Form 4835

What is the Form 4835

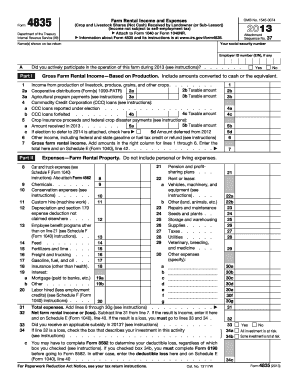

The Form 4835 is a tax document used by individuals who receive income from rental real estate activities. Specifically, it is designed for reporting income and expenses related to the rental of property that is not classified as a trade or business. This form is typically utilized by partners in a partnership or by individuals who are not actively engaged in the rental activity, allowing them to report their share of income or loss from the rental property on their tax returns.

How to use the Form 4835

To effectively use the Form 4835, individuals must first gather all relevant financial information related to their rental properties. This includes income received, expenses incurred, and any deductions applicable to the rental activities. Once the necessary data is collected, users can fill out the form, ensuring that all sections are completed accurately. After completion, the form should be submitted along with the individual’s tax return, typically by the April deadline each year.

Steps to complete the Form 4835

Completing the Form 4835 involves several key steps:

- Gather financial records, including income statements and receipts for expenses.

- Fill in the identification section with your name, address, and taxpayer identification number.

- Report rental income received during the tax year in the appropriate section.

- List all deductible expenses, such as repairs, maintenance, and property management fees.

- Calculate the total income or loss by subtracting total expenses from total income.

- Review the form for accuracy before submission.

Legal use of the Form 4835

The Form 4835 is legally binding when filled out correctly and submitted in accordance with IRS guidelines. To ensure its legal validity, it is essential to adhere to all applicable tax laws and regulations. This includes accurately reporting all income and expenses and maintaining proper documentation to support the claims made on the form. Failure to comply with these requirements can lead to penalties or audits by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4835 align with the general tax return deadlines. Typically, the form must be filed by April 15 of the year following the tax year being reported. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to tax deadlines that may occur annually.

Required Documents

When preparing to fill out the Form 4835, several documents are necessary to ensure accurate reporting:

- Income statements for rental properties.

- Receipts for all deductible expenses.

- Any relevant tax documents from partnerships or other entities.

- Previous year’s tax returns for reference.

Form Submission Methods (Online / Mail / In-Person)

The Form 4835 can be submitted through various methods, depending on the preference of the taxpayer. It can be filed electronically using tax preparation software, which is often the most efficient method. Alternatively, individuals may choose to print the completed form and mail it to the IRS. In-person submissions are generally not available for tax forms, as the IRS primarily processes submissions via mail or electronically.

Quick guide on how to complete form 4835

Complete Form 4835 easily on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 4835 on any platform with airSlate SignNow applications for Android or iOS and enhance any document-oriented process today.

The easiest way to modify and eSign Form 4835 without hassle

- Obtain Form 4835 and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, SMS, or shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 4835 and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4835

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4835 and who needs to file it?

Form 4835 is used by taxpayers to report farm rental income and expenses. It is typically filed by individuals who rent out land or farm operations as part of a trade or business. Understanding how to properly fill out Form 4835 can help you maximize your deductions and ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with Form 4835 submissions?

airSlate SignNow makes it simple to eSign and send your Form 4835 electronically. With our cloud-based solution, you can quickly gather signatures from all parties involved, ensuring timely submission to the IRS. Plus, our platform keeps all documents securely stored for easy access and reference.

-

What features does airSlate SignNow offer for managing Form 4835?

Our platform includes features such as document templates, automated workflows, and customizable fields specifically designed for Form 4835. With airSlate SignNow, you can streamline the process, reduce errors, and ensure that all necessary information is collected effectively. This can signNowly save time for businesses handling multiple submissions.

-

Is there a cost associated with using airSlate SignNow to manage Form 4835?

Yes, airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you’re a small business or a large enterprise, you can choose a plan that fits your budget and volume of Form 4835 submissions. Our cost-effective solution ensures that you get the most value while efficiently managing your documents.

-

Can I integrate airSlate SignNow with other software for handling Form 4835?

Absolutely! airSlate SignNow supports integration with various software solutions including CRMs and accounting tools, which can enhance your workflow when dealing with Form 4835. Integrating with these systems allows for seamless data transfer and reduces manual entry, leading to increased accuracy and efficiency.

-

How secure is airSlate SignNow when submitting Form 4835?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure data storage to protect your sensitive information while handling Form 4835. With our compliance to industry standards, you can rest assured that your documents are safe during and after submission.

-

What are the benefits of using airSlate SignNow for Form 4835?

Using airSlate SignNow for Form 4835 can signNowly simplify your documentation process. It enables efficient collaboration, faster turnaround times, and reduces the risk of errors. Moreover, the convenience of eSigning helps you stay compliant and organized throughout the filing process.

Get more for Form 4835

- Me back form

- Icici bank rtgs application form download pdf file

- Dd form 844

- City of houston alarm permit application form

- Report to determine status application for employer number tngov tn form

- Ara alarm administration permit the security store houston tx form

- React pdf form filler

- Recovery works referral form

Find out other Form 4835

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form