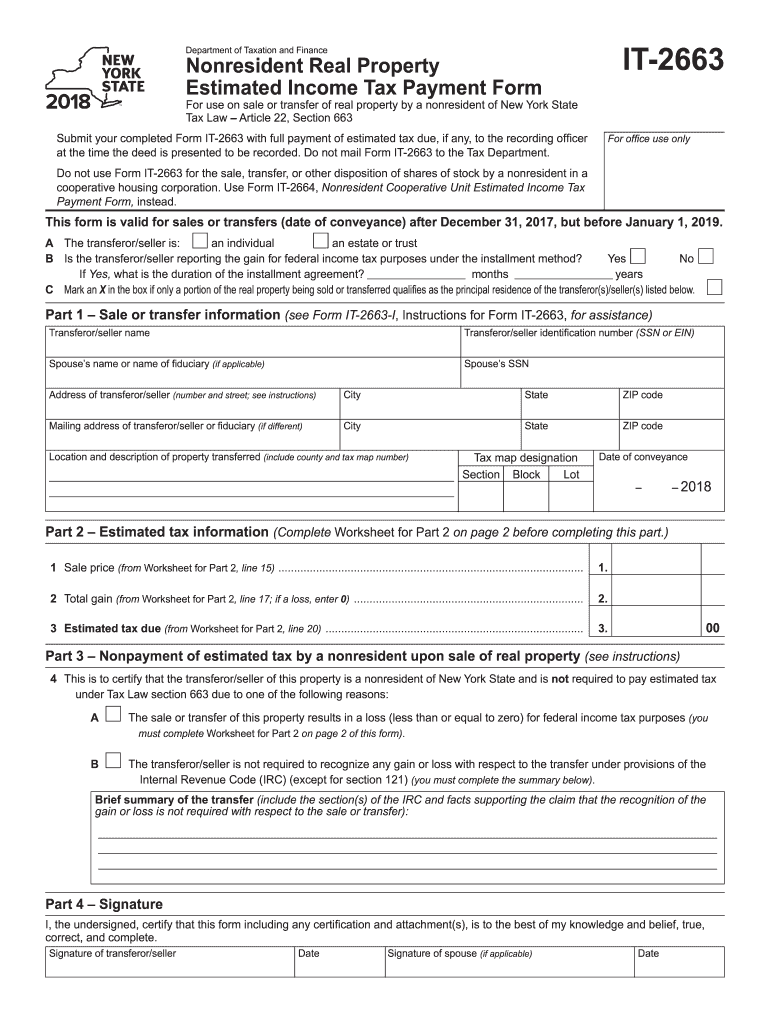

it 2663 Form 2018

What is the It 2663 Form

The It 2663 Form is a tax document used in the United States for specific reporting purposes. It is designed to collect information from taxpayers regarding their financial activities and obligations. This form is particularly relevant for individuals and businesses who need to report certain income types or claim specific deductions. Understanding the purpose of the It 2663 Form is essential for ensuring compliance with tax regulations and for accurate tax reporting.

How to use the It 2663 Form

Using the It 2663 Form involves several key steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, such as income statements and receipts. Next, fill out the form with the relevant details, ensuring that all fields are completed accurately. Once the form is filled out, review it for any errors or omissions. Finally, submit the It 2663 Form according to the specified filing methods, which may include online submission or mailing it to the appropriate tax authority.

Steps to complete the It 2663 Form

Completing the It 2663 Form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, including income statements and deduction records.

- Access the It 2663 Form online or obtain a physical copy from the appropriate source.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Provide detailed information regarding your income and any applicable deductions.

- Review the completed form for accuracy and completeness.

- Sign and date the form where required.

- Submit the form according to the instructions provided, ensuring it is sent to the correct address or submitted online.

Legal use of the It 2663 Form

The It 2663 Form must be used in accordance with federal and state tax laws to ensure its legal validity. It is essential to understand the specific regulations governing the use of this form, including any eligibility criteria and filing requirements. Failure to comply with these regulations can result in penalties or delays in processing. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal use of the It 2663 Form.

Filing Deadlines / Important Dates

Filing deadlines for the It 2663 Form vary depending on the specific tax year and the taxpayer's circumstances. Generally, taxpayers should be aware of the following important dates:

- The due date for submitting the form, which typically aligns with the annual tax filing deadline.

- Any extensions that may be available for filing the form, if applicable.

- Specific dates for quarterly estimated tax payments, if relevant to the taxpayer's situation.

Form Submission Methods (Online / Mail / In-Person)

The It 2663 Form can be submitted through various methods, providing flexibility for taxpayers. These methods include:

- Online submission through the designated tax authority's website, which is often the quickest and most efficient option.

- Mailing a physical copy of the form to the appropriate tax office, ensuring it is sent well before the deadline.

- In-person submission at designated tax offices, which may be available for those who prefer direct interaction.

Quick guide on how to complete it 2663 form 2018 2019

Your assistance manual on how to prepare your It 2663 Form

If you’re curious about how to generate and submit your It 2663 Form, here are some quick guidelines to simplify tax filing.

To start, you just need to set up your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is a user-friendly and robust document solution that enables you to alter, draft, and finalize your tax documents with ease. With its editor, you can navigate between text, checkboxes, and eSignatures, and revisit to amend information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your It 2663 Form in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your It 2663 Form in our editor.

- Complete the required fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to return errors and slow down refunds. Before e-filing your taxes, make sure to consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct it 2663 form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out the BHU's form of B.Com in 2018 and crack it?

you can fill from to go through bhu portal and read all those instruction and download previous year question paper . that u will get at the portal and solve more and more question paper and read some basics from your study level .focus on study save ur time and energy .do best to achieve your goal .for more detail discus with gajendra ta mtech in iit bhu .AND PKN .good luck .

-

Is it advantageous to fill out the JEE Mains 2018 form as soon as possible?

Yes. It is advantageous to fill out the JEE Mains 2018 form as soon as possible? Click here to know more about what are the advantage of filling JEE Main Application Form Earlier.

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the it 2663 form 2018 2019

How to make an electronic signature for the It 2663 Form 2018 2019 in the online mode

How to make an electronic signature for the It 2663 Form 2018 2019 in Google Chrome

How to make an eSignature for putting it on the It 2663 Form 2018 2019 in Gmail

How to create an eSignature for the It 2663 Form 2018 2019 right from your mobile device

How to make an electronic signature for the It 2663 Form 2018 2019 on iOS devices

How to make an electronic signature for the It 2663 Form 2018 2019 on Android

People also ask

-

What is the IT 2663 Form and why is it important?

The IT 2663 Form is a crucial document used for reporting New York State withholding tax for non-residents. It helps businesses ensure compliance with tax regulations when paying non-resident contractors and employees. Understanding how to properly fill out the IT 2663 Form is essential for avoiding penalties and maintaining accurate tax records.

-

How can airSlate SignNow help me with the IT 2663 Form?

airSlate SignNow offers a seamless eSignature solution that allows you to easily send and sign the IT 2663 Form electronically. Our platform simplifies the process by enabling you to track document status and ensure timely submissions. With airSlate SignNow, you can manage your tax documents efficiently and securely.

-

Is airSlate SignNow affordable for small businesses needing the IT 2663 Form?

Yes, airSlate SignNow provides a cost-effective solution suitable for small businesses that need to manage the IT 2663 Form. Our pricing plans are designed to fit various budgets, allowing you to access powerful eSigning features without breaking the bank. Plus, our free trial lets you explore our services risk-free.

-

What features does airSlate SignNow offer for managing the IT 2663 Form?

airSlate SignNow includes features like customizable templates, bulk sending, and real-time tracking to streamline the process of handling the IT 2663 Form. You can easily create and save templates for recurring use, making it more efficient to manage your tax documents. Additionally, our secure cloud storage keeps your documents safe and accessible.

-

Can I integrate airSlate SignNow with other applications for the IT 2663 Form?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow when working with the IT 2663 Form. You can connect with popular platforms like Google Drive, Salesforce, and Dropbox, allowing for a more seamless document management experience.

-

How does airSlate SignNow ensure the security of the IT 2663 Form?

Security is a top priority at airSlate SignNow. When handling the IT 2663 Form, we implement industry-standard encryption and compliance measures to protect your sensitive data. Our platform also features audit trails and authentication options to ensure that only authorized users can access the document.

-

What are the benefits of using airSlate SignNow for the IT 2663 Form compared to traditional methods?

Using airSlate SignNow for the IT 2663 Form offers numerous benefits over traditional methods. It saves time by eliminating the need for printing and mailing, reduces the risk of errors, and enhances collaboration by allowing multiple parties to sign simultaneously. This streamlined approach leads to faster processing and improved compliance.

Get more for It 2663 Form

- Parental tattoo consent form pain and pleasure tattoos

- Indemnity form umdoc secure intercape co

- Customer information form jn fund managers limited

- Uniform borrower assistance form selene

- Moneygram historical transaction form

- Editable bbbee affidavit doc form

- Motion for telephonic appearance nm courts form

- Ci 139 monterey county superior courts homepage monterey courts ca form

Find out other It 2663 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors