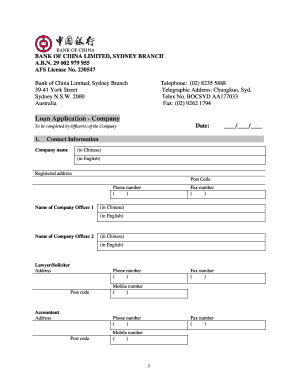

China Loan Form

What is the China Loan Form

The China Loan Form is a crucial document used by individuals or businesses seeking financial assistance from China Bank. This form serves as an official application for a loan, outlining the borrower's financial information, loan amount requested, and purpose of the loan. It is essential for applicants to provide accurate and complete information to facilitate the approval process.

How to use the China Loan Form

Using the China Loan Form involves several steps. First, applicants should obtain the form from a reliable source, such as the official China Bank website or a local branch. Next, fill out the form with the required personal and financial details. It is important to review the information for accuracy before submission. Finally, submit the completed form through the designated method, whether online or in person, to ensure it reaches the bank for processing.

Steps to complete the China Loan Form

Completing the China Loan Form requires careful attention to detail. Follow these steps:

- Gather necessary documents, including identification, proof of income, and any collateral information.

- Fill in personal details, such as your name, address, and contact information.

- Provide financial information, including income, expenses, and existing debts.

- Specify the loan amount and purpose clearly.

- Review the form for any errors or omissions before submission.

Legal use of the China Loan Form

The China Loan Form is legally binding once it is signed and submitted. To ensure its validity, all parties involved must adhere to relevant laws and regulations governing loan agreements. This includes compliance with eSignature laws and ensuring that all required disclosures are made. Proper execution of the form protects both the lender and the borrower in the event of disputes.

Eligibility Criteria

To qualify for a loan through the China Loan Form, applicants must meet specific eligibility criteria set by the bank. Generally, these criteria include:

- Proof of identity and residency in the United States.

- A stable source of income that demonstrates the ability to repay the loan.

- A satisfactory credit history, which may be assessed through a credit report.

- Age requirement, typically being at least eighteen years old.

Application Process & Approval Time

The application process for the China Loan Form involves several stages. After submitting the completed form, the bank will review the application, which may take anywhere from a few days to several weeks, depending on the complexity of the request and the bank's internal processes. Applicants may be contacted for additional information or clarification during this period. Once approved, the bank will provide details regarding the loan terms and conditions.

Quick guide on how to complete china loan form

Easily Prepare china loan form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily find the right form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly and without delays. Manage chinabank loan on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to Alter and eSign china bank loan application form Effortlessly

- Obtain loan matrix china bank and select Get Form to begin.

- Make use of the tools available to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign china bank loan requirements while ensuring excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to loan matrix china bank

Create this form in 5 minutes!

How to create an eSignature for the china bank loan requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask bank of china sydney

-

What is a Chinabank loan and how does it work?

A Chinabank loan is a financing option provided by Chinabank that helps individuals and businesses access funds for various needs. The application process is straightforward, typically requiring a set of documents for verification. Once approved, you can expect competitive interest rates and flexible repayment terms tailored to your financial situation.

-

What are the different types of Chinabank loans available?

Chinabank offers a variety of loans, including personal loans, home loans, and business loans. Each type is designed to cater to specific needs, whether for personal use, property acquisition, or business expansion. Understanding these options can help you choose the right Chinabank loan that suits your requirements.

-

How can I apply for a Chinabank loan?

You can apply for a Chinabank loan through their official website or by visiting a local branch. The online application is user-friendly and guides you through the necessary steps. Be prepared to provide personal information and financial documents to expedite the approval process.

-

What are the eligibility requirements for a Chinabank loan?

Eligibility for a Chinabank loan typically requires you to be of legal age, have a stable income, and provide necessary documentation such as ID and credit history. It’s important to check the specific requirements for the type of loan you are applying for. Meeting these criteria will increase your chances of loan approval.

-

What are the benefits of choosing a Chinabank loan?

Choosing a Chinabank loan provides access to flexible financing options with competitive interest rates. Their quick approval process allows you to secure funding when you need it most, and their tailored repayment plans can help you manage your finances effectively. This makes Chinabank loans a popular choice among consumers.

-

Are there any fees associated with a Chinabank loan?

While Chinabank loans come with competitive interest rates, there may be additional fees such as processing fees or late payment charges. It’s advisable to review the loan terms carefully to understand all potential costs involved. This will help you make an informed decision regarding your finances.

-

Can I refinance my existing loans with a Chinabank loan?

Yes, Chinabank offers options for refinancing existing loans, providing you a chance to lower your interest rates or adjust repayment terms. Refinancing can often result in lower monthly payments, improving your cash flow. Be sure to evaluate the terms and conditions to see if this aligns with your financial goals.

Get more for chinabank loan

- Maricopa county az title companies form

- Mobile food establishment permit application maricopa form

- Church extension partnership grant application form

- Zoning petition to support or opposea rezoning ap form

- Ladys island eagles youth football and cheerleading form

- Private school reston montessori school in reston virginia form

- Mulch order form

- Regulation 2601 37p special services intervention and form

Find out other china bank loan application form

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later