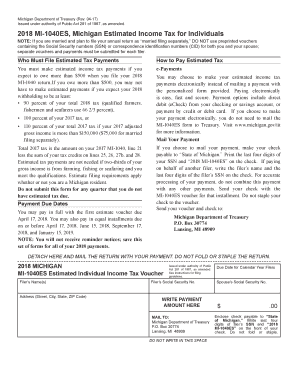

Mi 1040es Form

What is the MI 1040ES?

The MI 1040ES is a form used by taxpayers in Michigan to make estimated income tax payments. This form is essential for individuals who expect to owe tax of $500 or more when filing their annual return. It helps taxpayers stay compliant with state tax regulations by allowing them to pay their estimated taxes in a timely manner throughout the year. The MI 1040ES is specifically designed for those who have income that is not subject to withholding, such as self-employment income, rental income, or investment gains.

How to use the MI 1040ES

Using the MI 1040ES involves several straightforward steps. First, determine if you need to make estimated payments based on your expected tax liability. Next, calculate the amount you owe for each quarter based on your income projections. The form includes payment vouchers that you can submit along with your payment. It is important to keep track of payment deadlines to avoid penalties. Taxpayers can submit payments via mail or electronically, depending on their preference.

Steps to complete the MI 1040ES

Completing the MI 1040ES requires careful attention to detail. Follow these steps:

- Gather your financial information, including income sources and deductions.

- Estimate your total income for the year to determine your expected tax liability.

- Fill out the MI 1040ES form, ensuring all calculations are accurate.

- Choose your payment method: check, money order, or electronic payment.

- Submit the form and payment by the due date to avoid penalties.

Legal use of the MI 1040ES

The MI 1040ES is legally recognized as a valid method for making estimated tax payments in Michigan. Compliance with the state’s tax laws is crucial, as failure to submit estimated payments can result in penalties and interest on unpaid taxes. It is important to ensure that the form is filled out correctly and submitted on time to maintain legal standing with the Michigan Department of Treasury.

Filing Deadlines / Important Dates

Filing deadlines for the MI 1040ES are critical to avoid penalties. Estimated payments are typically due quarterly, with specific dates set by the Michigan Department of Treasury. Generally, the deadlines are:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Taxpayers should verify these dates annually, as they may change based on state regulations.

Who Issues the Form

The MI 1040ES form is issued by the Michigan Department of Treasury. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and guidance on how to properly complete and submit the form, as well as information on tax obligations in Michigan.

Quick guide on how to complete mi 1040es 430732483

Complete Mi 1040es effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Mi 1040es on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Mi 1040es with ease

- Locate Mi 1040es and then click Get Form to commence.

- Use the tools provided to finalize your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature utilizing the Sign feature, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mi 1040es to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi 1040es 430732483

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 mi 1040es form and why is it important?

The 2018 mi 1040es form is a Michigan estimated tax payment form that individuals use to calculate and submit their estimated state income tax. It is essential for self-employed individuals or those with signNow untaxed income to avoid penalties at tax time. Completing this form accurately helps ensure compliance with state tax laws.

-

How can airSlate SignNow streamline the process of submitting my 2018 mi 1040es?

airSlate SignNow offers a seamless platform for eSigning and sending documents, making it easy to manage your 2018 mi 1040es form. You can fill out, sign, and send your tax documents securely without the need for printing or mailing. This reduces both time and effort during tax season.

-

Is airSlate SignNow compliant with tax regulations for the 2018 mi 1040es?

Yes, airSlate SignNow is fully compliant with electronic signature regulations, ensuring your 2018 mi 1040es is submitted legally and securely. We utilize industry-standard encryption to protect your sensitive information, making us a reliable choice for tax-related documents.

-

What features does airSlate SignNow offer for managing my 2018 mi 1040es?

airSlate SignNow provides features such as document templates, real-time tracking, and automated reminders to streamline your 2018 mi 1040es process. You can also integrate with popular cloud storage services to easily import and access your tax documents. This all contributes to efficient document management.

-

Can I access my completed 2018 mi 1040es online?

Absolutely! airSlate SignNow allows you to access your completed 2018 mi 1040es online at any time. Your documents are stored securely in the cloud, providing easy access whenever you need to review or resend them to the authorities.

-

What are the costs associated with using airSlate SignNow for my 2018 mi 1040es?

airSlate SignNow offers competitive pricing plans tailored to various business needs, starting with a free trial for new users. You can choose a plan that best fits your tax filing requirements for the 2018 mi 1040es, ensuring you receive excellent value for your investment.

-

Does airSlate SignNow integrate with tax software for the 2018 mi 1040es?

Yes, airSlate SignNow integrates with several popular tax software solutions, making it easy to manage your 2018 mi 1040es directly. This feature helps ensure that your tax documents are accurately filled out and signed, streamlining your overall tax preparation process.

Get more for Mi 1040es

- Transcript request form malone university malone

- Manhattanville college family education rights and privacy act form

- Public space use form inside massart inside massart

- Mcpherson college ferpa waiver form

- Cpr form

- Immunization form student affairs macon campus mercer studentaffairs mercer

- Mercer university printable application form

- Direct deposit form miami dade college mdc

Find out other Mi 1040es

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document