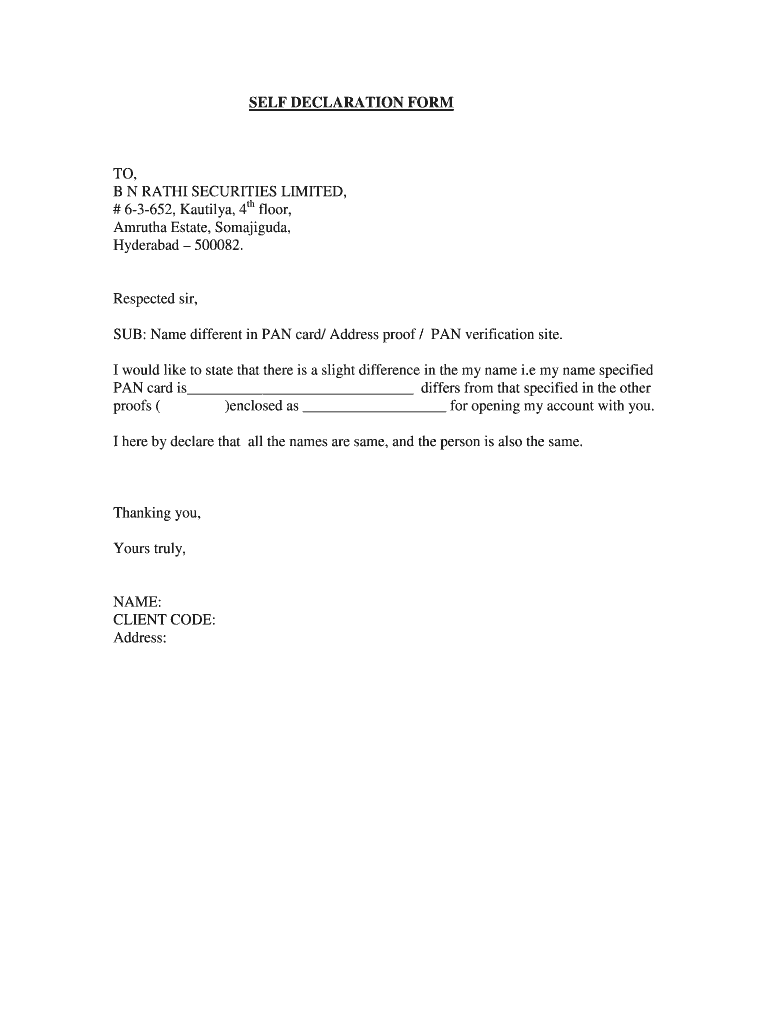

Pan Card Declaration Form

What is the Pan Card Declaration Form

The Pan Card Declaration Form is a crucial document used primarily for tax purposes in the United States. It serves as a declaration of an individual's or entity's Permanent Account Number (PAN) issued by the Internal Revenue Service (IRS). This form is essential for ensuring accurate tax reporting and compliance, as it helps the IRS track income and tax obligations. Individuals and businesses must accurately complete this form to avoid penalties and ensure that their tax filings are processed correctly.

Steps to Complete the Pan Card Declaration Form

Completing the Pan Card Declaration Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your PAN, personal identification details, and any relevant financial data. Follow these steps:

- Fill in your personal details, including your name, address, and Social Security Number (SSN).

- Provide your PAN, ensuring it is accurate to avoid discrepancies.

- Include any relevant financial information, such as income sources and tax liabilities.

- Review the completed form for accuracy and completeness.

- Sign and date the form to validate your declaration.

Legal Use of the Pan Card Declaration Form

The legal use of the Pan Card Declaration Form is governed by IRS regulations. This form must be completed accurately to be considered valid. Failure to provide truthful information can lead to legal consequences, including fines or audits. It is essential to understand that the form acts as a formal declaration to the IRS, and any inaccuracies can result in complications during tax assessments. Therefore, individuals and businesses should ensure compliance with all relevant tax laws when submitting this form.

Key Elements of the Pan Card Declaration Form

Several key elements must be included in the Pan Card Declaration Form to ensure its validity. These elements include:

- Personal Information: Full name, address, and SSN.

- PAN: The unique Permanent Account Number assigned by the IRS.

- Financial Information: Details about income sources and tax obligations.

- Signature: An authorized signature is required to validate the declaration.

- Date: The date of completion must be included to establish the timeline of the declaration.

How to Obtain the Pan Card Declaration Form

The Pan Card Declaration Form can be obtained through various channels. The most common method is to download it directly from the IRS website, where it is available in a printable format. Alternatively, individuals may request a physical copy from local IRS offices or authorized tax professionals. It is important to ensure that you are using the most current version of the form to comply with the latest regulations.

Form Submission Methods

Once the Pan Card Declaration Form is completed, it can be submitted through several methods. The most efficient way is to file it electronically via the IRS e-file system, which allows for quicker processing and confirmation of receipt. Alternatively, individuals may choose to mail the form to the appropriate IRS address or submit it in person at a local IRS office. Each submission method has its own processing times, so it is advisable to choose the one that best fits your timeline and needs.

Quick guide on how to complete pan card declaration form

Complete Pan Card Declaration Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to locate the proper form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Pan Card Declaration Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and electronically sign Pan Card Declaration Form with minimal effort

- Locate Pan Card Declaration Form and click Get Form to begin.

- Utilize the tools we offer to submit your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Pan Card Declaration Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pan card declaration form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PAN declaration letter and why is it important?

A PAN declaration letter is an official document that verifies your Permanent Account Number (PAN) for tax purposes. It is crucial for businesses and individuals to ensure compliance with tax regulations. Using a PAN declaration letter can help streamline your financial documentation and prevent future tax issues.

-

How can airSlate SignNow help with creating a PAN declaration letter?

airSlate SignNow provides an intuitive platform that allows you to create, send, and eSign your PAN declaration letter quickly and efficiently. With customizable templates, you can easily input your information and ensure the document meets all necessary requirements. This saves you time and ensures accuracy.

-

Is airSlate SignNow a cost-effective solution for managing PAN declaration letters?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs, making it a cost-effective solution for managing PAN declaration letters. With flexible payment options and a range of features included in each plan, you can choose the one that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing PAN declaration letters?

airSlate SignNow offers features such as document templates, real-time collaboration, secure eSignatures, and extensive tracking capabilities. These features not only simplify the process of managing PAN declaration letters but also enhance the overall efficiency of your document workflow. You can easily monitor the status and ensure timely completion.

-

Are there integrations available for airSlate SignNow to streamline PAN declaration letter processing?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications such as Google Drive, Salesforce, and Microsoft Office. These integrations enable you to easily access your files and manage your PAN declaration letters without leaving your preferred tools, enhancing your overall productivity.

-

Can I share my PAN declaration letter with multiple recipients?

Yes, airSlate SignNow allows you to share your PAN declaration letter with multiple recipients simultaneously. You can send the document to various stakeholders for review and signatures, ensuring everyone involved can collaborate effectively. This feature simplifies the communication process and speeds up document completion.

-

How secure is my data when using airSlate SignNow for PAN declaration letters?

Security is a top priority at airSlate SignNow. All data, including PAN declaration letters, is encrypted during transmission and storage, ensuring your sensitive information remains protected. Additionally, the platform complies with various industry standards for data protection, giving you peace of mind.

Get more for Pan Card Declaration Form

- Quitclaim deed from individual to individual with specific waiver of spouses interests california form

- Grant deed from individual to individual california form

- California life estate 497298253 form

- Enhanced life estate or lady bird grant deed from individual to two individuals or husband and wife california form

- Ca notice completion form

- Ca deed form

- Grant deed form 497298257

- Under deed trust form

Find out other Pan Card Declaration Form

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History