Fsa Dependent Care Receipt Template Form

What is the FSA dependent care receipt template

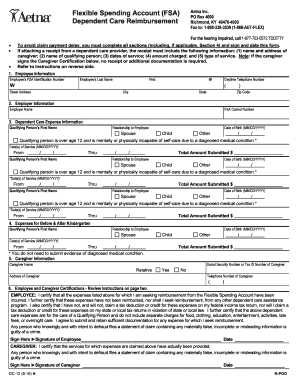

The FSA dependent care receipt template is a crucial document used for claiming reimbursement for eligible dependent care expenses through a Flexible Spending Account (FSA). This template provides a structured format for detailing the services provided, the costs incurred, and the provider's information. It is essential for parents or guardians who wish to utilize their FSA funds to cover childcare expenses, such as payments made to babysitters, daycare facilities, or other approved care providers. Using this template helps ensure that all necessary information is included, making the reimbursement process smoother and more efficient.

Key elements of the FSA dependent care receipt template

When filling out the FSA dependent care receipt template, certain key elements must be included to ensure compliance and facilitate reimbursement. These elements typically include:

- Provider's name and address: This identifies the individual or organization providing care.

- Dates of service: Specific dates when care was provided should be noted.

- Type of service: A description of the care provided, such as babysitting or daycare.

- Total amount charged: The total cost for the services rendered.

- Signature of the provider: A signature or initials from the care provider validating the receipt.

Including these elements helps ensure that the receipt meets the requirements set by the IRS and the FSA plan administrator.

How to use the FSA dependent care receipt template

Using the FSA dependent care receipt template involves several straightforward steps. First, gather all necessary information regarding the care provider and the services rendered. Next, fill in the template with accurate details, including the provider's name, the dates of service, and the total amount charged. After completing the template, ensure that the provider signs it to validate the receipt. Finally, submit the completed receipt along with any required forms to your FSA plan administrator for reimbursement. Following these steps will help streamline the reimbursement process and ensure compliance with FSA rules.

Steps to complete the FSA dependent care receipt template

Completing the FSA dependent care receipt template requires attention to detail to ensure all necessary information is accurately recorded. Here are the steps to follow:

- Gather information: Collect details about the care provider, including their name, address, and contact information.

- Document services: Note the dates when care was provided and the type of service rendered.

- Calculate costs: Determine the total amount charged for the services provided.

- Complete the template: Fill in all required fields on the receipt template with the gathered information.

- Obtain a signature: Ensure the care provider signs the receipt to validate the information.

- Submit for reimbursement: Send the completed receipt to your FSA plan administrator along with any other required documentation.

By following these steps, you can ensure that your dependent care expenses are accurately documented and eligible for reimbursement.

Legal use of the FSA dependent care receipt template

The legal use of the FSA dependent care receipt template is essential for ensuring that claims for reimbursement are valid and compliant with IRS regulations. The template must accurately reflect the services provided and include all required elements, such as the provider's signature and detailed descriptions of care. Failure to comply with these requirements may result in denied claims or potential penalties. It is also important to retain copies of submitted receipts and any correspondence with the FSA plan administrator to maintain a complete record of your claims.

IRS guidelines for FSA dependent care receipts

The IRS provides specific guidelines regarding the use of dependent care receipts for FSA claims. According to IRS regulations, expenses must be for care provided to children under the age of thirteen or for dependents who are physically or mentally incapable of self-care. Receipts must clearly indicate the nature of the service, the dates of care, and the total amount charged. Additionally, the IRS requires that the care provider be a qualified individual or organization, and all claims must be submitted within the designated timeframe set by the FSA plan. Adhering to these guidelines is crucial for ensuring that your claims are processed without issues.

Quick guide on how to complete fsa dependent care receipt template

Prepare Fsa Dependent Care Receipt Template effortlessly on any device

Digital document management has gained widespread acceptance among organizations and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without interruptions. Manage Fsa Dependent Care Receipt Template on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centric task today.

The simplest way to modify and eSign Fsa Dependent Care Receipt Template seamlessly

- Obtain Fsa Dependent Care Receipt Template and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to share your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors requiring the reprinting of new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign Fsa Dependent Care Receipt Template and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fsa dependent care receipt template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an itemized receipt for FSA?

An itemized receipt for FSA is a detailed document that outlines the individual expenses covered by your Flexible Spending Account. It specifies the services received, costs incurred, and often includes the provider's information. This type of receipt is essential for reimbursement claims and helps ensure compliance with FSA guidelines.

-

How can airSlate SignNow help me create an itemized receipt for FSA?

With airSlate SignNow, you can easily create and customize an itemized receipt for FSA using pre-built templates. The platform allows you to input all necessary details quickly, ensuring that your receipts are accurate and compliant. This streamlines the process of submitting claims and helps you get reimbursed faster.

-

Is there a cost associated with using airSlate SignNow for itemized receipts?

airSlate SignNow offers a variety of pricing plans tailored to different business needs, including options for creating itemized receipts for FSA. There are no hidden fees, and you can choose a plan that fits your budget while still benefiting from robust features. A cost-effective solution will ensure you manage your document signing and receipt generation efficiently.

-

Can I integrate airSlate SignNow with my existing accounting software for itemized receipts?

Yes, airSlate SignNow can easily integrate with various accounting software, making it simple to generate itemized receipts for FSA within your existing workflow. This integration allows for seamless data transfer, reducing the hassle of manual entries. You'll save time and improve accuracy when managing your receipts and other documents.

-

What features does airSlate SignNow offer for managing itemized receipts?

airSlate SignNow provides a range of features specifically designed for managing itemized receipts for FSA. These include customizable templates, electronic signatures, and secure cloud storage. With these tools, you can ensure your receipts are not only compliant but also easily accessible whenever needed.

-

How do I ensure my itemized receipt for FSA meets compliance requirements?

To ensure that your itemized receipt for FSA meets compliance requirements, make sure it includes all necessary details, such as the date of service, provider's information, and specific items purchased. Using airSlate SignNow, you can create compliant receipts according to IRS guidelines, reducing the chances of denied claims. Always double-check the information before submitting your receipt.

-

Can airSlate SignNow help me track my FSA expenses effectively?

Absolutely! airSlate SignNow not only helps you create itemized receipts for FSA but also provides tools that can help track your expenses. With organized digital storage and easy access to your receipts, you can manage your FSA expenditures efficiently and prepare for tax season with ease. This makes staying on top of your finances much simpler.

Get more for Fsa Dependent Care Receipt Template

- Behavioral health echo case presentation form

- Student financial services mount holyoke college mtholyoke form

- College fair registration form esc of medina county medina esc

- Star college registration form

- University approved form for payment

- Fiu medical surveillance program health questionnaire for employees with animal contact form

- Cs major advising release form department of computer science cs sjsu

- Submission forms center for human identification

Find out other Fsa Dependent Care Receipt Template

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement