T4 Summary Fillable 2018

What is the T4 Summary Fillable

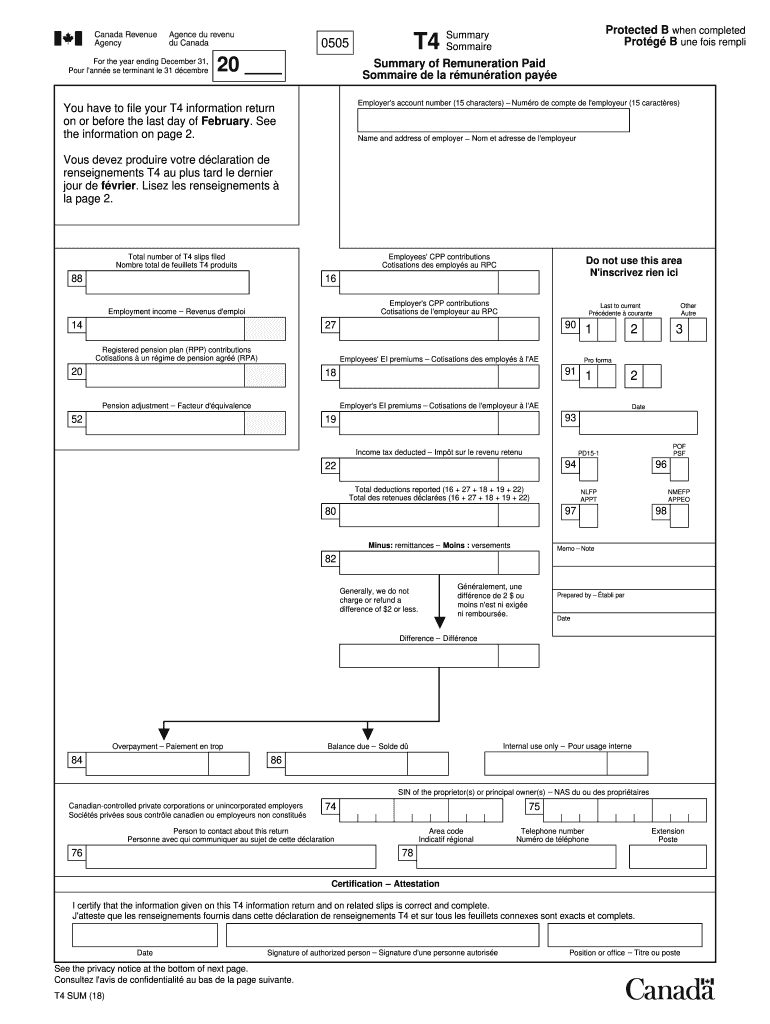

The T4 summary fillable form is an essential document used in Canada to report employment income and deductions. It is issued by employers to summarize the earnings and tax withheld for each employee over a specific tax year. This form is crucial for both employees and the Canada Revenue Agency (CRA) as it provides a comprehensive overview of remuneration paid and taxes deducted. The fillable version allows users to complete the form digitally, ensuring accuracy and ease of submission.

How to Use the T4 Summary Fillable

Using the T4 summary fillable form involves a straightforward process. First, access the form through a reliable platform that offers digital signatures and secure submissions. Next, input the required information, including employer details, employee earnings, and tax deductions. Ensure all fields are completed accurately to avoid issues with the CRA. Once filled, review the information for any discrepancies and then submit the form electronically or print it for mailing. Utilizing a fillable form streamlines the process and minimizes errors.

Steps to Complete the T4 Summary Fillable

Completing the T4 summary fillable form involves several key steps:

- Gather necessary information, including employer and employee details.

- Access the fillable form through a secure platform.

- Enter the total remuneration paid to each employee.

- Include the total deductions made for income tax, CPP, and EI.

- Double-check all entries for accuracy.

- Submit the form electronically or print it for mailing.

Legal Use of the T4 Summary Fillable

The T4 summary fillable form must be completed in compliance with Canadian tax laws. It is legally binding when filled out accurately and submitted within the required deadlines. Employers are responsible for ensuring that the information provided is correct and complete, as inaccuracies can lead to penalties from the CRA. Using a certified platform to fill out and submit the form helps ensure compliance with regulations such as the Income Tax Act.

Key Elements of the T4 Summary Fillable

Several key elements must be included in the T4 summary fillable form:

- Employer's name and address

- Employee's name and Social Insurance Number (SIN)

- Total remuneration paid

- Total income tax deducted

- Contributions to the Canada Pension Plan (CPP) and Employment Insurance (EI)

Each of these elements is crucial for accurate reporting and compliance with tax regulations.

Who Issues the Form

The T4 summary fillable form is issued by employers in Canada. Each employer is responsible for providing this form to their employees at the end of the tax year. The CRA requires that employers submit the T4 summary to report the total income and deductions for each employee, ensuring that all tax obligations are met. Employers must also provide copies to their employees for personal tax filing purposes.

Quick guide on how to complete t4 summary fillable 2018 2019 form

A concise guide on how to prepare your T4 Summary Fillable

Locating the correct template can be difficult when you need to submit official international documents. Even if you possess the necessary form, it may be cumbersome to swiftly prepare it in accordance with all requirements if you rely on physical copies instead of handling everything online. airSlate SignNow is the digital eSignature solution that assists you in navigating these challenges. It enables you to acquire your T4 Summary Fillable and rapidly complete and sign it on-site without the need to reprint papers in case of errors.

Here are the steps you should follow to prepare your T4 Summary Fillable with airSlate SignNow:

- Click the Get Form button to instantly add your document to our editor.

- Begin with the first empty field, enter the required information, and move forward using the Next tool.

- Complete the blank fields with the Cross and Check tools from the panel above.

- Select the Highlight or Line options to emphasize the most critical details.

- Click on Image and upload one if your T4 Summary Fillable necessitates it.

- Utilize the right-side panel to add extra fields for yourself or others to complete if needed.

- Review your responses and finalize the template by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete your modifications to the form by clicking the Done button and selecting your file-sharing preferences.

When your T4 Summary Fillable is prepared, you can distribute it however you prefer - send it to your recipients via email, SMS, fax, or even print directly from the editor. You can also securely keep all your completed documents in your account, organized in folders according to your preferences. Don’t waste time on manual document completion; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct t4 summary fillable 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the t4 summary fillable 2018 2019 form

How to generate an electronic signature for the T4 Summary Fillable 2018 2019 Form online

How to generate an eSignature for the T4 Summary Fillable 2018 2019 Form in Google Chrome

How to create an eSignature for putting it on the T4 Summary Fillable 2018 2019 Form in Gmail

How to make an electronic signature for the T4 Summary Fillable 2018 2019 Form right from your smartphone

How to make an eSignature for the T4 Summary Fillable 2018 2019 Form on iOS

How to make an electronic signature for the T4 Summary Fillable 2018 2019 Form on Android devices

People also ask

-

What is a t4 summary and why is it important?

A t4 summary is a critical document that provides an annual summary of employee earnings and deductions for Canadian tax purposes. It is important because it helps individuals accurately report their income and taxes owed to the Canada Revenue Agency. Utilizing airSlate SignNow can simplify the process of sending and signing t4 summaries, ensuring compliance and accuracy.

-

How can airSlate SignNow help with sending t4 summaries?

airSlate SignNow allows businesses to easily upload, send, and eSign t4 summaries digitally. This platform streamlines the document management process, reducing the time spent on administrative tasks while ensuring that all necessary recipients receive their t4 summaries promptly and securely.

-

Is airSlate SignNow cost-effective for managing t4 summaries?

Yes, airSlate SignNow offers a cost-effective solution for managing t4 summaries compared to traditional paper methods. With various pricing plans, businesses can choose the option that best fits their needs, making it easy to manage documents without breaking the bank.

-

What features does airSlate SignNow offer for handling t4 summaries?

airSlate SignNow provides features such as customizable templates, secure electronic signatures, and automated workflows that enhance the efficiency of managing t4 summaries. These features ensure that your documents are professionally handled while maintaining compliance with legal requirements.

-

Can airSlate SignNow integrate with accounting software for handling t4 summaries?

Yes, airSlate SignNow integrates with popular accounting tools, making it easier to manage t4 summaries along with other financial documents. This integration allows for seamless data transfer and enhanced workflow automation, improving overall efficiency in document handling.

-

How secure is the process of sending t4 summaries with airSlate SignNow?

The security of sending t4 summaries via airSlate SignNow is robust, featuring advanced encryption and secure data storage. This ensures that your sensitive financial information remains protected throughout the signing process, providing peace of mind to both businesses and employees.

-

What are the benefits of using airSlate SignNow for t4 summaries?

Using airSlate SignNow for t4 summaries offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced accessibility. The digital platform allows for faster processing times and easier tracking of document status, ultimately saving time and resources for businesses.

Get more for T4 Summary Fillable

- Name of business barnsco form

- Donation transmittal form

- Employee fmla request form city of toledo

- Kyb feeling is believing consumer promotion form

- Mv 198c 723 form

- Laos visa application form

- Irs form 8960 walkthrough net investment income tax

- About form 8814 parentamp039s election to report childamp039s

Find out other T4 Summary Fillable

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form