Cp301 Irs Form

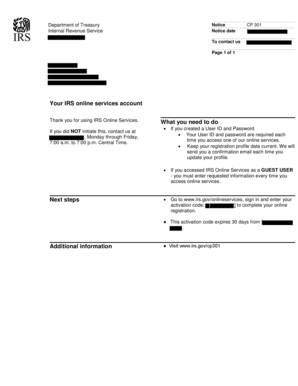

What is the Cp301 IRS?

The Cp301 IRS notice is a communication from the Internal Revenue Service (IRS) that provides important information regarding a taxpayer's account. This notice typically addresses discrepancies in tax filings or account balances. It is essential for taxpayers to understand the contents of the Cp301 notice, as it may indicate actions required to resolve issues related to their tax obligations. The notice serves as an official record from the IRS, ensuring that taxpayers are informed about their tax status and any necessary steps they need to take.

How to use the Cp301 IRS

Using the Cp301 IRS notice effectively involves understanding its purpose and the actions it may require. Taxpayers should carefully read the notice to identify any discrepancies or issues highlighted by the IRS. It is advisable to compare the information in the notice with personal tax records to verify accuracy. If the notice indicates that a response is necessary, taxpayers should follow the instructions provided, which may include contacting the IRS or submitting additional documentation. Utilizing digital tools, such as eSignature solutions, can simplify the process of responding to the notice and ensure timely communication with the IRS.

Steps to complete the Cp301 IRS

Completing the requirements outlined in the Cp301 IRS notice involves several steps:

- Review the notice carefully to understand the specific issue being addressed.

- Gather relevant documentation, such as tax returns and supporting records, to verify the information.

- Prepare a response if required, ensuring that it addresses all points raised in the notice.

- Utilize an eSignature solution to sign and submit any necessary documents electronically, ensuring compliance with IRS requirements.

- Keep a copy of the submitted documents and any correspondence for personal records.

Legal use of the Cp301 IRS

The legal use of the Cp301 IRS notice is crucial for maintaining compliance with tax regulations. This notice is considered a formal communication from the IRS, and responding appropriately is necessary to avoid penalties or further complications. Taxpayers should ensure that any response to the notice is accurate and submitted within the specified time frame. Utilizing reliable digital tools for documentation and eSigning can enhance the legal standing of the submitted materials, as these solutions often comply with regulations such as the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Filing deadlines associated with the Cp301 IRS notice can vary based on the specific issue being addressed. It is important for taxpayers to pay close attention to any dates mentioned in the notice. Typically, the IRS will provide a deadline for responding to the notice or for taking specific actions. Missing these deadlines can result in penalties or additional interest on owed amounts. Taxpayers should mark these dates on their calendars and ensure timely compliance to avoid complications.

Who Issues the Form

The Cp301 IRS notice is issued by the Internal Revenue Service, which is the federal agency responsible for tax collection and enforcement in the United States. The IRS sends this notice to taxpayers when there are discrepancies or issues that need to be addressed regarding their tax accounts. Understanding that the IRS is the source of this communication is essential for recognizing its importance and the need for prompt attention.

Quick guide on how to complete cp301 irs

Manage Cp301 Irs effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents rapidly without delay. Manage Cp301 Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

How to modify and electronically sign Cp301 Irs with ease

- Locate Cp301 Irs and click Access Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Signature tool, which takes just moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Finalize button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from your chosen device. Modify and electronically sign Cp301 Irs to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp301 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'ww irs gov cp21b' refer to in relation to airSlate SignNow?

'ww irs gov cp21b' is a reference commonly associated with IRS tax notices. airSlate SignNow can help you manage these documents efficiently by providing a streamlined platform for sending and eSigning important tax-related forms, ensuring compliance and proper documentation.

-

How can airSlate SignNow assist me with my tax documents related to 'ww irs gov cp21b'?

With airSlate SignNow, you can easily upload, manage, and eSign tax documents that are relevant to 'ww irs gov cp21b'. The platform allows you to track the progress of your forms, ensuring you meet necessary deadlines and maintain an organized record of all submissions.

-

Are there any costs associated with using airSlate SignNow for IRS documentation?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes, making it cost-effective for managing 'ww irs gov cp21b' documents. Each plan is designed to include essential features that ensure you can eSign and store all necessary documents securely and efficiently.

-

What features does airSlate SignNow offer to assist with document signing?

airSlate SignNow provides a range of features to facilitate document signing, including templates, in-person signing, and automated workflows. These functionalities are particularly useful for handling forms like those related to 'ww irs gov cp21b', making the signing process faster and more reliable.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow supports integrations with various applications such as Google Drive, Dropbox, and Zapier. This compatibility makes it easier to manage documents related to 'ww irs gov cp21b' by centralizing your document workflows in one accessible location.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, security is a top priority for airSlate SignNow. The platform uses industry-standard encryption and compliance measures to ensure that all documents, including those related to 'ww irs gov cp21b', are kept safe and secure throughout the entire signing and management process.

-

What benefits can I expect when using airSlate SignNow for eSigning?

By using airSlate SignNow for eSigning, you can expect increased efficiency, faster turnaround times, and improved tracking of your documents. These benefits are crucial when dealing with 'ww irs gov cp21b' forms, as they help streamline the process and minimize the risk of delays.

Get more for Cp301 Irs

Find out other Cp301 Irs

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast