Sc W2 Form

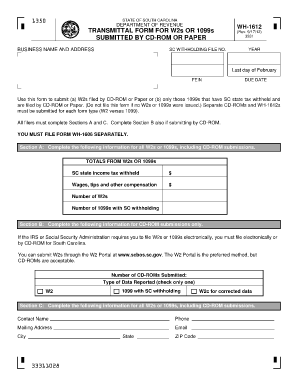

What is the SC W-2 Form?

The SC W-2 form is a tax document used in South Carolina to report an employee's annual wages and the taxes withheld from their paychecks. Employers are required to issue this form to their employees by January thirty-first each year. The SC W-2 form includes essential information such as the employee's Social Security number, total earnings, and state income tax withheld. This document plays a crucial role in the employee's tax filing process, allowing individuals to accurately report their income to the Internal Revenue Service (IRS) and the South Carolina Department of Revenue.

How to Use the SC W-2 Form

Using the SC W-2 form involves several steps. First, employees should ensure they receive their W-2 from their employer by the deadline. Once obtained, the form must be reviewed for accuracy, including verifying personal information and earnings. Employees will then use the information from the SC W-2 to complete their federal and state tax returns. It is important to keep a copy of the W-2 for personal records. If discrepancies are found, employees should contact their employer for corrections before filing their taxes.

Steps to Complete the SC W-2 Form

Completing the SC W-2 form requires careful attention to detail. Follow these steps:

- Gather necessary information, including your Social Security number and earnings details.

- Fill out the employee information section accurately, ensuring names and addresses are correct.

- Input total wages earned in the appropriate box, along with federal and state tax withheld.

- Double-check all entries for accuracy to avoid issues with the IRS or state tax authorities.

- Submit the completed form to the appropriate tax authorities by the filing deadline.

Legal Use of the SC W-2 Form

The SC W-2 form is legally binding when completed accurately and submitted on time. It serves as an official record of income and tax withholding, which is essential for compliance with both federal and state tax laws. Employers must adhere to regulations regarding the issuance of W-2 forms, ensuring that all employees receive their forms by the designated deadline. Failure to comply can result in penalties for both employers and employees, making it crucial to understand the legal implications of this form.

Who Issues the SC W-2 Form?

The SC W-2 form is issued by employers to their employees. All employers who withhold wages for state income tax purposes are required to provide this form. This includes businesses of all sizes, from large corporations to small sole proprietorships. Employers must ensure that the W-2 forms are accurate and distributed in a timely manner to facilitate the tax filing process for their employees.

Filing Deadlines / Important Dates

Filing deadlines for the SC W-2 form are critical for compliance. Employers must issue W-2 forms to employees by January thirty-first each year. Additionally, employers are required to submit copies of the W-2 forms to the South Carolina Department of Revenue by the same date. Employees should be aware of these deadlines to ensure they file their tax returns accurately and on time, avoiding potential penalties.

Quick guide on how to complete sc w2 form

Complete Sc W2 Form effortlessly on any device

Digital document management has gained increased popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Sc W2 Form on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

The simplest method to modify and eSign Sc W2 Form without hassle

- Locate Sc W2 Form and click on Get Form to initiate.

- Use the tools provided to fill out your form.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers for this exact purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Sc W2 Form to ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc w2 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is w2asap web and how does it work?

W2asap web is an online platform that facilitates the electronic signing of documents, primarily focused on W-2 forms. By using w2asap web, businesses can easily send, sign, and store W-2 documents securely, streamlining their payroll process. This service is designed to enhance efficiency and reduce paperwork.

-

What are the key features of w2asap web?

w2asap web offers several key features, including customizable templates, secure electronic signatures, and cloud storage for documents. Additionally, it allows real-time tracking of document status and provides reminders for signers. These features ensure a comprehensive solution for managing W-2 forms efficiently.

-

How much does w2asap web cost?

The pricing for w2asap web varies based on the number of users and volume of documents processed. It provides flexible plans suitable for businesses of all sizes, ensuring cost-effectiveness and value. For detailed pricing, we recommend visiting the airSlate SignNow website to explore the available options.

-

Is w2asap web secure for handling sensitive documents?

Yes, w2asap web prioritizes the security and privacy of users' documents. It employs industry-standard encryption and complies with regulations such as GDPR and HIPAA. This commitment to security ensures that sensitive information, like W-2 forms, is protected throughout the signing process.

-

Can w2asap web be integrated with other software?

Absolutely! w2asap web offers seamless integration with various business applications, including payroll software and CRM systems. These integrations enhance productivity by allowing users to manage documents directly from their existing workflows, simplifying the entire process.

-

What are the benefits of using w2asap web for businesses?

Using w2asap web provides businesses with signNow benefits, including time savings, reduced costs associated with printing and mailing, and improved accuracy. The ease of tracking and managing W-2 forms digitally minimizes errors and enhances overall efficiency. This solution is particularly advantageous for remote teams.

-

How does the signing process work on w2asap web?

The signing process on w2asap web is simple and user-friendly. Users upload their documents, specify signers, and send requests for signatures via email. Signers receive a notification, can review the document, and provide their electronic signature with just a few clicks, streamlining the entire workflow.

Get more for Sc W2 Form

- The green paper preliminary thoughts ec europa form

- P2236a rev 01 09form 3046 limited school choice qxd qxd

- Homecoming dance guest permission form wcpss net

- Dance guest permission form pchs student name

- Criminal history self disclosure affidavit english form

- Rn en indd form

- Rn ex indd form

- Referral form template child ampamp adolescent

Find out other Sc W2 Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document