filling out and signing this form, making it easy for businesses to manage their tax documentation efficiently.

-

Is airSlate SignNow suitable for businesses needing to manage form 10f?

Yes, airSlate SignNow is designed for businesses of all sizes that need to handle form 10f and other important documents. Its intuitive platform simplifies the eSigning process, ensuring that your form 10f is completed quickly and accurately.

-

What features does airSlate SignNow offer for managing form 10f?

airSlate SignNow includes features such as document templates, secure eSignature capabilities, and collaboration tools. These features are particularly beneficial for managing form 10f, as they help ensure that the document is filled out correctly and signed in compliance with regulations.

-

Are there any costs associated with using airSlate SignNow for form 10f?

airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide value through cost-effective solutions for managing form 10f and other documents, with no hidden fees or long-term commitments.

-

Can I integrate airSlate SignNow with other applications for form 10f management?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for managing form 10f. This integration capability allows for better data management and ease of access to your documents across different platforms.

-

How does airSlate SignNow ensure the security of form 10f documents?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption protocols to protect your form 10f and other sensitive documents, ensuring that your data remains confidential and secure throughout the signing process.

-

What benefits can I expect when using airSlate SignNow for form 10f?

Using airSlate SignNow for form 10f offers several benefits, including reduced paperwork, increased efficiency, and improved compliance with tax regulations. The platform simplifies document handling, enabling you to focus on your business instead of administrative tasks.

Get more for Form 10f

Find out other Form 10f

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe