05 102 Texas Franchise Tax Public Information Report 2022-2026

What is the 05 102 Texas Franchise Tax Public Information Report

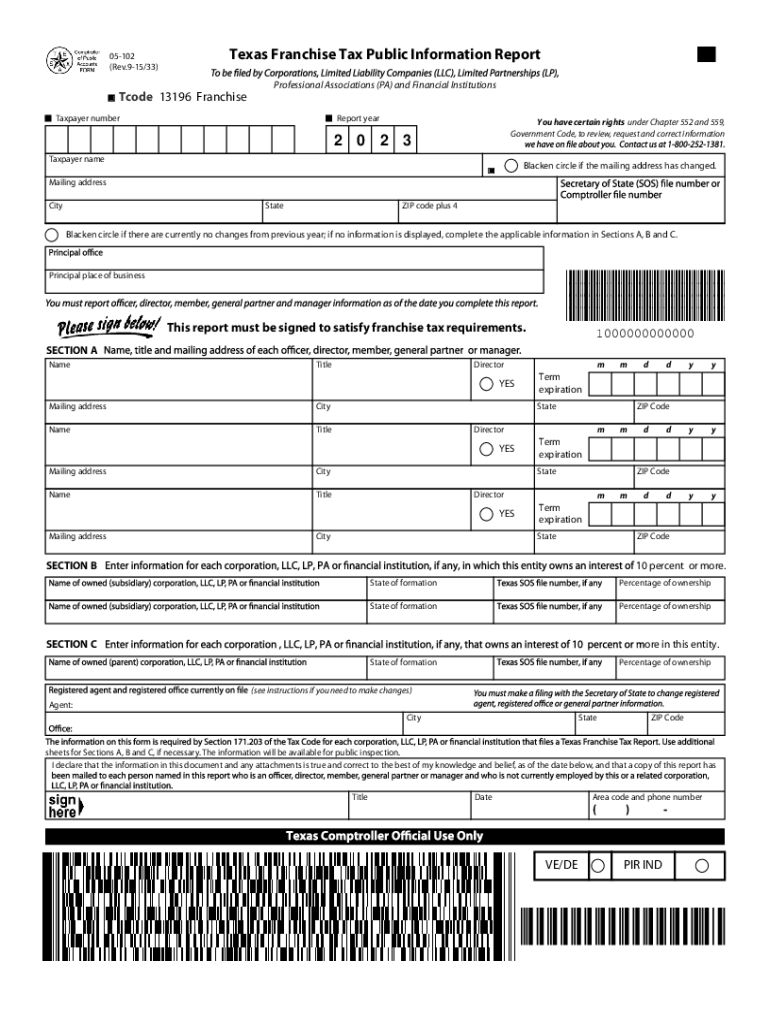

The 05 102 Texas Franchise Tax Public Information Report is a mandatory filing for businesses operating in Texas. This report provides essential information about the entity, including its name, address, and ownership details. It is a part of the franchise tax obligations set by the Texas Comptroller of Public Accounts. The report is crucial for maintaining compliance with state regulations and ensuring transparency in business operations.

Steps to complete the 05 102 Texas Franchise Tax Public Information Report

Completing the 05 102 Texas Franchise Tax Public Information Report involves several key steps:

- Gather necessary information about your business, including the legal name, address, and ownership structure.

- Access the official form, which can be found on the Texas Comptroller's website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy and completeness before submission.

- Submit the form either online, by mail, or in person, depending on your preference.

How to obtain the 05 102 Texas Franchise Tax Public Information Report

To obtain the 05 102 Texas Franchise Tax Public Information Report, businesses can visit the Texas Comptroller of Public Accounts website. The form is available for download and can also be filled out online. For those who prefer a physical copy, it can be requested through the office or printed directly from the website. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Legal use of the 05 102 Texas Franchise Tax Public Information Report

The legal use of the 05 102 Texas Franchise Tax Public Information Report is essential for businesses to fulfill their franchise tax obligations. This report serves as a public document that provides transparency about the business entity's operations. It is often required for various legal and financial transactions, including securing loans, entering contracts, and maintaining good standing with the state. Failure to file this report can lead to penalties and loss of business privileges.

Filing Deadlines / Important Dates

Filing deadlines for the 05 102 Texas Franchise Tax Public Information Report are crucial for compliance. Typically, the report is due on May 15 of each year. However, if May 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Businesses should stay informed about any changes to these dates to avoid penalties and ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The 05 102 Texas Franchise Tax Public Information Report can be submitted through various methods:

- Online: Businesses can fill out and submit the form electronically through the Texas Comptroller's website.

- Mail: The completed form can be printed and sent via postal service to the appropriate address provided by the Comptroller's office.

- In-Person: Businesses may also choose to deliver the form directly to a local Comptroller office.

Quick guide on how to complete 05 102 texas franchise tax public information report

Complete 05 102 Texas Franchise Tax Public Information Report effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 05 102 Texas Franchise Tax Public Information Report on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign 05 102 Texas Franchise Tax Public Information Report with ease

- Locate 05 102 Texas Franchise Tax Public Information Report and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important portions of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 05 102 Texas Franchise Tax Public Information Report and maintain excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 05 102 texas franchise tax public information report

Create this form in 5 minutes!

How to create an eSignature for the 05 102 texas franchise tax public information report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the texas comptroller report and how can it benefit my business?

The texas comptroller report is a financial statement that provides key insights into a business's tax obligations and financial health. Using tools like airSlate SignNow, you can easily manage and digitally sign these documents, ensuring compliance and improving efficiency. Understanding this report can help businesses optimize their tax strategies and stay informed about their financial standing.

-

How can airSlate SignNow assist with preparing a texas comptroller report?

airSlate SignNow simplifies the process of preparing a texas comptroller report by allowing you to gather, sign, and store essential documents electronically. This cloud-based solution streamlines document management and reduces paperwork, making it easier to compile the necessary information for reporting. With its eSigning capability, you can save time and ensure accuracy for your reports.

-

What are the pricing options for airSlate SignNow related to the texas comptroller report?

airSlate SignNow offers several pricing tiers to cater to various business needs, including plans that allow for unlimited eSigning and document templates specifically designed for reports like the texas comptroller report. Competitive pricing and flexible options ensure that businesses of all sizes can find an affordable solution. Contact airSlate SignNow for a detailed breakdown of pricing plans.

-

Are there any integrations available with airSlate SignNow for handling the texas comptroller report?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software that can help with the texas comptroller report. These integrations allow you to efficiently transfer data and access important financial information directly within the platform. Connecting your tools enhances collaboration and streamlines your workflow.

-

Can I customize document templates for the texas comptroller report in airSlate SignNow?

Absolutely! airSlate SignNow provides customizable document templates that cater specifically to the texas comptroller report. This feature allows businesses to create, edit, and standardize their reports, ensuring that all necessary information is included and formatted correctly. Customization adds convenience and efficiency to your reporting process.

-

Is airSlate SignNow user-friendly for managing the texas comptroller report?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for users to manage the texas comptroller report without extensive training. The intuitive interface allows for straightforward navigation, document signing, and collaborative features. This ease of use helps teams to quickly adapt and efficiently handle their reporting requirements.

-

What security measures does airSlate SignNow implement for documents related to the texas comptroller report?

airSlate SignNow takes security seriously, employing advanced encryption and compliance standards to protect documents, including the texas comptroller report. With features like secure cloud storage and audit trails, businesses can trust that their sensitive information is safeguarded. Ensuring your data's integrity is a priority with airSlate SignNow.

Get more for 05 102 Texas Franchise Tax Public Information Report

- Amount due in accordance with the laws of the state of louisiana form

- Parish of and state of louisiana to wit form

- City of parish of and state of louisiana to wit form

- Western district of louisianaunited states bankruptcy court form

- Sellers andor buyers shall correct andor replace any closing document at the request of form

- The property at the address described above flood zone status is form

- Pledge of certificate of deposit state of louisiana parish form

- La rev stat121421 rs 121421dissolution by form

Find out other 05 102 Texas Franchise Tax Public Information Report

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document