Payroll Discrepancy Form Template

What is the payroll discrepancy form template

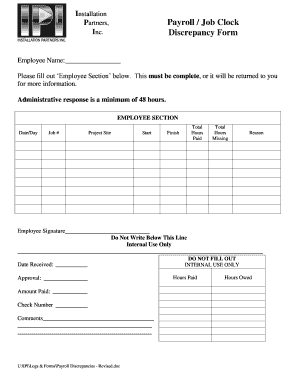

The payroll discrepancy form is a crucial document used by employees to report any inconsistencies or errors in their paychecks. This form allows employees to formally notify their employer about issues such as underpayment, overpayment, or incorrect deductions. By utilizing a payroll discrepancy form template, employees can ensure that all necessary information is captured accurately and consistently, facilitating a prompt resolution of the issue.

How to use the payroll discrepancy form template

Using the payroll discrepancy form template involves several straightforward steps. First, gather all relevant information, including your employee ID, the pay period in question, and details about the discrepancy. Next, fill out the form by clearly stating the nature of the discrepancy, providing supporting documentation if necessary. Finally, submit the completed form to your HR department or payroll administrator, ensuring you keep a copy for your records.

Steps to complete the payroll discrepancy form template

Completing the payroll discrepancy form template requires attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, employee ID, and department.

- Specify the pay period affected by the discrepancy.

- Clearly describe the nature of the discrepancy, such as the amount of underpayment or overpayment.

- Attach any supporting documents, such as pay stubs or bank statements, that validate your claim.

- Review the form for accuracy and completeness before submitting it.

Legal use of the payroll discrepancy form template

The payroll discrepancy form template is legally recognized as a formal request for correction of payroll errors. To ensure its legal validity, it must be filled out accurately and submitted in accordance with company policies. Compliance with relevant employment laws is essential, as it protects both the employee's rights and the employer's obligations. Utilizing a reliable eSignature solution can further enhance the legal standing of the submitted form.

Key elements of the payroll discrepancy form template

Essential components of the payroll discrepancy form template include:

- Employee Information: Name, employee ID, and contact details.

- Pay Period: The specific timeframe for which the discrepancy is reported.

- Description of the Discrepancy: A detailed explanation of the issue, including amounts and types of errors.

- Supporting Documentation: Any relevant documents that substantiate the claim.

- Signature: The employee's signature, which may be required for validation.

Examples of using the payroll discrepancy form template

There are various scenarios where the payroll discrepancy form template may be utilized. For instance, an employee may notice that their paycheck reflects fewer hours worked than they actually logged. Another example could involve an employee receiving a bonus that was not accounted for in their pay. In both cases, completing the payroll discrepancy form ensures that the issue is formally documented and addressed by the employer.

Quick guide on how to complete payroll discrepancy form template

Prepare Payroll Discrepancy Form Template effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can locate the needed form and safely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Payroll Discrepancy Form Template on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Payroll Discrepancy Form Template without hassle

- Locate Payroll Discrepancy Form Template and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive details with features that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then select the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Payroll Discrepancy Form Template and guarantee seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll discrepancy form template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payroll discrepancy form?

A payroll discrepancy form is a document used to report and resolve any inconsistencies or errors in payroll calculations. This form helps employees communicate their concerns to the payroll department effectively. Utilizing a payroll discrepancy form streamlines the process of correcting errors, ensuring that employees receive the right compensation in a timely manner.

-

How can airSlate SignNow help with payroll discrepancy forms?

airSlate SignNow simplifies the process of creating, sending, and signing payroll discrepancy forms. Our platform enables users to quickly generate these forms, ensuring they are electronically signed and sent back efficiently. This speeds up the resolution of payroll issues, allowing businesses to maintain employee satisfaction.

-

Is there a cost associated with using the payroll discrepancy form feature?

While the specific cost can vary based on your subscription plan, airSlate SignNow offers a range of pricing options designed to be cost-effective. Using our platform to manage payroll discrepancy forms can save time and reduce administrative costs, making it a valuable investment for businesses of any size.

-

Are payroll discrepancy forms customizable with airSlate SignNow?

Yes, airSlate SignNow allows users to customize payroll discrepancy forms to meet their specific organizational needs. You can add your branding, specific fields for employee information, and instructions. This flexibility ensures that the forms align with your business processes and improve overall efficiency.

-

What features support the use of payroll discrepancy forms on airSlate SignNow?

airSlate SignNow includes features such as drag-and-drop form builders, templates for payroll discrepancy forms, and secure eSignature capabilities. These features make it easy for businesses to create accurate forms while ensuring compliance and security. Additionally, tracking and reporting features help monitor the status of submitted forms.

-

Can I integrate payroll discrepancy forms with other applications?

Yes, airSlate SignNow offers seamless integration with popular HR and payroll software. This means you can easily manage your payroll discrepancy forms alongside other business processes in one centralized location. Integrations help streamline workflows and reduce the need for manual data entry.

-

How does using payroll discrepancy forms benefit employees?

Using payroll discrepancy forms benefits employees by providing a clear and simple way to report payroll issues. The electronic submission process through airSlate SignNow ensures their concerns are documented and addressed quickly. This transparency strengthens trust between employees and management, fostering a positive workplace culture.

Get more for Payroll Discrepancy Form Template

- Pennsylvania house lease blumberg legal forms online

- 592 t commercial lease form

- Memorandum of administrative closing forms

- Foursquare salary form

- Georgia form st 3use 2011

- Kcc license application 2010 form

- Kansas secretary of state corporations rr form 2010

- Www irs govaffordable care actindividuals andhealth insurance marketplace statementsinternal revenue form

Find out other Payroll Discrepancy Form Template

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now