Irs Form 9452 for

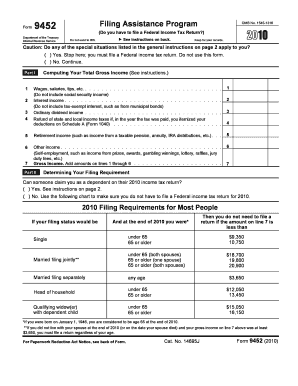

What is the IRS Form 9452 For

The IRS Form 9452 is specifically designed for taxpayers who are seeking to apply for a waiver of the estimated tax penalty. This form allows individuals and businesses to request relief from penalties associated with underpayment of estimated tax. By submitting Form 9452, taxpayers can demonstrate that they qualify for an exception based on specific criteria outlined by the IRS.

How to Use the IRS Form 9452 For

Using the IRS Form 9452 involves several straightforward steps. First, taxpayers must accurately fill out the form, providing necessary personal and financial information. It's essential to review the instructions carefully to ensure all required fields are completed. After filling out the form, it should be submitted to the IRS either electronically or via mail, depending on the chosen submission method. Keeping a copy of the completed form for personal records is also advisable.

Steps to Complete the IRS Form 9452 For

Completing the IRS Form 9452 requires careful attention to detail. Begin by gathering relevant financial documents, such as previous tax returns and records of estimated tax payments. Next, follow these steps:

- Provide your name, address, and taxpayer identification number.

- Indicate the tax year for which you are requesting the waiver.

- Detail the reasons for underpayment and any relevant circumstances.

- Sign and date the form to certify the information is accurate.

Once completed, review the form for accuracy before submission.

Legal Use of the IRS Form 9452 For

The IRS Form 9452 is legally recognized as a valid request for penalty relief under specific circumstances. To ensure its legal standing, taxpayers must adhere to IRS guidelines and provide truthful information. Misrepresentation or failure to meet the eligibility criteria can result in penalties or denial of the request. Therefore, understanding the legal implications of the form and ensuring compliance with IRS regulations is crucial.

Filing Deadlines / Important Dates

Timeliness is essential when submitting the IRS Form 9452. Taxpayers should be aware of key deadlines, particularly those related to estimated tax payments. Generally, Form 9452 should be filed as soon as the taxpayer realizes they may qualify for penalty relief. It is advisable to check the IRS website or consult a tax professional for specific dates related to the current tax year.

Required Documents

When filing the IRS Form 9452, certain documents may be required to support the request. These can include:

- Previous tax returns to demonstrate payment history.

- Records of estimated tax payments made during the year.

- Any correspondence with the IRS regarding penalties or payments.

Having these documents ready can facilitate a smoother filing process and strengthen the case for penalty relief.

Form Submission Methods

The IRS Form 9452 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the IRS e-file system.

- Mailing a printed copy to the appropriate IRS address.

- In-person submission at designated IRS offices.

Choosing the right submission method can depend on individual preferences and circumstances, such as the urgency of the request.

Quick guide on how to complete irs form 9452 for

Effortlessly prepare Irs Form 9452 For on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without delays. Handle Irs Form 9452 For on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to modify and eSign Irs Form 9452 For with ease

- Locate Irs Form 9452 For and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign feature, which only takes a few seconds and has the same legal standing as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Revise and eSign Irs Form 9452 For while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 9452 for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 9452 for 2018?

IRS Form 9452 for 2018 is a form used by certain organizations to request a waiver from the requirement to electronically file information returns. Understanding this form is essential for compliance and accurate reporting.

-

How can airSlate SignNow help with IRS Form 9452 for 2018?

AirSlate SignNow provides a streamlined process for electronically signing and managing IRS Form 9452 for 2018. Our platform ensures that your documents are completed and submitted quickly, reducing the chances of errors.

-

Is there a cost associated with using airSlate SignNow for IRS Form 9452 for 2018?

AirSlate SignNow offers flexible pricing plans that can accommodate your needs for managing IRS Form 9452 for 2018. We provide a cost-effective solution for businesses, which can save you time and money.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow includes features like electronic signatures, document templates, and real-time tracking to simplify your workflow. These tools are beneficial when handling important documents like IRS Form 9452 for 2018.

-

Can I integrate airSlate SignNow with other software for IRS Form 9452 for 2018?

Yes, airSlate SignNow offers seamless integrations with popular software tools that can help manage IRS Form 9452 for 2018. Make your document processes more efficient by connecting with your existing systems.

-

What are the benefits of using airSlate SignNow for filing IRS Form 9452 for 2018?

Using airSlate SignNow for IRS Form 9452 for 2018 allows you to enhance accuracy, save time, and ensure compliance. Our service takes the hassle out of document management, making it easier for businesses to focus on growth.

-

How secure is airSlate SignNow when handling IRS Form 9452 for 2018?

AirSlate SignNow prioritizes security and compliance, employing stringent measures to protect your documents like IRS Form 9452 for 2018. You can trust our platform to keep your sensitive information safe.

Get more for Irs Form 9452 For

Find out other Irs Form 9452 For

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document