Fsemp Florida Self Employment Form

What is the Fsemp Florida Self Employment Form

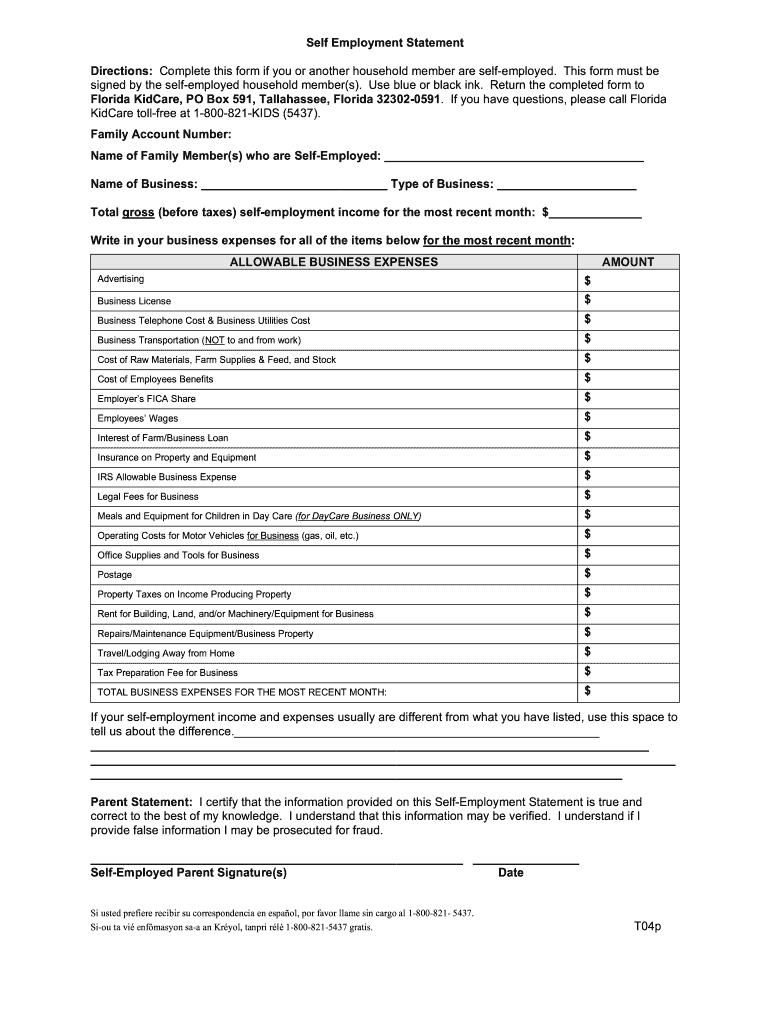

The Fsemp Florida Self Employment Form is a crucial document for individuals operating as self-employed in Florida. This form is typically used to report income and expenses to the state, ensuring compliance with tax obligations. It captures essential information about the nature of the business, the income generated, and any deductions that may apply. Understanding this form is vital for maintaining accurate records and fulfilling legal requirements.

Steps to complete the Fsemp Florida Self Employment Form

Completing the Fsemp Florida Self Employment Form involves several straightforward steps:

- Gather necessary information, including your business name, address, and tax identification number.

- Document your income sources and any associated expenses, ensuring you have receipts or records for verification.

- Fill out the form accurately, detailing your income and expenses in the designated sections.

- Review the completed form for accuracy, checking for any missing information or errors.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Fsemp Florida Self Employment Form

The legal use of the Fsemp Florida Self Employment Form is essential for compliance with state regulations. This form serves as an official record of your self-employment income and expenses, which can be critical during audits or tax assessments. It adheres to various state laws and guidelines, ensuring that your self-employment activities are documented correctly and legally recognized.

Required Documents

When completing the Fsemp Florida Self Employment Form, certain documents are required to support your claims. These may include:

- Proof of income, such as invoices or bank statements.

- Receipts for business-related expenses.

- Your tax identification number or Social Security number.

- Any previous tax returns if applicable.

Who Issues the Form

The Fsemp Florida Self Employment Form is issued by the Florida Department of Revenue. This agency oversees the collection of taxes and ensures compliance with state tax laws. Understanding the issuing authority is important for accessing the correct version of the form and receiving any updates or changes to regulations that may affect self-employed individuals.

Filing Deadlines / Important Dates

Filing deadlines for the Fsemp Florida Self Employment Form are critical to avoid penalties. Typically, the form must be submitted by April 15 for the previous tax year. However, it is advisable to check for any specific dates or changes that may occur annually. Staying informed about deadlines helps ensure timely compliance with state requirements.

Quick guide on how to complete self employment form

Discover how to effortlessly navigate the Fsemp Florida Self Employment Form completion with this simple guide

Filing and finalizing documents digitally is gaining traction and is the preferred choice for numerous clients. It offers a multitude of benefits over outdated paper forms, such as ease of use, time savings, enhanced precision, and security.

With tools like airSlate SignNow, you can find, modify, validate, and enhance your Fsemp Florida Self Employment Form without the hassle of endless printing and scanning. Follow this concise guide to begin and finalize your form.

Implement these steps to access and complete Fsemp Florida Self Employment Form

- Commence by clicking the Get Form button to access your form in our editor.

- Observe the green marker on the left indicating necessary fields so you don’t miss them.

- Utilize our sophisticated tools to annotate, modify, approve, secure, and enhance your form.

- Secure your document or convert it into a fillable format using the appropriate tab options.

- Review the form and inspect it for mistakes or inconsistencies.

- Click DONE to complete the editing process.

- Rename your document or keep it as is.

- Select the storage option you wish to use for saving your form, send it via USPS, or click the Download Now button to acquire your file.

If Fsemp Florida Self Employment Form isn’t what you were looking for, you can explore our extensive collection of pre-uploaded forms that you can complete with ease. Try our platform today!

Create this form in 5 minutes or less

FAQs

-

What form can I fill out as a self-employed individual to make my CPA’s job easier?

A QuickBooks Trial Balance and Detailed General Ledger - printed and in Excel format. Work with your CPA to create an appropriate chart of accounts for your business. And use a good bookkeeper to keep your books. If your books look good, the CPA will ask some question to gain comfort and then accept your numbers with little further investigation.Please do not bring a boxful of crumpled receipts. You will pay more for your CPA to uncrumple them and categorize them. If you are a really small business, a legal pad sheet categorizing your receipts. If your receipts are a mess, or your books a mess, your CPA needs to ask a lot more questions and spend a lot more time gaining comfort with your books. Bad books from a shady client means a lot of grief for the CPA and a lot more fees.

-

While filing ITR, which form should a self-employed person with STCG from equity gains (that are no part of his business) fill out?

If you are self employed person and have business income with capital gains (they are not a part of business ) you can file itr-3 and ITR4. But if you are not having any business income but have only capital gains you should file itr-2

-

What form should I fill out if I am a UK self-employed resident invoicing the EU company?

You question is unclear. Do you mean another company in the EU, or administration of the EU like the Parliament or the Commission.

-

How does Denmark have more economic freedom than the United States of America if Denmark is a social democracy with a bigger mixed economy and more government regulation?

Q:How does Denmark have more economic freedom than the United States of America if Denmark is a social democracy with a bigger mixed economy and more government regulation?I'll try to answer this from my point of view - as a Dane with a good understanding of the North American system.The thing is, in Scandinavia / Denmark you can be what you want to be as long as your abilities and skills are good enough. It does not matter if your father is a janitor or your mother a waiter. The opportunities a child from a highly educated family has is roughly the same as the opportunities a child from a less educated family has.Why is this? It is because all education and healthcare are paid by taxes.When people get to apply their full abilities and are not held back because of lack of money and education everybody can shine and better their circumstances.Another important thing is we demand a high rate of service for all our tax money. Therefore our government run facilities are very streamlined, and often much more effective than a private run facility.The thing is, we do not have more government-run regulations than in the USA. My feeling is that we in Scandinavian have far fewer regulations than in the USA. We demand streamlined regulations and oppose very hard when we see something that is not effective.When visiting the USA I have a sneaking suspicion, that every government run facility is very much obstructed by political will. IT is not supposed to be run effectively, and the results are therefore predictable.We have seen some of the same results in Denmark when they tried to do without waiting lists in the health industry. The right-wing politicians jumped at this and made a private run alternative - which was more or less public funded. This resulted among other things in a cannibal effect where doctors started to work in the private industry, but all education of new doctors was still a responsibility of the public hospitals. and thus waiting lists exploded.All in all, it was a disaster and later they started to invest in the public health system and made a more effective system altogether.

-

What things are more advanced in Europe than in the U.S. right now?

This depends a lot on the country, and I don't know other European countries too well, so I will answer for mine.In no particular order, off the top of my head:Faster, more reliable, and cheaper broadband.Better, cheaper mobile data, and mobile use in general.Technical infrastructure is mostly subterranean. You never see a jumbled mess of wires hanging from poles or building walls.Less bureaucracy. The US is riddled with paper forms that are manually processed. "Doing your taxes" in the US seems like a nightmare. Here, we either do nothing at all, trusting that the automatically filled out numbers are correct, or we log on to a website to make changes where necessary. Usually though, there aren't many posts that need to be edited or are even relevant to most people.Less manual labor for easily automated jobs. In the US, for instance in airports, there are people whose only job is to point people in the right direction, a job that elsewhere in the world is done by a sign. And what's the deal with toll booth operators? Why isn't tolling a fully automated process?Less pointless jobs in general. What do you need a parking lot attendant for in a tiny parking lot? Greeters in stores? Just to name a couple of common ones.Universal healthcare. We spend much, much less, and everyone gets the treatment they need. Those who can afford it may still pay to get ahead, but even then we're not talking the astronomical total sum that the US spends per capita.Practically free higher education.Better public transport, even in sparsely populated areas. Most of the US is practically inaccessible if you don't drive a car. Some areas are covered by Greyhound buses or smaller, local bus operators, the occasional passenger rail lines, shuttle services etc, but movement is still very limited compared to most of Europe. Even many of the big cities there are difficult to get around in.Almost no one pays in cash, except old people and criminals. Whenever I'm in the US, I typically spend all small change on tips as soon as I can. They're annoying to carry around, and they have really low value.No one writes checks. It’s either debit/credit cards, cash, or various types of digital payments.My debit card is also valid legal ID.More focus on universal design, whether it's building codes, products, websites etc.The US lacks things like unified building codes on a federal level. Just as an example, one result of this is that many states/counties/cities do not require water proofing of bathrooms, which is completely ridiculous. I like the idea of states having some autonomy, but for commonsensical things like this, it makes no sense.Despite efforts by the right, we still have decent worker's rights. We definitely do not have so-called "right-to-work" laws, which can be found in many US states, which is, of course, the exact opposite of what it sounds like, a right for an employer to fire anyone at will, whenever they feel like it, no reasons given.Workplaces are generally not highly hierarchical. There's definitely some signNow pay gaps (though not nearly like in the US), but it is not reflected in how people deal with each other in the workplace. There's generally a sense of mutual respect, and you talk to your CEO more or less like any other colleague. The exception may be some of the really big companies.While it varies between lines of work, most of us are defined by the value we provide, not how many hours we put in. Overtime is generally not encouraged, and there is an understanding that we all have private lives, families etc. Sometimes you need to leave early, or will be late, and that's totally okay.Practically all electrical power generated and used in this country is renewable. We do "import" a lot of fossil-based electricity, due to the very odd way the European power market is set up. They are, however, rapidly closing coal plants on the continent. The US, despite amazing efforts in many states, still lags far behind.While our democracy isn't rock solid either, it's not quite as easily manipulated as in the US, with its gerrymandering, filibustering, the legalized corruption that is lobbying, ultra-expensive donation-driven political campaigns, political campaign ads on TV, political campaigns masquerading as news etc.Less over-use of pointless prescription medication. We do not have an opioid epidemic. Enough said.Lower use of antibiotics. In the US you can buy certain types of antibiotics without a prescription, which is absolutely insane.Poor people are not completely destitute, and no one is homeless (unless they actively refuse all options they are provided with). Rich people, on the other hand, do not live in gated communities, trying to shield themselves from the rest of society.The whole legal system is geared towards rehabilitation of criminals, not punishment or revenge. As a result, we have lower crime rates and much, much lower recidivism rates. This was not true before the prisons were completely re-worked some decades ago, so we know there's a direct correlation.Convicted criminals have the right to vote. How can you expect someone to be rehabilitated if all their basic rights as citizens are taken away from them, even for minor offenses? Also, on the same tangent, we do not have laws that require sex offenders to go door-to-door and identify themselves to new neighbors, or dictate where they can and can’t live. You take your punishment, and you’re allowed to rejoin society, and not live with additional punishment for the rest of your life.Less urban sprawl. Cities are more condensed, and again, even where they aren't, there's decent public transport. Downtown areas are typically fairly vibrant areas with stores, restaurants, cafés, and stuff to do in general, not the almost completely deserted, office building dominated downtown areas found in many US cities.

-

How do small businesses pay their taxes?

The answer to this question depends on how your small business is set up. Let’s consider the two most common structures: sole proprietorship/single member LLC and partnership/multi-member LLCIf your business is a sole proprietorship or a single member LLC, you’re income and losses pass through the business and are reporting on Schedule C of your personal tax return. You will be responsible for paying the self-employment tax and income tax on your profits. Most businesses set aside roughly 30% of income to cover these amounts and make estimated tax payments quarterly.If your business is partnership or a multi-member LLC, the income and losses are still passed through, but must be reported according to the percentage shares of ownership. You allocate the income and losses among partners by filing a form K-1 and then using that information to fill in the Schedule C on your personal tax return. Again, you may need to pay estimated taxes throughout the year.An experienced tax lawyer can help you determine the best structure for your business and map out your tax reporting obligations, while helping you preserve liability and minimize the amounts owed to the IRS and the state. LawTrades can connect you with one of the knowledgable attorneys in our network for a free 20 minute consultation to discuss how they can assist you.

-

Do freelancers have to pay tax?

In the UK, You must declare all income that is not already taxed at source. Be aware that HMRC are very hot on catching freelancers or traders those are earning money and not declaring it to HMRC. As a freelancer, if you are paid via a payslip (PAYE) and tax is being taken “at source”, you might not need to do anything. It is different, however, if you’re a freelancer, as freelancers are usually paid gross income and therefore it is your responsibility to make sure you do your own tax return, calculate the correct tax, and pay HMRC by the deadline. Now, seeing as this whole exercise is somewhat cumbersome, you like hundreds of other taxpayers can probably use the help of an accountant.In order to work out the amount of tax you need to pay there is a raft of rules, reliefs, and exemptions, which you might misinterpret, miss out on, or miscalculate, but which an accountant can work out for you, and help reduce the amount of tax you will have to pay as well.Remember, anyone who thinks they can get away with not paying tax or not filling out a self-assessment tax return (SATR) for income not already tax at source is seriously misguided. That you can get away without paying tax or “disguise” income is a myth. To this end, HMRC’s ability to snoop into your online transactions, bank accounts, and all other personal records are boundless.If you start working freelance, most likely you’re classed as a sole trader. This means you’re self-employed and you must inform HMRC at the earliest opportunity that you are a freelance or self-employed and register for self-assessment, in order to declare all your income that’s not already taxed at source. You do this on a self-assessment tax return (SATR). This is the same, even if you have a full time job where you are taxed at source as well as doing freelance work.You are freelance, self-employed or a sole-trader if you:Work for yourselfHave several customers at the same timeAre able to decide how, where, and when you do your workHire other people at your own expense to help you or to do the work for youProvide the main items of equipment to do your workAre responsible for finishing any unsatisfactory work in your own timeCharge an agreed fixed price for your workSell goods or services to make a profit (including online on via an app).From 6 April 2017, the money you can earn before paying income tax (called the Personal Allowance) is £11,500 (up £500 from 2016). But you must still report all your income and pay national insurance and income tax on self-employed income, and you should report all income above the stipulated allowances.As a freelancer, you and you alone are responsible for ensuring the correct amount of tax and national insurance is paid by the deadline (31 January in each tax year). And you must make sure you have the money to pay your tax and NI when it’s due, or you will be hit by penalties and fines that grow the longer you leave paying them.These are your responsibilitiesYou’ll need to:Keep records of your business’s sales and expenses (and hold on to them for at least six years)Send a Self Assessment tax return every yearPay Income Tax on your profits and Class 2 and Class 4 National InsuranceYou can use the HMRC calculator to find out how much you are likely to have to pay in tax and national insurance.It is not a legal requirement to run a separate business bank account, but it is advisable to have a bank account that is separate from your personal bank account.What MUST YOU DO as a freelancer, self-employed or sole-trader?You must pay tax on business profits (see the thresholds here);You must pay class 2 National Insurance contributions (NICs) at £2.85 per week (unless you earn less than £6,025 per year);And you must pay class 4 NICs on profits over £8,164 at 9% up to £45,00, and then 2% thereafter.The amount of income tax and class 4 national insurance contributions you pay will depend on the information you provided in your SATR.Do you need an accountant?Some freelancers use an accountant to do their accounts and submit their self-assessment tax return to HMRC. These freelancers tend to benefit from an accountant knowing exactly which expenses are allowable and can be offset against tax, and be 100% certain that they are getting all the allowances and benefits they are due.In addition, an accountant will avoid costly mistakes and errors. So while it may seem cheaper to do your own accounts and file your own SATR, it’s likely an accountant will save you time and save you money in taxes, which will add up to a lot more than what you pay in accountancy fees. Also remember that accountancy fees are an allowable expense!

-

My wife is working for a new company that wants to issue her a 1099 for contract work. Should I have them pay our LLC (which is an S-Corp) instead of through a W-9?

Before we start, I'd like to clarify something. A W-9 form is a Request for Taxpayer information and serves as the basis for the 1099 form that will be issued at the end of the calendar year. Most companies will not issue any checks without first having this information in their hands. Your wife will have to fill out one, no matter what (assuming she wants to be paid).Now, on to you question. For your wife, there are two compensation options for a non-employee (i.e. independent contractor):They can make the checks payable to her personallyThey can make the checks payable to your S CorpI would advise that you have the checks made payable to the S Corp. The primary reason is that, to a certain extent, you will avoid self employment taxes, namely FICA (6.2%) and Medicare (1.45%).Had your wife been an employee of the company, these 'payroll taxes' would be paid by the employer. They represent a 'matching amount' that employer pays, based upon how much is deducted from an employees' gross pay for these taxes.However, when you are self-employed, rather than the employer paying these taxes, you pay this matching portion.The tax advantage of an S Corp is that the earnings of this type of entity is not subject self employment taxes, whereas, if the check is payable directly to your wife, they are.This is outside the scope of your question, but related. The IRS is determined to get 'some' payroll taxes from your S Corp. You must pay all shareholders who participate in the operations a reasonable salary. In doing so, your S Corp will be required to pay the FICA and Medicare taxes for anyone on payroll. Many S Corp owners mistakenly believe they can simply pay themselves no official salary, thereby escaping the payroll taxes. Further reading:S Corporation SE Avoidance Still A Solid StrategyS Corporation Taxes, Self Employment Tax Savings

-

How do I pay taxes as a freelancer?

A lot of it depends on country’s tax legislation, but if you’re based out of the U.S., I would strongly recommend reading Freelance Taxes Made Easy: 1099 vs. W2 vs. W-8BEN. The article covers both the employer/client side and the freelancer side, for the latter, it covers: when taxes are filed, what the minimum income is to necessitate filing, what forms need to be filled out, what the self-employment tax is, and what the state income tax rate is across the board.What is a Self-Employment Tax?As a freelance developer, you are subject to a 15.3% self-employment tax on top of your normal tax bracket obligations. The self-employment tax is comprised of Social Security and Medicare taxes that, as a regular employee, would be deducted from your paycheck. However, because you’re self-employed, you pay both the employer and employee parts of your Social Security and Medicare taxes.Social Security accounts for 12.4% of your self-employment tax, and applies to the first $118,500 of your earnings. Anything you earn past that is not taxed.Medicare makes up the remaining 2.9% of the tax. There is no ceiling for this 2.9% tax, whether you make $20,000 or $200,000 from freelancing, you will pay 2.9% of your income towards Medicare taxes.That being said, you can claim 50% of what you pay in self-employment tax as income tax deduction. Other deductions can include software costs, hardware costs, a percentage of internet bills, unpaid invoices, and home office space (if your home office is used exclusively for your freelance engagements).As mentioned earlier, if you expect to pay more than $1,000 in self-employment taxes after all other withholdings, you may need to pay quarterly payments on your taxes.To estimate how much to pay, take your total revenue, deduct expenses and deductions, and come up with your taxable income. Calculate your tax liability, divide that number by 4, and submit your quarterly payments (January 15th, April 15th, June 15th, and September 15th) online, through the Electronic Federal Tax Payment System.If you have taxes that were not covered by your quarterly payments, you’ll pay the balance when you file your annual tax return in April. If you overpaid, you'll receive a refund. If you underpaid and did not make quarterly payments, you may face a penalty from the IRS.

Create this form in 5 minutes!

How to create an eSignature for the self employment form

How to create an eSignature for the Self Employment Form in the online mode

How to create an electronic signature for your Self Employment Form in Google Chrome

How to create an eSignature for putting it on the Self Employment Form in Gmail

How to make an eSignature for the Self Employment Form right from your mobile device

How to generate an eSignature for the Self Employment Form on iOS

How to create an eSignature for the Self Employment Form on Android OS

People also ask

-

What is a Florida self employment form?

The Florida self employment form is a document that individuals must complete to report their income when they are self-employed. This form helps ensure that you comply with state tax laws. Understanding how to fill out the Florida self employment form accurately can help you avoid potential fines or penalties.

-

How can airSlate SignNow help with the Florida self employment form?

airSlate SignNow provides an efficient platform for filling out and eSigning your Florida self employment form. The software allows you to manage your documents electronically, making it easy to complete and submit your forms on time. This ensures that you have a seamless experience while staying compliant with tax guidelines.

-

Is there a cost associated with using airSlate SignNow for the Florida self employment form?

Yes, there is a subscription fee for using airSlate SignNow, which varies based on the plan you choose. However, the cost is often outweighed by the benefits it provides in terms of time savings and convenience when handling the Florida self employment form. The platform offers various pricing tiers to accommodate different business needs.

-

What features does airSlate SignNow offer for managing the Florida self employment form?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and advanced eSignature technology to streamline the Florida self employment form process. These features allow users to create, share, and sign documents quickly and securely. Additionally, users can track document status to ensure timely submissions.

-

Can I integrate airSlate SignNow with other software for my Florida self employment form?

Absolutely! airSlate SignNow integrates with various popular applications, including Google Drive, Dropbox, and CRM systems. This integration capability allows users to effortlessly import and export necessary documents related to the Florida self employment form, enhancing productivity and workflow efficiency.

-

What are the benefits of using airSlate SignNow for my Florida self employment form?

Using airSlate SignNow for your Florida self employment form simplifies the documentation process, saving you time and reducing the potential for errors. The platform’s secure electronic signature capabilities ensure that your documents are legally binding, making your submissions compliant with state regulations. Additionally, it helps keep your business organized by centralizing your documents.

-

Is airSlate SignNow secure for handling my Florida self employment form?

Yes, airSlate SignNow employs industry-standard security measures to protect your documents, including the Florida self employment form. Features like encrypted data, secure cloud storage, and user authentication are in place to safeguard your information. This ensures that sensitive personal and financial information remains confidential and secure.

Get more for Fsemp Florida Self Employment Form

- Appeal form de 1000aa

- Certificate in supervisory management scciob form

- Adventurer registration form gulf states conference

- Cpa ontario transcript assessment form cpa ontario transcript assessment form

- Schedule of liabilities form 2015 2019

- Request for a business number and certain program accounts form

- Printable t1135 2017 2019 form

- 6059b 2016 2019 form

Find out other Fsemp Florida Self Employment Form

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple