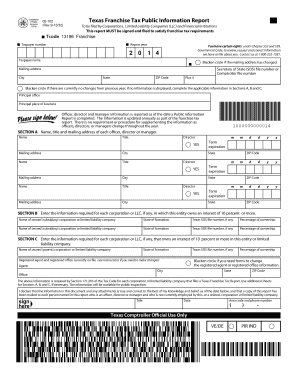

05 102 Texas Franchise Tax Public Information Report 05 102 Texas Franchise Tax Public Information Report 2018

Understanding the Texas Franchise Tax Public Information Report

The Texas Franchise Tax Public Information Report, commonly referred to as the Texas 05 102 report, is a crucial document for businesses operating in Texas. This report provides essential information about a business's financial status and its compliance with state tax laws. It is a requirement for entities that are subject to the Texas franchise tax, including limited liability companies (LLCs), corporations, and partnerships. The report includes details such as the business's name, address, and type, along with financial data that reflects its revenue and tax obligations.

Steps to Complete the Texas 05 102 Report

Filling out the Texas 05 102 report involves several key steps to ensure accuracy and compliance. Start by gathering necessary information about your business, including its legal name, address, and federal employer identification number (EIN). Next, calculate your total revenue for the reporting period, as this will determine your franchise tax liability. Once you have all the required information, you can proceed to complete the report. It's advisable to review the document carefully before submission to avoid errors that could lead to penalties.

How to Obtain the Texas 05 102 Report

To obtain the Texas 05 102 report, businesses can access it through the Texas Comptroller's website. The report is available in a downloadable format, making it convenient to fill out electronically. Alternatively, businesses can request a physical copy if needed. Ensure that you are using the most current version of the report to comply with the latest regulations. Keeping abreast of any updates or changes to the report is essential for maintaining compliance with state tax laws.

Legal Use of the Texas Franchise Tax Public Information Report

The Texas Franchise Tax Public Information Report serves several legal purposes. It is used to demonstrate compliance with state tax obligations, which is essential for maintaining good standing with the Texas Secretary of State. Additionally, the report may be required for various business transactions, such as securing loans, entering contracts, or applying for permits. Ensuring that the report is filled out correctly and submitted on time can help avoid legal complications and penalties.

Penalties for Non-Compliance with the Texas 05 102 Report

Failure to file the Texas 05 102 report by the deadline can result in significant penalties. The Texas Comptroller may impose fines for late submissions, which can accumulate over time. Additionally, non-compliance can lead to the loss of good standing for the business, affecting its ability to operate legally in Texas. It is important for businesses to be aware of filing deadlines and to ensure that their reports are submitted on time to avoid these consequences.

Form Submission Methods for the Texas 05 102 Report

The Texas 05 102 report can be submitted through various methods, including online filing, mail, or in-person submission. Online filing is often the most efficient option, allowing for immediate processing and confirmation of receipt. For those who prefer traditional methods, mailing the completed report to the Texas Comptroller's office is also acceptable. In-person submissions can be made at designated locations, providing an opportunity for direct assistance if needed.

Quick guide on how to complete 05 102 texas franchise tax public information report 05 102 texas franchise tax public information report

Easily Prepare 05 102 Texas Franchise Tax Public Information Report 05 102 Texas Franchise Tax Public Information Report on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the right template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle 05 102 Texas Franchise Tax Public Information Report 05 102 Texas Franchise Tax Public Information Report on any device using the airSlate SignNow Android or iOS applications and enhance any document-dependent process today.

Easily Modify and Electronically Sign 05 102 Texas Franchise Tax Public Information Report 05 102 Texas Franchise Tax Public Information Report

- Find 05 102 Texas Franchise Tax Public Information Report 05 102 Texas Franchise Tax Public Information Report and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign 05 102 Texas Franchise Tax Public Information Report 05 102 Texas Franchise Tax Public Information Report to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 05 102 texas franchise tax public information report 05 102 texas franchise tax public information report

Create this form in 5 minutes!

How to create an eSignature for the 05 102 texas franchise tax public information report 05 102 texas franchise tax public information report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas Comptroller report?

A Texas Comptroller report is a financial document that provides insights on state revenues, expenses, and overall budget performance. Businesses often need access to these reports to comply with state regulations and ensure transparency in financial practices. Using airSlate SignNow, companies can easily eSign and send documents related to their Texas Comptroller reports.

-

How can airSlate SignNow help with filing Texas Comptroller reports?

airSlate SignNow simplifies the process of filing Texas Comptroller reports by allowing users to prepare, send, and eSign necessary documents quickly and securely. This efficiency helps businesses stay compliant with state requirements while saving valuable time. Additionally, it minimizes paperwork and aids in accurate reporting.

-

What are the pricing options for using airSlate SignNow for Texas Comptroller reports?

airSlate SignNow offers several pricing tiers to cater to different business needs, including plans that are affordable for all sizes of organizations. Each plan provides features ideal for managing Texas Comptroller reports, ensuring you choose a solution that fits your budget. Visit our website to see the latest pricing and to find the best option for your business.

-

Does airSlate SignNow integrate with accounting software for Texas Comptroller reports?

Yes, airSlate SignNow seamlessly integrates with various accounting and business management software. These integrations allow users to manage their Texas Comptroller reports directly within their existing systems, ensuring a smooth workflow. This makes it easier to synchronize documents and data across platforms.

-

What features does airSlate SignNow offer for managing Texas Comptroller reports?

airSlate SignNow includes features like templates, customizable workflows, and secure eSigning which are essential for managing Texas Comptroller reports effectively. These tools streamline document management, enhance collaboration, and ensure the entire process is compliant and efficient. Users can also track document status and receive notifications for timely submissions.

-

Why should businesses use airSlate SignNow for eSigning Texas Comptroller reports?

Using airSlate SignNow for eSigning Texas Comptroller reports offers enhanced security and legal compliance. Our platform is designed to facilitate swift and trustworthy eSigning processes that meet legal standards. This ensures that your financial documents are handled with the utmost care and are always valid for submission.

-

Can I use airSlate SignNow on mobile devices for Texas Comptroller reports?

Absolutely! airSlate SignNow is fully compatible with mobile devices, which allows users to manage Texas Comptroller reports on the go. Whether you need to eSign a document or check the status of your submissions, our mobile-friendly platform ensures flexibility and convenience anytime, anywhere.

Get more for 05 102 Texas Franchise Tax Public Information Report 05 102 Texas Franchise Tax Public Information Report

Find out other 05 102 Texas Franchise Tax Public Information Report 05 102 Texas Franchise Tax Public Information Report

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy