Ca Tax Return Form

What is the California Tax Return

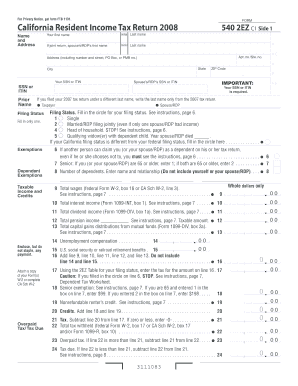

The California tax return is a crucial document for individuals and businesses in the state, used to report income, calculate tax obligations, and determine eligibility for various credits and deductions. This form is essential for ensuring compliance with state tax laws and plays a significant role in the overall tax system. The California tax return typically includes information about income sources, tax deductions, and credits, which can impact the final tax liability.

Steps to Complete the California Tax Return

Completing the California tax return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including W-2s, 1099s, and any other income statements. Next, determine your filing status and exemptions. Then, accurately report your income, taking care to include all relevant sources. After calculating your deductions and credits, complete the form by following the instructions provided. Finally, review the entire return for accuracy before submitting it.

Legal Use of the California Tax Return

The legal use of the California tax return is governed by state tax laws, which dictate how the information must be reported and what constitutes a valid submission. To ensure legal compliance, the return must be signed and dated, with all required information accurately filled out. Additionally, electronic submissions must meet specific standards to be considered valid, including the use of secure eSignature solutions that comply with legal frameworks such as ESIGN and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the California tax return are critical to avoid penalties and interest. Typically, the deadline for individual taxpayers is April 15 of each year, unless it falls on a weekend or holiday, in which case it may be extended to the next business day. Extensions may be available, but they do not extend the time to pay any taxes owed. It's important to keep track of these dates to ensure timely filing and payment.

Required Documents

When preparing to file the California tax return, several documents are essential. These include W-2 forms from employers, 1099 forms for other income sources, records of any deductions or credits claimed, and documentation of any estimated tax payments made throughout the year. Gathering these documents in advance can streamline the filing process and help ensure that all necessary information is included.

Form Submission Methods

There are multiple methods for submitting the California tax return, allowing taxpayers to choose the option that best suits their needs. The most common methods include electronic filing through approved software, mailing a paper return, or submitting in person at designated locations. Each method has its advantages, such as faster processing times for electronic submissions or the option to pay in person when filing by mail.

Penalties for Non-Compliance

Failure to comply with California tax return requirements can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action. Understanding the implications of non-compliance is essential for all taxpayers, as it can lead to financial strain and complications in future tax filings. Staying informed about tax obligations and deadlines can help mitigate these risks.

Quick guide on how to complete ca tax return

Effortlessly Prepare Ca Tax Return on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Handle Ca Tax Return across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Ca Tax Return effortlessly

- Find Ca Tax Return and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more worries about lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Ca Tax Return and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for eSigning my California tax return using airSlate SignNow?

With airSlate SignNow, you can easily eSign your California tax return by uploading your document to our platform. Afterward, you can add your signature and any required fields. Once signed, you can securely send and store your California tax return digitally.

-

Is airSlate SignNow suitable for filing California tax returns for businesses?

Yes, airSlate SignNow is an excellent solution for businesses needing to file California tax returns. Our platform allows businesses to manage multiple signers and streamline the document process, ensuring compliance and efficiency. Plus, it can help keep all tax-related documents organized and accessible.

-

What are the costs associated with using airSlate SignNow for California tax returns?

airSlate SignNow offers a cost-effective solution with various pricing plans. Each plan provides features that can assist with your California tax return, allowing you to choose the one best suited to your needs. You can take advantage of the free trial to explore our services without any financial commitment.

-

Can I integrate airSlate SignNow with accounting software for my California tax return?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your California tax return. This integration allows for automatic data extraction and synchronization, which saves time and reduces the chances of errors.

-

What benefits does airSlate SignNow offer for electronically signing California tax returns?

The primary benefits of using airSlate SignNow for electronically signing your California tax return include increased speed, security, and convenience. You can sign documents from anywhere, reduce paper waste, and ensure that your returns are filed on time, all while maintaining compliance with California regulations.

-

Is it safe to store my California tax return documents on airSlate SignNow?

Yes, your documents are safe with airSlate SignNow. We use advanced encryption and security protocols to protect your California tax return while stored on our platform. Additionally, you can manage access controls to ensure that only authorized users can view or edit sensitive documents.

-

How does airSlate SignNow ensure compliance with California tax laws?

airSlate SignNow is designed to help users comply with California tax laws by providing legally binding electronic signatures. Our platform also offers features that adhere to state regulations and guidelines, ensuring that your California tax return meets all necessary legal requirements.

Get more for Ca Tax Return

- Application for automobile insurance alberta finance and enterprise finance alberta form

- Brinks application form

- Sears job application pdf form

- Replying to an application filed by an applicant ministry of justice ag gov bc form

- Record of suspension 2013 form

- Tim hortons jobs apply online form

- Rc66 2008 2019 form

- Blanket filling form

Find out other Ca Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors