Taxpayers Counterfoil Form

What is the taxpayers counterfoil?

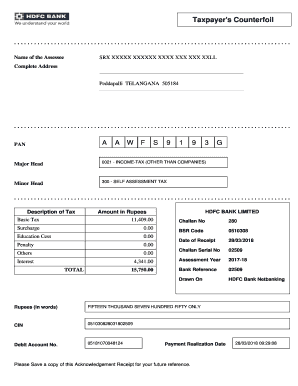

The taxpayers counterfoil is a crucial document used in the United States for tax-related purposes. It serves as a receipt or proof of payment for taxes submitted by individuals or businesses. This form is often required to confirm that a taxpayer has fulfilled their obligations, especially when dealing with tax authorities or financial institutions. The counterfoil typically includes essential details such as the taxpayer's identification number, the amount paid, and the date of payment.

How to use the taxpayers counterfoil

Using the taxpayers counterfoil involves several steps to ensure proper documentation and compliance with tax regulations. First, taxpayers need to fill out the form accurately, providing all required information. Once completed, the counterfoil should be submitted to the relevant tax authority or kept for personal records. It is advisable to retain a copy of the counterfoil for future reference, especially when filing tax returns or in case of audits.

Steps to complete the taxpayers counterfoil

Completing the taxpayers counterfoil requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your taxpayer identification number and payment details.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check the information for any errors or omissions.

- Sign and date the form if required.

- Submit the counterfoil to the appropriate tax authority or keep it for your records.

Legal use of the taxpayers counterfoil

The legal use of the taxpayers counterfoil is essential for maintaining compliance with tax laws. This document acts as proof of payment, which can be crucial during audits or disputes with tax authorities. To ensure its legal standing, the counterfoil must be filled out correctly and submitted in accordance with IRS guidelines. Additionally, retaining a copy can provide protection against potential penalties or issues that may arise in the future.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the taxpayers counterfoil. Taxpayers should familiarize themselves with these regulations to ensure compliance. Key points include the requirements for filling out the form, deadlines for submission, and the importance of accurate information. Adhering to IRS guidelines helps prevent errors that could lead to penalties or delays in processing tax payments.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the taxpayers counterfoil can result in significant penalties. These may include fines, interest on unpaid taxes, or even legal action in severe cases. It is crucial for taxpayers to understand the implications of non-compliance and to ensure that all forms are completed accurately and submitted on time. By doing so, individuals and businesses can avoid unnecessary complications with tax authorities.

Quick guide on how to complete taxpayers counterfoil

Complete Taxpayers Counterfoil effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without interruptions. Handle Taxpayers Counterfoil on any device using the airSlate SignNow Android or iOS applications and enhance your document-centric processes today.

How to edit and eSign Taxpayers Counterfoil with ease

- Locate Taxpayers Counterfoil and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of tedious searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Taxpayers Counterfoil and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayers counterfoil

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a taxpayers counterfoil?

A taxpayers counterfoil is a document that acts as a receipt for tax payments made by individuals or businesses. It serves as proof of payment and is essential for record-keeping and tax filing. Understanding how to manage your taxpayers counterfoil can simplify your tax-related processes.

-

How can airSlate SignNow help with managing taxpayers counterfoils?

airSlate SignNow streamlines the process of signing and managing important documents like taxpayers counterfoils. Our platform allows users to easily upload and electronically sign these documents, ensuring they are securely stored. This simplifies your tax documentation processes, making it easier to retrieve when needed.

-

Is there a cost associated with using airSlate SignNow for taxpayers counterfoils?

Yes, airSlate SignNow offers affordable pricing plans tailored to meet various business needs. These plans allow you to manage documents, including your taxpayers counterfoils, without breaking your budget. Investing in our solution leads to signNow savings in time and resources in document management.

-

Can airSlate SignNow integrate with other tools for taxpayers counterfoil management?

Absolutely! airSlate SignNow offers integrations with various business tools such as CRM systems, cloud storage, and accounting software. This means you can seamlessly manage your taxpayers counterfoil documents alongside other business operations, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for taxpayers counterfoils?

Using airSlate SignNow for your taxpayers counterfoils provides several benefits, including easy electronic signing, secure storage, and streamlined workflows. This leads to faster processing times and reduced paperwork overhead. Additionally, our solution helps ensure compliance with legal requirements.

-

Is it easy to find my taxpayers counterfoils with airSlate SignNow?

Yes, airSlate SignNow is designed to make document retrieval quick and easy. Our intuitive interface allows users to search for and access their taxpayers counterfoils without hassle. You'll spend less time searching and more time focusing on your business.

-

What security measures does airSlate SignNow provide for taxpayers counterfoils?

Security is a top priority at airSlate SignNow. We implement encryption protocols, secure storage solutions, and user authentication to keep your taxpayers counterfoils safe. You can trust that your sensitive financial documents are well-protected on our platform.

Get more for Taxpayers Counterfoil

- Notice of assignment of contract for deed alabama form

- Contract for sale and purchase of real estate with no broker for residential home sale agreement alabama form

- Buyers home inspection checklist alabama form

- Alabama corporation form

- Legallife multistate guide and handbook for selling or buying real estate alabama form

- Al agreement contract form

- Option to purchase addendum to residential lease lease or rent to own alabama form

- Alabama prenuptial premarital agreement with financial statements alabama form

Find out other Taxpayers Counterfoil

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement