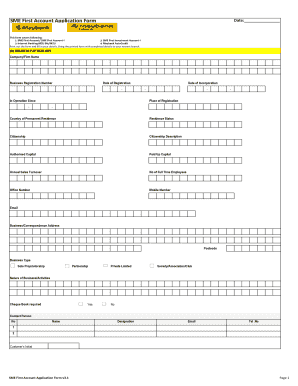

Sme First Account Form

What is the Sme First Account

The Sme First Account is a specialized financial product designed to support small and medium enterprises (SMEs) in their initial investment endeavors. This account offers unique features tailored to meet the financial needs of businesses just starting out. It provides access to essential banking services, such as deposits, withdrawals, and transfers, while also offering tools to help manage cash flow effectively. The Sme First Account is an ideal choice for entrepreneurs looking to establish a solid financial foundation for their businesses.

How to use the Sme First Account

Using the Sme First Account is straightforward. Once you have successfully opened the account, you can manage your finances through various channels, including online banking and mobile applications. This account allows you to make deposits, process payments, and monitor your account activity in real time. Additionally, you can set up automated transactions to streamline your financial management, ensuring that your business operations run smoothly.

Steps to complete the Sme First Account

Completing the application for the Sme First Account involves several key steps:

- Gather necessary documentation, including your business registration details and identification.

- Visit the bank's website or a local branch to access the application form.

- Fill out the application form accurately, providing all required information.

- Submit the completed form along with the necessary documents, either online or in person.

- Wait for the bank to process your application and notify you of the account approval status.

Legal use of the Sme First Account

The Sme First Account is subject to various legal regulations that ensure its proper use. To maintain compliance, businesses must adhere to the terms and conditions set forth by the financial institution. This includes using the account solely for business-related transactions and keeping accurate records of all financial activities. Understanding these legal requirements is crucial for avoiding penalties and ensuring that the account remains in good standing.

Eligibility Criteria

To qualify for the Sme First Account, applicants must meet specific eligibility criteria. Typically, this includes being a registered small or medium enterprise within the United States. The business should have a valid tax identification number and demonstrate a clear business purpose. Additionally, the bank may require a minimum deposit to open the account, which varies by institution. Meeting these criteria is essential for a successful application.

Required Documents

When applying for the Sme First Account, certain documents are necessary to verify your business identity and financial status. Commonly required documents include:

- Business registration certificate

- Tax identification number (TIN)

- Identification for the business owner(s), such as a driver's license or passport

- Proof of business address, such as a utility bill

Having these documents prepared in advance can streamline the application process and facilitate quicker approval.

Quick guide on how to complete sme first account

Complete Sme First Account effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Sme First Account on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Sme First Account with ease

- Find Sme First Account and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, either via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Sme First Account and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sme first account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SME First Account and who can benefit from it?

The SME First Account is a specialized account designed for small and medium-sized enterprises. It provides tailored features and pricing to meet the unique needs of these businesses, enabling them to manage their documents more effectively. By using the SME First Account, businesses can enhance their operational efficiency and streamline their signing processes.

-

How does the SME First Account improve document management?

The SME First Account offers tools that facilitate easy document creation, sharing, and electronic signing. With this account, users can efficiently track document status and obtain signatures, reducing turnaround times signNowly. This improved document management can lead to enhanced productivity for small and medium enterprises.

-

What are the pricing options for the SME First Account?

The pricing for the SME First Account is designed to be cost-effective for small to medium-sized businesses. Various tiers are available, allowing users to choose a plan that fits their usage and budget. This flexibility ensures that companies get the best value while utilizing comprehensive signing features.

-

What features are included with the SME First Account?

The SME First Account comes with a range of features, including unlimited eSigning, robust document templates, and customized branding options. These tools are designed to simplify the signing process and improve overall document workflow for businesses. Users will find the interface intuitive and easy to navigate, boosting their operational effectiveness.

-

Can the SME First Account integrate with other applications?

Yes, the SME First Account is compatible with a variety of third-party applications, which enhances its functionality. Integrations with CRMs, cloud storage services, and productivity tools make it easy to sync data and streamline operations. This interoperability empowers businesses to optimize their workflows using a holistic approach.

-

What benefits can businesses expect from the SME First Account?

By adopting the SME First Account, businesses can expect improvements in efficiency, cost savings, and enhanced document security. It allows for quicker turnaround times on contracts and agreements, leading to faster decision-making. Overall, the account is designed to support growth and facilitate smoother operations for SMEs.

-

Is there customer support available for the SME First Account?

Absolutely! Users of the SME First Account have access to dedicated customer support to assist with any inquiries or issues. Whether you need help getting started or have questions about features, the support team is there to ensure a smooth experience for all businesses utilizing the account.

Get more for Sme First Account

Find out other Sme First Account

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile