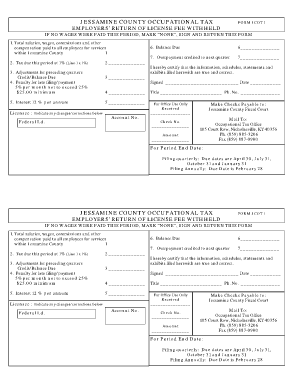

JESSAMINE COUNTY OCCUPATIONAL TAX Form

What is the Jessamine County Occupational Tax

The Jessamine County Occupational Tax is a tax levied on individuals and businesses operating within Jessamine County, Kentucky. This tax is typically assessed based on income earned within the county and is designed to fund local services and infrastructure. Understanding this tax is crucial for residents and business owners to ensure compliance and proper financial planning.

How to Obtain the Jessamine County Occupational Tax

To obtain the Jessamine County Occupational Tax, individuals and businesses must first register with the local tax authority. This process often involves providing personal identification, proof of residency or business operation, and any relevant financial documentation. It is advisable to check with the Jessamine County tax office for specific requirements and procedures, as these can vary based on individual circumstances.

Steps to Complete the Jessamine County Occupational Tax

Completing the Jessamine County Occupational Tax form involves several key steps:

- Gather necessary documentation, including income statements and identification.

- Access the official form from the Jessamine County tax office or their website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form via the designated method, whether online, by mail, or in person.

Legal Use of the Jessamine County Occupational Tax

The Jessamine County Occupational Tax must be used in accordance with local and state regulations. This includes adhering to deadlines for filing and payment to avoid penalties. The tax is legally binding, and failure to comply can result in fines or other legal consequences. It is essential for taxpayers to understand their rights and responsibilities regarding this tax.

Filing Deadlines / Important Dates

Filing deadlines for the Jessamine County Occupational Tax are typically set by the local tax authority. It is important to be aware of these dates to ensure timely submission and payment. Common deadlines may include:

- Annual filing deadline for individuals and businesses.

- Quarterly payment deadlines for estimated taxes.

Taxpayers should regularly check for any updates or changes to these deadlines to maintain compliance.

Penalties for Non-Compliance

Failure to comply with the Jessamine County Occupational Tax regulations can result in various penalties. These may include:

- Fines for late filing or payment.

- Interest on unpaid tax amounts.

- Potential legal action for persistent non-compliance.

Understanding these penalties can help taxpayers avoid costly mistakes and ensure they meet their obligations.

Quick guide on how to complete jessamine county occupational tax

Effortlessly prepare JESSAMINE COUNTY OCCUPATIONAL TAX on any device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without hassles. Manage JESSAMINE COUNTY OCCUPATIONAL TAX on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-centered task today.

The easiest way to modify and eSign JESSAMINE COUNTY OCCUPATIONAL TAX seamlessly

- Obtain JESSAMINE COUNTY OCCUPATIONAL TAX and select Get Form to begin.

- Utilize the tools at your disposal to finish your document.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign JESSAMINE COUNTY OCCUPATIONAL TAX and ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the jessamine county occupational tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the jessamine county occupational tax?

The jessamine county occupational tax is a local tax imposed on individuals and businesses operating within Jessamine County. This tax helps fund public services and infrastructure developments in the area. It's important for businesses and employees to understand their responsibilities regarding this tax.

-

How can airSlate SignNow help with jessamine county occupational tax documents?

airSlate SignNow streamlines the process of sending and signing documents related to the jessamine county occupational tax. With our platform, users can easily manage forms and submit them electronically, ensuring compliance and saving time. The ease of use can signNowly reduce administrative burdens associated with tax documentation.

-

What are the costs associated with using airSlate SignNow for jessamine county occupational tax filings?

Using airSlate SignNow involves a subscription fee that varies based on the features you choose. This cost is often outweighed by the efficiency and convenience of managing jessamine county occupational tax filings online. We offer a range of pricing plans to suit different business sizes and needs, ensuring you have access to an affordable solution.

-

What features does airSlate SignNow offer for managing jessamine county occupational tax?

airSlate SignNow provides a variety of features for managing jessamine county occupational tax documents, including customizable templates, eSignature capabilities, and secure storage. Additionally, you can track the status of your documents in real-time, making it easier to ensure compliance with tax regulations. The platform is designed to simplify the entire process, enhancing productivity.

-

Are there any benefits to eSigning jessamine county occupational tax forms with airSlate SignNow?

Yes, eSigning jessamine county occupational tax forms with airSlate SignNow offers several benefits, including faster processing times and reduced paper usage. Our platform ensures that your documents are securely signed and legally binding, which helps with compliance. Additionally, you can access your documents from anywhere, making it convenient for busy professionals.

-

Does airSlate SignNow integrate with other tools for handling jessamine county occupational tax?

airSlate SignNow offers integrations with various popular tools and platforms, allowing seamless handling of jessamine county occupational tax documentation. You can connect our service with accounting software, project management tools, and more to streamline your workflow. This interoperability enhances your ability to manage tax-related tasks efficiently.

-

Can airSlate SignNow assist with audit preparations for jessamine county occupational tax?

Absolutely! airSlate SignNow can help you organize and retrieve all your jessamine county occupational tax documents in one place, which is essential during an audit. Our secure storage and document management features ensure that you can quickly provide the required documentation without hassle. Being prepared will make the audit process smoother.

Get more for JESSAMINE COUNTY OCCUPATIONAL TAX

Find out other JESSAMINE COUNTY OCCUPATIONAL TAX

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement