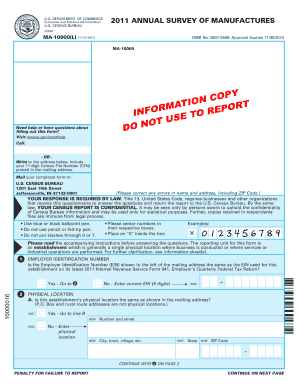

Ma10000 Form

What is the Ma10000 Form

The Ma10000 Form is a specific document used primarily for tax purposes in the United States. It is typically required for reporting certain types of income or deductions. Understanding the purpose of this form is essential for compliance with federal tax regulations. The form collects vital information that helps the Internal Revenue Service (IRS) assess tax liabilities accurately.

Steps to complete the Ma10000 Form

Completing the Ma10000 Form involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather necessary documentation, such as income statements, deductions, and any relevant tax records.

- Fill out the form with accurate personal information, including your name, address, and Social Security number.

- Report your income and deductions as required, ensuring that all figures are correct and match your documentation.

- Review the completed form for any errors or omissions before submission.

How to use the Ma10000 Form

The Ma10000 Form is utilized to report specific financial information to the IRS. It is important to use the form correctly to avoid any issues with your tax filings. Ensure that you follow the instructions carefully, as each section of the form corresponds to different types of income or deductions. Proper usage of the form can help streamline the tax filing process and ensure compliance with tax laws.

Legal use of the Ma10000 Form

The legal use of the Ma10000 Form is governed by IRS regulations. To be considered valid, the form must be filled out accurately and submitted by the appropriate deadlines. Failing to comply with these regulations can result in penalties or delays in processing your tax return. It is crucial to understand the legal implications of the form and ensure that all information provided is truthful and complete.

Who Issues the Form

The Ma10000 Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the form along with detailed instructions on how to complete it. It is important to obtain the most current version of the form directly from the IRS to ensure compliance with any updates or changes in tax law.

Filing Deadlines / Important Dates

Filing deadlines for the Ma10000 Form vary depending on individual circumstances, such as whether you are filing as an individual or a business entity. Generally, the form must be submitted by the annual tax filing deadline, which is typically April 15th for individuals. It is important to stay informed about specific deadlines to avoid penalties and ensure timely processing of your tax return.

Quick guide on how to complete ma10000 form

Effortlessly prepare Ma10000 Form on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without any delays. Handle Ma10000 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Ma10000 Form seamlessly

- Locate Ma10000 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or mask sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign Ma10000 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ma10000 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ma10000 Form and how is it used?

The Ma10000 Form is a crucial document for various business processes, enabling users to gather necessary signatures and information efficiently. By integrating the Ma10000 Form into your workflow, you can streamline your document management processes and ensure compliance with relevant regulations.

-

How does airSlate SignNow simplify the completion of the Ma10000 Form?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign the Ma10000 Form. Its user-friendly interface guides you through the process, ensuring that you can complete the document quickly and accurately without any hassle.

-

What are the pricing options for using the Ma10000 Form with airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs, making it affordable to use the Ma10000 Form. With flexible subscription options, you can choose a plan that fits your budget while gaining full access to this essential document.

-

Can I integrate the Ma10000 Form with my existing software?

Yes, airSlate SignNow supports multiple integrations, allowing you to seamlessly incorporate the Ma10000 Form into your existing software ecosystem. This integration capability helps enhance your workflow and improve overall efficiency when managing documents.

-

What are the key benefits of using the Ma10000 Form with airSlate SignNow?

Using the Ma10000 Form with airSlate SignNow brings numerous benefits, such as improved turnaround times, better document tracking, and enhanced security measures. These features ensure that your important documents are handled efficiently and securely throughout the signing process.

-

Is the Ma10000 Form compliant with legal regulations?

Absolutely, the Ma10000 Form processed through airSlate SignNow adheres to all necessary legal regulations and standards. This compliance ensures that your signed documents are legally binding and recognized in various jurisdictions.

-

How can I store and manage the Ma10000 Form after signing?

After completing the Ma10000 Form with airSlate SignNow, you can securely store and manage it within the platform. The system allows for easy retrieval, sharing, and archiving of all signed documents, ensuring you always have access to your important forms.

Get more for Ma10000 Form

Find out other Ma10000 Form

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online