Instructions for Nys 45 Form 2015

What is the Instructions For Nys 45 Form

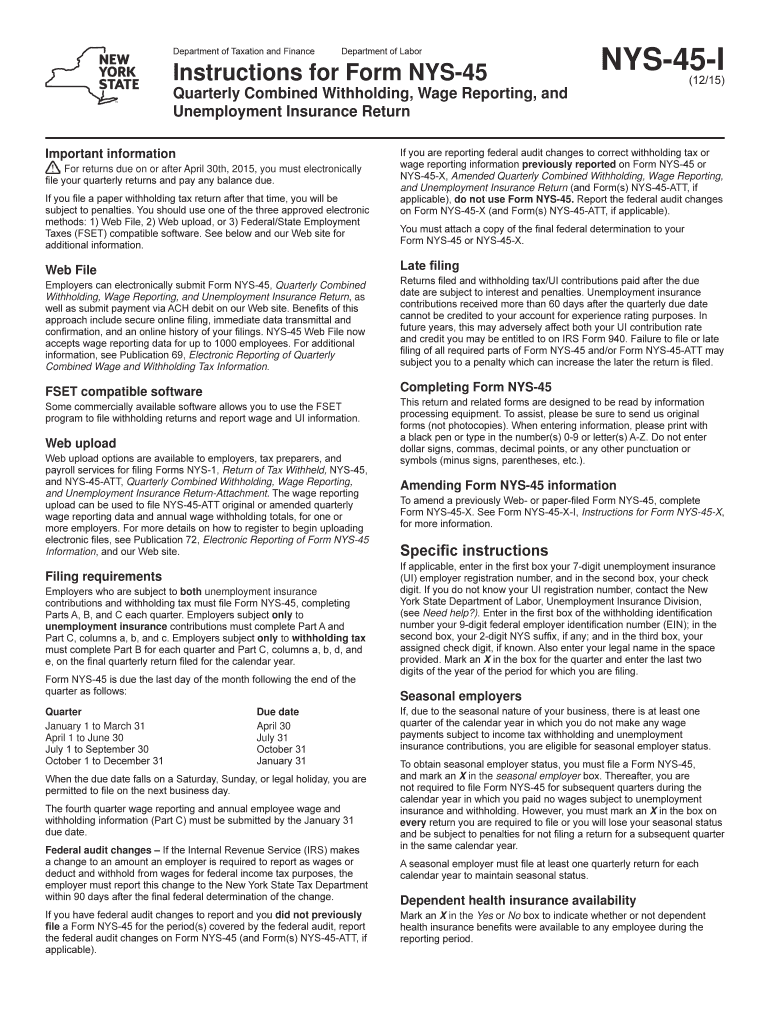

The Instructions For Nys 45 Form is a crucial document used for reporting employee wages and withholding taxes in New York State. This form is essential for employers to accurately report wages paid to employees and the taxes withheld from those wages. It ensures compliance with state tax regulations and helps maintain accurate records for both the employer and the employee. The form typically includes information on gross wages, tax withholdings, and other relevant payroll details.

How to use the Instructions For Nys 45 Form

Using the Instructions For Nys 45 Form involves several key steps. Employers should first gather all necessary payroll information, including total wages paid to employees and the amount of taxes withheld. Next, they should carefully complete the form, ensuring that all fields are filled out accurately. After completing the form, employers must review it for any errors before submitting it to the appropriate tax authority. The instructions provide detailed guidance on how to fill out each section of the form, making it easier for employers to ensure compliance.

Steps to complete the Instructions For Nys 45 Form

To complete the Instructions For Nys 45 Form, follow these steps:

- Gather all payroll records, including employee information and wage details.

- Access the form through the New York State Department of Taxation and Finance website or other official sources.

- Fill in the required fields, including employer information, employee wages, and tax withholdings.

- Double-check all entries for accuracy to avoid potential penalties.

- Submit the completed form electronically or by mail, following the submission guidelines provided in the instructions.

Key elements of the Instructions For Nys 45 Form

Key elements of the Instructions For Nys 45 Form include:

- Employer Information: Details about the employer, including name, address, and identification number.

- Employee Information: Information about each employee, such as name, Social Security number, and wages earned.

- Wage Reporting: Total wages paid during the reporting period, including any bonuses or additional compensation.

- Tax Withholdings: Amount of state and federal taxes withheld from employee wages.

- Signature: Required signature of the employer or authorized representative to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Nys 45 Form are critical for compliance. Employers must submit the form quarterly, with specific deadlines for each quarter:

- First quarter: Due by April 30.

- Second quarter: Due by July 31.

- Third quarter: Due by October 31.

- Fourth quarter: Due by January 31 of the following year.

It is essential to adhere to these deadlines to avoid penalties and ensure timely processing of tax information.

Form Submission Methods (Online / Mail / In-Person)

The Instructions For Nys 45 Form can be submitted through various methods, providing flexibility for employers. The submission options include:

- Online Submission: Employers can file the form electronically through the New York State Department of Taxation and Finance's online services.

- Mail Submission: The completed form can be printed and mailed to the designated tax office address provided in the instructions.

- In-Person Submission: Employers may also choose to submit the form in person at local tax offices, although this option may vary based on location.

Quick guide on how to complete instructions for nys 45 2015 2019 form

Your assistance manual on how to get ready your Instructions For Nys 45 Form

If you’re curious about how to finalize and submit your Instructions For Nys 45 Form, here are some straightforward guidelines on how to simplify tax submission signNowly.

To begin, you just need to establish your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document platform that enables you to edit, create, and finalize your tax documentation with ease. With its editing tool, you can alternate between text, check boxes, and eSignatures while having the ability to revisit and modify responses as necessary. Streamline your tax administration with advanced PDF editing, eSignatures, and convenient sharing options.

Adhere to the instructions below to complete your Instructions For Nys 45 Form in just a few minutes:

- Set up your account and begin handling PDFs promptly.

- Utilize our directory to find any IRS tax form; navigate through variants and schedules.

- Press Get form to access your Instructions For Nys 45 Form in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-recognized eSignature (if applicable).

- Review your document and amend any errors.

- Save your modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Be aware that submitting on paper can lead to increased errors and delayed refunds. Additionally, prior to e-filing your taxes, verify the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct instructions for nys 45 2015 2019 form

FAQs

-

How can I fill out the application form for the JMI (Jamia Millia Islamia) 2019?

Form for jamia school have been releaseYou can fill it from jamia siteJamia Millia Islamia And for collegeMost probably the form will out end of this month or next monthBut visit the jamia site regularly.Jamia Millia Islamiacheck whether the form is out or not for the course you want to apply.when notification is out then you have to create the account for entrance and for 2 entrance same account will be used you have to check in the account that the course you want to apply is there in listed or not ….if not then you have to create the different account for that course .If you have any doubts you can freely ask me .

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

How do I fill out the JEE Main 2019 exam application form?

Steps to fill out the JEE Mains 2019 application form?How to Fill JEE Main 2019 Application FormJEE Main 2019 Registration Process to be followed on the NTA Website:Step 1: Visit the website of NTA or CLick here.Step 2: Click on NTA exams or on Joint Entrance Examination under the Engineering Section given on the same page.Step 3: You will see the registration button as shown in the image below. Read all the eligibility criteria and click on “Registration”Step 4: Candidates will be redirected to the JEE Main 2019 official website where they have to click on “Fill Application Form”.Step 5: Now, Click on “Apply for JEE Main 2019”. Read all instructions carefully and proceed to apply online by clicking on the button given at the end of the page.Step 6: Fill in all the details as asked. Submit the authentication form with correct details.Step 7: Upload the scanned images in correct specification given on the instructions page.Step 8: Pay the Application fee and take a print out of the filled up application form.Aadhar Card Required for JEE Main 2019 RegistrationFor the last two years, Aadhar card was made mandatory for each candidate to possess for the application form filling of JEE Main. However, since JEE Main 2019 is now to be conducted by NTA, they have asked the candidates to enter their Aadhar card number. The Aadhar card number is necessary for JEE Main 2019 Application form and candidates must be ready with their Aadhar card number to enter it in the application form.JEE main 2019 Application Form will be available twice, once in the month of September for the January 2019 exam and again in the month of February for the April exam. Thus, first, the candidates have to fill out the application form of January 2019 examination in the month of September 2018.

-

What things are required to fill out the NDA form for 2019?

Hello,To fill the application form candidates must have the following details/documents.Email id and Mobile numberBank card details for online paymentPhotograph (3 KB - 40 KB)Signature ( 1 KB - 40 KB)Community CertificateEducational qualification detailsTo know the details about NDA Application form - Click hereThank you..!!

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

How do I fill out the IGNOU admission form for the B.Sc in physics 2019 July session?

Now-a-days admission in IGNOU is very easy. Everything is online now.. you have to visit IGNOU website for the same. Go to admission section and follow step by step process to fill online application form.

Create this form in 5 minutes!

How to create an eSignature for the instructions for nys 45 2015 2019 form

How to make an eSignature for your Instructions For Nys 45 2015 2019 Form in the online mode

How to make an eSignature for your Instructions For Nys 45 2015 2019 Form in Google Chrome

How to make an eSignature for putting it on the Instructions For Nys 45 2015 2019 Form in Gmail

How to make an eSignature for the Instructions For Nys 45 2015 2019 Form straight from your smartphone

How to create an eSignature for the Instructions For Nys 45 2015 2019 Form on iOS

How to generate an electronic signature for the Instructions For Nys 45 2015 2019 Form on Android OS

People also ask

-

What are the Instructions For Nys 45 Form?

The Instructions For Nys 45 Form provide detailed guidelines on completing the form accurately. This form is essential for employers to comply with New York State tax regulations. Understanding the instructions ensures that you provide the correct information to avoid penalties.

-

How can airSlate SignNow help with the Instructions For Nys 45 Form?

airSlate SignNow streamlines the process of completing the Instructions For Nys 45 Form by offering easy-to-use eSigning tools. Our platform allows you to fill out, sign, and send documents securely and efficiently. This not only saves time but also reduces the risk of errors in document submission.

-

Is there a cost associated with using airSlate SignNow for the Instructions For Nys 45 Form?

Yes, airSlate SignNow offers various pricing plans tailored to suit the needs of different businesses. Our cost-effective solution ensures that you have access to all necessary features for completing the Instructions For Nys 45 Form without breaking the bank. Explore our pricing page to find the best fit for your organization.

-

What features does airSlate SignNow provide for efficient form handling?

airSlate SignNow is equipped with features like document templates, collaboration tools, and automated workflows that simplify filling out the Instructions For Nys 45 Form. Our robust platform allows for easy customization and sharing, enabling teams to work together seamlessly. Additionally, advanced security measures ensure that your information remains protected.

-

Can I integrate airSlate SignNow with other applications for the Instructions For Nys 45 Form?

Absolutely! airSlate SignNow supports integrations with popular applications, making it convenient to manage your documents related to the Instructions For Nys 45 Form. You can sync data with tools like CRM systems, project management apps, and more, enhancing the overall efficiency of your operations.

-

What are the benefits of using airSlate SignNow for the Instructions For Nys 45 Form?

Using airSlate SignNow for the Instructions For Nys 45 Form offers numerous benefits, including speed, efficiency, and accuracy. Our platform reduces the time it takes to gather signatures and complete forms. Furthermore, you can easily store and retrieve documents, ensuring you have everything at your fingertips when needed.

-

How do I get started with airSlate SignNow for the Instructions For Nys 45 Form?

Getting started with airSlate SignNow for the Instructions For Nys 45 Form is simple. Just sign up for an account on our website, and you will have access to a range of tools for document management. Follow our user-friendly tutorials and start utilizing our features right away to enhance your workflow.

Get more for Instructions For Nys 45 Form

Find out other Instructions For Nys 45 Form

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now