Ifta Ct Form

What is the IFTA CT?

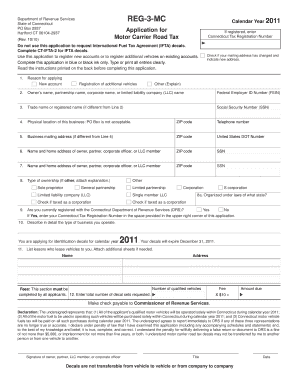

The International Fuel Tax Agreement (IFTA) is a cooperative agreement among U.S. states and Canadian provinces that simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. The IFTA CT, or Connecticut motor carrier road tax, specifically pertains to the fuel tax obligations for carriers operating within Connecticut and across IFTA member jurisdictions. This agreement allows carriers to file a single quarterly fuel tax return, rather than separate returns for each state or province where they operate.

How to Use the IFTA CT

Using the IFTA CT involves several steps to ensure compliance with fuel tax regulations. Carriers must first determine their eligibility under IFTA guidelines. Once eligibility is established, they can register with the Connecticut Department of Revenue Services (DRS) to obtain an IFTA license and decals. These decals must be displayed on each qualifying vehicle. Carriers then track their fuel purchases and mileage in each jurisdiction, which is essential for accurate reporting on the quarterly IFTA return.

Steps to Complete the IFTA CT

Completing the IFTA CT requires careful attention to detail. Here are the key steps:

- Gather Information: Collect data on fuel purchases and mileage for each jurisdiction where the vehicle operated.

- Calculate Fuel Tax: Determine the total gallons of fuel consumed and the miles traveled in each state or province.

- Complete the IFTA Return: Fill out the IFTA return form, including all relevant information about fuel usage and mileage.

- Submit the Form: File the completed IFTA return with the Connecticut DRS by the designated deadline.

Legal Use of the IFTA CT

The legal use of the IFTA CT is governed by both state and federal regulations. Carriers must ensure compliance with the terms of the IFTA agreement, which includes accurate reporting and timely payment of taxes owed. Failure to adhere to these regulations can result in penalties, including fines and interest on unpaid taxes. It is crucial for carriers to maintain accurate records and documentation to support their IFTA filings.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA CT are critical for compliance. Carriers must submit their quarterly IFTA returns by the last day of the month following the end of each quarter. The quarters are defined as follows:

- First Quarter: January 1 to March 31, due by April 30

- Second Quarter: April 1 to June 30, due by July 31

- Third Quarter: July 1 to September 30, due by October 31

- Fourth Quarter: October 1 to December 31, due by January 31

Required Documents

To successfully complete the IFTA CT, carriers need to gather several key documents:

- Fuel Purchase Receipts: Detailed records of all fuel purchases, including date, amount, and location.

- Mileage Records: Documentation of miles driven in each jurisdiction, typically maintained through logs or electronic tracking systems.

- IFTA License and Decals: Proof of registration under the IFTA agreement, including the display of decals on vehicles.

Quick guide on how to complete ifta ct

Complete Ifta Ct effortlessly on any device

Digital document management has become widely embraced by companies and individuals alike. It offers a flawless environmentally friendly substitute for conventional printed and signed papers, as you can access the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Ifta Ct on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to adjust and eSign Ifta Ct with ease

- Find Ifta Ct and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the files or conceal sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, exhausting form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Ifta Ct and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta ct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT motor carrier road tax?

The CT motor carrier road tax is a tax imposed on certain motor carriers operating on Connecticut highways. This tax is assessed based on a vehicle's weight and the miles driven within the state. Understanding CT motor carrier road tax is essential for compliance and effective cost management as a business.

-

How can airSlate SignNow help with managing CT motor carrier road tax documents?

airSlate SignNow simplifies the process of managing CT motor carrier road tax documents by providing an easy platform for document creation, eSigning, and secure storage. With features that enhance productivity, businesses can efficiently manage their tax-related paperwork and keep their records organized. This ensures timely compliance with CT motor carrier road tax regulations.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features like customizable templates, eSignature capabilities, and automated workflows specifically designed for managing tax documents, including CT motor carrier road tax forms. These features streamline the approval process, reduce turnaround time, and improve accuracy in documentation, catering directly to the needs of businesses managing tax obligations.

-

Is there a cost associated with using airSlate SignNow for CT motor carrier road tax submissions?

Yes, using airSlate SignNow for CT motor carrier road tax submissions involves a subscription cost, which is competitive and cost-effective compared to other document management solutions. The pricing plans offer flexible options that cater to varying business sizes and needs, ensuring that managing CT motor carrier road tax is affordable.

-

Can I integrate airSlate SignNow with my existing accounting software for CT motor carrier road tax?

Absolutely! airSlate SignNow provides seamless integrations with various accounting software, enabling users to manage their CT motor carrier road tax filings alongside other financial tools. This integration helps streamline processes and ensures that all relevant tax information is available in one location, improving overall efficiency.

-

What benefits does airSlate SignNow offer for handling CT motor carrier road tax?

Using airSlate SignNow delivers numerous benefits for handling CT motor carrier road tax, including enhanced efficiency, improved compliance, and reduced paper usage. The platform ensures that all documents are securely eSigned and stored, enabling businesses to focus on their operations while meeting tax requirements effortlessly.

-

How do I get started with airSlate SignNow for CT motor carrier road tax management?

Getting started with airSlate SignNow for CT motor carrier road tax management is easy. Simply sign up for an account, explore the platform's features, and start creating or uploading your tax documents. Our user-friendly interface makes managing your CT motor carrier road tax processes straightforward and efficient.

Get more for Ifta Ct

- Fle lp 604 form

- Instructions for sealing a criminal record in texas form

- Expunge seal package download florida form

- Lis pendens form california

- Sedgwick county expungement forms

- Sedgwick county felony expungement form

- What is scca expungement and south carolina form

- Fingerprint record removal request form

Find out other Ifta Ct

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template