Wage Reconciliation Form

What is the Wage Reconciliation Form

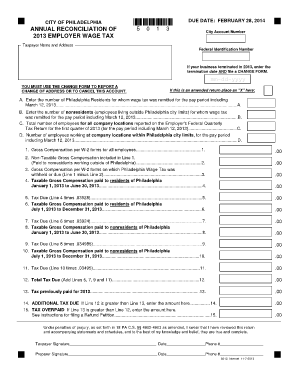

The Wage Reconciliation Form is a crucial document used by employers to reconcile payroll records with employee earnings. This form ensures that all wages paid to employees are accurately reported and accounted for, which is essential for tax compliance and financial reporting. It helps identify discrepancies between the amounts reported to the Internal Revenue Service (IRS) and the actual wages disbursed to employees. By maintaining accurate records, businesses can avoid potential penalties and ensure that employees receive the correct compensation.

How to use the Wage Reconciliation Form

Using the Wage Reconciliation Form involves several steps to ensure accurate completion. First, gather all relevant payroll records and employee information. This includes total wages paid, tax withholdings, and any deductions. Next, fill out the form with the necessary details, including the employer's information and the period for which the reconciliation is being conducted. After completing the form, review it for accuracy before submitting it to the appropriate tax authorities. This process helps maintain compliance and ensures that all financial records align with IRS requirements.

Steps to complete the Wage Reconciliation Form

Completing the Wage Reconciliation Form requires careful attention to detail. Follow these steps for a smooth process:

- Collect payroll records for the specified period.

- Verify employee earnings and tax withholdings against company records.

- Fill in the employer identification information accurately.

- Enter total wages paid and any adjustments that may apply.

- Review the completed form for any errors or omissions.

- Submit the form to the relevant tax authority by the designated deadline.

Legal use of the Wage Reconciliation Form

The Wage Reconciliation Form serves a legal purpose by ensuring that employers comply with federal and state tax regulations. Proper completion of this form is essential for accurate reporting of employee wages and tax liabilities. It is legally binding, meaning that any discrepancies reported can lead to audits or penalties from tax authorities. Therefore, it is crucial for businesses to maintain accurate records and submit the form in accordance with the law to avoid potential legal issues.

Key elements of the Wage Reconciliation Form

Several key elements must be included in the Wage Reconciliation Form to ensure its validity and compliance. These elements typically include:

- Employer's name and identification number.

- Employee details, including names and Social Security numbers.

- Total wages paid during the reporting period.

- Tax withholdings and deductions.

- Signature of the employer or authorized representative.

Including these elements helps ensure that the form is complete and meets regulatory requirements.

Form Submission Methods

The Wage Reconciliation Form can be submitted through various methods, depending on the preferences of the employer and the requirements of the tax authority. Common submission methods include:

- Online submission through the tax authority's website.

- Mailing a physical copy of the form to the designated address.

- In-person submission at local tax offices or designated locations.

Choosing the appropriate submission method can help ensure timely processing and compliance with deadlines.

Quick guide on how to complete wage reconciliation form

Complete Wage Reconciliation Form smoothly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle Wage Reconciliation Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Wage Reconciliation Form effortlessly

- Acquire Wage Reconciliation Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure private information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Wage Reconciliation Form and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wage reconciliation form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Wage Reconciliation Form?

A Wage Reconciliation Form is a document used to compare the wages outlined in payroll records against the actual amounts paid to employees. This form helps identify discrepancies and ensure accurate compensation. Utilizing airSlate SignNow to create and manage your Wage Reconciliation Form makes the process efficient and secure.

-

How can airSlate SignNow help with the Wage Reconciliation Form?

airSlate SignNow provides an intuitive platform to create, send, and eSign your Wage Reconciliation Form. With features like templates and audit trails, businesses can streamline their wage reconciliation processes. This ensures compliance and enhances accuracy in wage reporting.

-

Is there a cost associated with using airSlate SignNow for a Wage Reconciliation Form?

airSlate SignNow offers various pricing plans tailored to meet different business needs, including features for managing Wage Reconciliation Forms. Each plan is designed to provide cost-effective solutions that ensure you get the most value for document management. You can explore the website for detailed pricing and select a plan that suits your requirements.

-

Can I integrate airSlate SignNow with other tools for Wage Reconciliation?

Yes, airSlate SignNow supports integrations with popular financial and accounting software, enhancing your workflow for Wage Reconciliation Forms. These integrations facilitate seamless data transfer and improve accuracy in record-keeping. Businesses can easily connect their existing systems to streamline the reconciliation process.

-

What are the security features for the Wage Reconciliation Form on airSlate SignNow?

airSlate SignNow prioritizes security, offering robust features such as encryption and multi-factor authentication for your Wage Reconciliation Form. These measures protect sensitive payroll information and ensure that only authorized users have access. Trusting airSlate SignNow means safeguarding your important documents.

-

How does electronic signing work for the Wage Reconciliation Form?

With airSlate SignNow, you can easily eSign your Wage Reconciliation Form digitally. The platform allows signers to review and sign the document online, signNowly reducing processing time. This electronic signing capability enhances convenience and simplifies record management.

-

Can I track the status of my Wage Reconciliation Form?

Yes, airSlate SignNow includes tracking features for your Wage Reconciliation Form, allowing you to monitor its status at every stage. You'll receive notifications when the document is viewed and signed. This transparency keeps your reconciliation process organized and up to date.

Get more for Wage Reconciliation Form

Find out other Wage Reconciliation Form

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form