Bir Form 1701a Editable

What is the Bir Form 1701a Editable

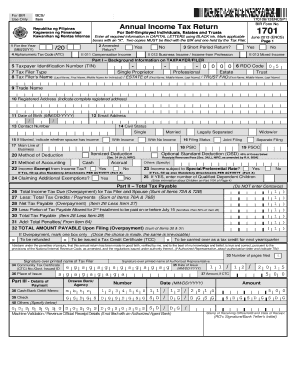

The Bir Form 1701a editable is a tax form used by individuals in the United States to report their income and calculate their tax obligations. This form is particularly relevant for self-employed individuals and those with mixed income sources. The editable version allows users to fill out the form digitally, making it easier to complete and submit. By utilizing digital tools, users can ensure accuracy and efficiency in their tax reporting process.

How to Use the Bir Form 1701a Editable

To effectively use the Bir Form 1701a editable, follow these steps:

- Download the editable PDF version of the form from a reliable source.

- Open the form using a PDF editor that supports form filling.

- Enter your personal information, including your name, address, and taxpayer identification number.

- Input your income details, deductions, and any applicable credits.

- Review the completed form for accuracy before saving or printing it.

Steps to Complete the Bir Form 1701a Editable

Completing the Bir Form 1701a editable involves several key steps:

- Gather necessary documents, such as income statements and receipts for deductions.

- Open the editable form and fill in your personal and financial information.

- Calculate your total income and allowable deductions accurately.

- Ensure all fields are completed, including signatures if required.

- Save the completed form securely and prepare for submission.

Legal Use of the Bir Form 1701a Editable

The Bir Form 1701a editable is legally binding when completed and submitted according to IRS regulations. To ensure legal compliance, it is essential to follow the guidelines set forth by the IRS, including accurate reporting of income and proper documentation of deductions. Utilizing a reputable eSignature solution can enhance the legal validity of the form by providing a digital certificate and maintaining compliance with relevant eSignature laws.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Bir Form 1701a editable is crucial for compliance. Typically, the deadline for submitting this form is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to tax deadlines and plan accordingly to avoid penalties.

Examples of Using the Bir Form 1701a Editable

There are various scenarios in which individuals might use the Bir Form 1701a editable:

- A self-employed individual reporting income from freelance work.

- A part-time business owner calculating taxes on additional income sources.

- An individual with rental income who needs to report earnings and expenses.

Each of these examples highlights the versatility of the form in addressing different income situations.

Quick guide on how to complete bir form 1701a editable 92679250

Prepare Bir Form 1701a Editable easily on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents quickly without hassles. Handle Bir Form 1701a Editable on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Bir Form 1701a Editable effortlessly

- Obtain Bir Form 1701a Editable and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from whichever device you choose. Modify and eSign Bir Form 1701a Editable and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bir form 1701a editable 92679250

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BIR Form 1701A editable template?

The BIR Form 1701A editable template is a digital version of the tax form designed for self-employed individuals and professionals in the Philippines. This template allows you to fill out and modify the form conveniently online, ensuring accuracy and compliance with tax regulations.

-

How can I access the BIR Form 1701A editable template?

You can access the BIR Form 1701A editable template through the airSlate SignNow platform. Simply sign up for an account, and you'll have immediate access to a variety of fully editable forms, including the BIR Form 1701A, allowing you to easily manage your tax documentation.

-

Is the BIR Form 1701A editable template free to use?

While airSlate SignNow offers a free trial, the BIR Form 1701A editable template is part of the premium subscription. This subscription is cost-effective and provides valuable features for managing your online forms and electronic signatures.

-

Can I save my progress when filling out the BIR Form 1701A editable template?

Yes, with airSlate SignNow, you can easily save your progress while filling out the BIR Form 1701A editable template. This feature allows you to return to the form at any time without losing your data, making it a convenient solution for busy professionals.

-

What are the main benefits of using the BIR Form 1701A editable template?

Using the BIR Form 1701A editable template streamlines the tax filing process, reduces the risk of errors, and ensures compliance. It offers the convenience of editing digital forms on any device, and with airSlate SignNow, you can electronically sign and share documents securely.

-

Can I integrate the BIR Form 1701A editable template with other applications?

Yes, airSlate SignNow offers various integrations with popular applications such as Google Drive and Dropbox. This allows you to import and export the BIR Form 1701A editable template effortlessly, enhancing your workflow and document management processes.

-

How secure is my data when using the BIR Form 1701A editable template?

AirSlate SignNow prioritizes the security of your data. When using the BIR Form 1701A editable template, your information is protected with advanced encryption and secure servers, ensuring that your sensitive tax information remains confidential and secure.

Get more for Bir Form 1701a Editable

- Chilln form no 32aoriginalstate bank of pakistanc

- Welcome packet business information wisconsin gov

- Osu expend subcode state object code form

- Affidavit of test of casing in well form

- Guardian notice and proof of claim for disability benefits form

- Sealed bid form for surface lease lease no

- California estate 495562657 form

- Workers report of injury or occupational disease form

Find out other Bir Form 1701a Editable

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document