Form 501 Gujarat Vat

What is the Form 501 Gujarat VAT

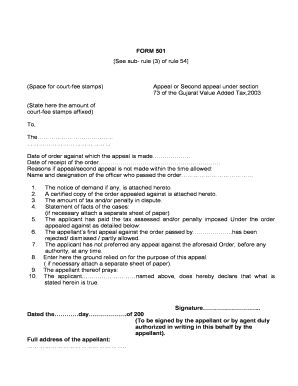

The Form 501 Gujarat VAT is a crucial document used for Value Added Tax (VAT) purposes in the state of Gujarat, India. This form is primarily utilized by businesses to report their VAT liabilities and ensure compliance with local tax regulations. It serves as a declaration of the taxable sales and purchases made by a business during a specific period. Understanding the purpose and requirements of this form is essential for businesses operating in Gujarat to maintain accurate tax records and avoid potential penalties.

How to use the Form 501 Gujarat VAT

Using the Form 501 Gujarat VAT involves several steps to ensure accurate and compliant reporting. First, businesses must gather all relevant financial data, including sales and purchase invoices. Next, the form should be filled out with precise figures reflecting the total VAT collected and paid during the reporting period. It is essential to double-check the entries for accuracy before submission. Once completed, the form can be submitted through the appropriate channels, either online or in person, depending on the local regulations.

Steps to complete the Form 501 Gujarat VAT

Completing the Form 501 Gujarat VAT requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including sales and purchase invoices.

- Calculate the total VAT collected from sales and the total VAT paid on purchases.

- Fill out the form, ensuring all fields are accurately completed.

- Review the form for any errors or omissions.

- Submit the form through the designated method, ensuring compliance with submission deadlines.

Legal use of the Form 501 Gujarat VAT

The legal use of the Form 501 Gujarat VAT is governed by the state's VAT laws and regulations. It is essential for businesses to ensure that the form is filled out correctly and submitted on time to avoid legal repercussions. Non-compliance can lead to penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of this form is vital for maintaining good standing with tax authorities.

Key elements of the Form 501 Gujarat VAT

The Form 501 Gujarat VAT includes several key elements that must be accurately reported. These elements typically consist of:

- Business identification details, including name and registration number.

- Total sales and purchase amounts for the reporting period.

- Calculated VAT payable or refundable.

- Signature and date of submission, confirming the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

Businesses have multiple options for submitting the Form 501 Gujarat VAT. The available methods include:

- Online Submission: Many businesses prefer to submit the form electronically through the state's tax portal, which often provides a faster processing time.

- Mail Submission: Forms can also be sent via postal mail to the designated tax office, although this method may take longer for processing.

- In-Person Submission: Businesses may choose to submit the form in person at their local tax office, allowing for immediate confirmation of receipt.

Quick guide on how to complete form 501 gujarat vat

Prepare Form 501 Gujarat Vat effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed forms, allowing you to access the necessary documents and securely store them online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Form 501 Gujarat Vat on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to edit and eSign Form 501 Gujarat Vat with ease

- Find Form 501 Gujarat Vat and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight essential parts of the documents or black out sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign function, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious searches for forms, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 501 Gujarat Vat and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 501 gujarat vat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 501 Gujarat VAT and why is it important?

Form 501 Gujarat VAT is a crucial document for businesses operating in Gujarat that details VAT returns. It is important because it ensures compliance with state tax regulations, helping businesses avoid penalties and streamline tax reporting.

-

How can airSlate SignNow help with filing form 501 Gujarat VAT?

airSlate SignNow simplifies the process of filling and eSigning form 501 Gujarat VAT. Our platform allows users to easily create, customize, and transmit this form securely, saving time and ensuring accuracy in submission.

-

Is there a cost associated with using airSlate SignNow for form 501 Gujarat VAT?

Yes, airSlate SignNow operates on a subscription model, providing cost-effective options tailored to your business needs. The pricing includes access to features that streamline the completion and signing of form 501 Gujarat VAT.

-

What features does airSlate SignNow offer for managing form 501 Gujarat VAT?

Our platform offers features such as intuitive drag-and-drop editing, automated workflows, and secure eSignature capabilities specifically for form 501 Gujarat VAT. These tools enhance productivity and ensure a smooth filing process.

-

Can I integrate airSlate SignNow with other applications for managing form 501 Gujarat VAT?

Absolutely! airSlate SignNow integrates seamlessly with various applications like CRM systems, accounting software, and cloud storage services. This interoperability simplifies data management related to form 501 Gujarat VAT.

-

What are the benefits of using airSlate SignNow for form 501 Gujarat VAT?

Using airSlate SignNow for form 501 Gujarat VAT offers numerous benefits, including reduced paperwork, enhanced compliance, and faster processing times. Additionally, our platform's user-friendly design minimizes errors and accelerates document turnaround.

-

Is airSlate SignNow compliant with the regulations for form 501 Gujarat VAT?

Yes, airSlate SignNow complies with all relevant regulations for form 501 Gujarat VAT. Our commitment to security and legal standards ensures that your documents are handled in accordance with state and federal guidelines.

Get more for Form 501 Gujarat Vat

- Marital legal separation and property settlement agreement where no children or no joint property or debts and divorce action 497300134 form

- Marital legal separation and property settlement agreement where minor children and no joint property or debts and divorce 497300135 form

- Marital legal separation and property settlement agreement where minor children and no joint property or debts that is 497300136 form

- Marital legal separation and property settlement agreement where minor children and parties may have joint property or debts 497300137 form

- Marital legal separation and property settlement agreement minor children parties may have joint property or debts effective 497300138 form

- Marital legal separation and property settlement agreement for persons with no children no joint property or debts effective 497300139 form

- Marital legal separation and property settlement agreement where no children and parties may have joint property and or debts 497300140 form

- Co marital form

Find out other Form 501 Gujarat Vat

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement