1021 Form

What is the 1021 Form

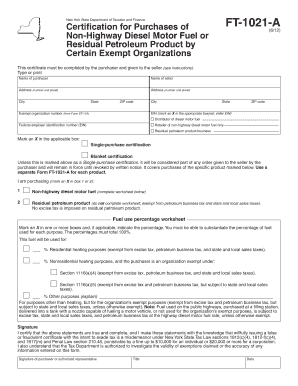

The 1021 form, also known as the FT 1021 A form, is a tax document used primarily for reporting specific financial information to the Internal Revenue Service (IRS). This form is essential for taxpayers who need to disclose certain income, deductions, or credits. Understanding the purpose of the 1021 form is crucial for ensuring compliance with federal tax regulations and avoiding potential penalties.

How to use the 1021 Form

Using the 1021 form involves several key steps. First, gather all necessary financial documents, including income statements and receipts for deductible expenses. Next, accurately fill out the form, ensuring that all information is complete and correct. Once the form is filled out, review it for any errors before submission. The 1021 form can be submitted electronically or via mail, depending on your preference and the IRS guidelines.

Steps to complete the 1021 Form

Completing the 1021 form requires careful attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, provide the relevant financial data as prompted on the form. This may include income from various sources, deductions, and any applicable credits. After filling out all sections, double-check your entries for accuracy. Finally, sign and date the form before submitting it to the IRS.

Legal use of the 1021 Form

The legal use of the 1021 form is governed by IRS regulations. It is important to ensure that the form is filled out truthfully and accurately, as any discrepancies can lead to legal consequences. The form serves as a formal declaration of your financial situation and must comply with all applicable tax laws. Utilizing a reliable eSignature solution can enhance the legal standing of your submitted form by ensuring proper authentication and compliance with electronic signature laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1021 form vary depending on the specific tax year and the taxpayer's situation. Generally, the form must be submitted by the annual tax filing deadline, which is typically April 15 for most individuals. It is essential to stay informed about any changes to these deadlines, as late submissions may incur penalties. Mark your calendar with important dates to ensure timely filing and compliance with IRS requirements.

Required Documents

To complete the 1021 form accurately, certain documents are required. These may include W-2 forms, 1099 statements, and receipts for deductible expenses. Having these documents on hand will facilitate the completion process and help ensure that all necessary information is reported. Organizing your documents in advance can save time and reduce the likelihood of errors when filling out the form.

Examples of using the 1021 Form

The 1021 form can be used in various scenarios, such as reporting income from freelance work, rental properties, or investments. For instance, a self-employed individual may use the form to report earnings and claim deductions for business expenses. Understanding the different contexts in which the 1021 form is applicable can help taxpayers maximize their benefits and ensure compliance with tax regulations.

Quick guide on how to complete 1021 form 5427309

Complete 1021 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage 1021 Form on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign 1021 Form with ease

- Find 1021 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form—via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign 1021 Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1021 form 5427309

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1021 form and why is it important?

The 1021 form is a key document used for specific tax purposes. Understanding its requirements is crucial for businesses to ensure compliance and avoid penalties. Using airSlate SignNow to manage your 1021 form can streamline your workflow while ensuring that all signatures are securely collected.

-

How can airSlate SignNow help with signing the 1021 form?

AirSlate SignNow allows you to easily upload, send, and eSign your 1021 form digitally. Our platform offers a simple interface that makes it easy for all parties to sign the document quickly. Plus, you'll have access to a full audit trail to verify the signing process.

-

Is there a cost associated with using airSlate SignNow for the 1021 form?

Yes, airSlate SignNow offers a variety of pricing plans designed to fit different business needs. Each plan includes features such as unlimited signing and secure document storage, making it a cost-effective solution for handling your 1021 form and other documents.

-

What features does airSlate SignNow offer for managing the 1021 form?

With airSlate SignNow, you can create templates specifically for the 1021 form, automate workflows, and track document statuses in real-time. The platform also supports in-person signing, ensuring versatility in how you manage your documents. All these features help ensure your 1021 form processes are efficient.

-

Can I integrate airSlate SignNow with other software for the 1021 form?

Absolutely! AirSlate SignNow integrates with popular business applications like Google Drive, Salesforce, and Microsoft Office. This means you can easily import and manage your 1021 form alongside your existing tools, streamlining your operations.

-

What are the benefits of eSigning the 1021 form with airSlate SignNow?

eSigning your 1021 form with airSlate SignNow is faster, more secure, and environmentally friendly. It eliminates the need for printing and scanning, allowing you to save time and resources. Additionally, you can access and sign the document from anywhere, enhancing flexibility for all parties involved.

-

How secure is my information when using airSlate SignNow for the 1021 form?

AirSlate SignNow prioritizes the security of your information with advanced encryption and secure cloud storage. All signed documents, including the 1021 form, are protected against unauthorized access. Our compliance with industry standards ensures that your sensitive data remains confidential.

Get more for 1021 Form

- Military acceptance letter form

- Huntsville hospital doctors excuse 203938853 form

- 2x movies online form

- Beih 38 v slovenine form

- Lyceum past papers form

- 125 735701720dqkdwwdq5hjlrqdo2iilfh form

- Abbyy finereader server automated document conversion server server based ocr service for automated high volume document form

- Caregiver contract template 787750295 form

Find out other 1021 Form

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement