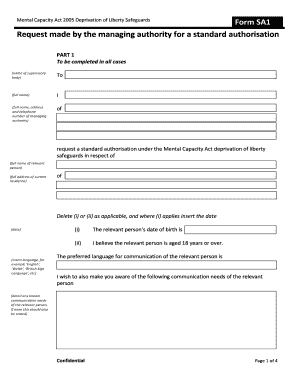

Sa1 Form

What is the SA1 Form?

The SA1 form is a crucial document used primarily for tax purposes in the United States. It serves as a means for individuals and businesses to report specific information to the Internal Revenue Service (IRS). Understanding the full form of SA1 is essential for accurate tax reporting and compliance. The SA1 form is often required in various scenarios, including when applying for certain tax benefits or reporting income from specific sources.

How to Use the SA1 Form

Using the SA1 form involves several steps to ensure that the information is reported correctly. First, gather all necessary documentation that supports the information you will provide on the form. This may include income statements, identification numbers, and any relevant tax documents. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once completed, review the form for any errors before submission. It is advisable to keep a copy of the submitted form for your records.

Steps to Complete the SA1 Form

Completing the SA1 form requires attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, such as income statements and identification.

- Fill in personal information, including name, address, and Social Security number.

- Provide details regarding income or deductions as required by the form.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of the SA1 Form

The SA1 form must be used in compliance with applicable tax laws and regulations. It is essential to ensure that all information provided is truthful and accurate to avoid potential legal issues. The form is considered legally binding once it is signed and submitted, making it vital to understand the implications of the information reported. Non-compliance can lead to penalties or legal repercussions, emphasizing the importance of proper use.

Who Issues the SA1 Form

The SA1 form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations. It is important to refer to the IRS website or official publications for the most current version of the form and any updates to filing requirements.

Required Documents

When preparing to fill out the SA1 form, certain documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Identification documents, including Social Security numbers.

- Previous tax returns, if applicable.

- Any supporting documentation for deductions or credits claimed.

Form Submission Methods

The SA1 form can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient, allowing for quicker processing and confirmation. If submitting by mail, ensure that the form is sent to the correct IRS address, and consider using a trackable mailing option. In-person submissions may be made at designated IRS offices, where assistance can be provided if needed.

Quick guide on how to complete sa1 form

Complete Sa1 Form easily on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documentation, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without any delays. Handle Sa1 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Sa1 Form effortlessly

- Obtain Sa1 Form and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Sa1 Form and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sa1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an SA1 form and how is it used?

The SA1 form is a document used for various purposes, including business registrations and compliance. With airSlate SignNow, you can easily fill out, sign, and manage your SA1 form digitally, streamlining your workflow and reducing paper waste.

-

Is airSlate SignNow compatible with the SA1 form?

Yes, airSlate SignNow is fully compatible with the SA1 form. Our platform allows you to upload, edit, and eSign your SA1 form quickly and securely, ensuring that all your important documents are handled efficiently.

-

What are the pricing plans for using airSlate SignNow for SA1 forms?

airSlate SignNow offers a variety of pricing plans that accommodate different business needs, including those requiring the SA1 form. Our plans are cost-effective and designed to provide you with the best value for managing and eSigning your documents.

-

Can I integrate airSlate SignNow with other applications to manage my SA1 form?

Absolutely! airSlate SignNow supports a variety of integrations with popular applications, allowing you to manage your SA1 form alongside other tools. This integration simplifies document workflows and enhances productivity.

-

What are the benefits of using airSlate SignNow for SA1 forms?

Using airSlate SignNow for your SA1 form provides numerous benefits, including improved efficiency, reduced processing time, and enhanced security. Our platform ensures that your documents are signed, stored, and managed in a reliable manner.

-

How does airSlate SignNow ensure the security of my SA1 form?

airSlate SignNow prioritizes the security of your SA1 form through advanced encryption and compliance with industry standards. This way, your sensitive information remains protected during the signing and storing process.

-

Can I track the status of my SA1 form with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your SA1 form in real-time. You will be notified when the document is viewed, signed, or completed, giving you full visibility into your document processes.

Get more for Sa1 Form

Find out other Sa1 Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF