Form 2248

What is the Form 2248

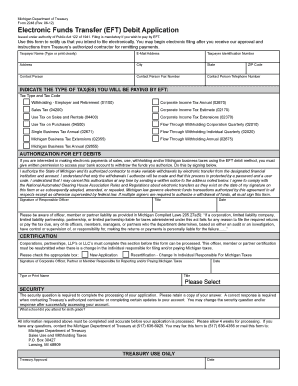

The Michigan Form 2248, also known as the IRS Form 2248, is a tax-related document primarily used for specific reporting purposes. This form is essential for taxpayers who need to report certain types of income or claim specific deductions. Understanding its purpose is crucial for compliance with tax regulations and ensuring accurate reporting to the IRS.

How to use the Form 2248

Using the Michigan Form 2248 involves several key steps. First, gather all necessary documentation that supports the information you will report. This may include income statements, receipts, or other relevant financial records. Next, accurately complete the form by entering the required information in the designated fields. Be mindful of any specific instructions provided by the IRS to avoid errors. Finally, review the completed form for accuracy before submission.

Steps to complete the Form 2248

Completing the Michigan Form 2248 requires careful attention to detail. Follow these steps to ensure proper completion:

- Gather necessary documents, such as income statements and receipts.

- Fill out the personal information section, including your name and Social Security number.

- Report your income and deductions in the appropriate sections of the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 2248

The Michigan Form 2248 is legally binding when filled out correctly and submitted in accordance with IRS guidelines. It is important to ensure that all information reported is truthful and accurate, as discrepancies can lead to penalties or legal issues. Utilizing a reliable eSignature solution can help maintain the integrity of the document and ensure compliance with legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Form 2248 are critical to avoid penalties. Typically, this form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, if you are unable to meet this deadline, you may file for an extension. It is essential to stay informed about any changes to deadlines announced by the IRS to ensure timely submission.

Required Documents

To complete the Michigan Form 2248, certain documents are required. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Any prior year tax returns for reference.

Having these documents ready will streamline the completion process and help ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The Michigan Form 2248 can be submitted through various methods, depending on your preference. You may choose to file online using approved e-filing software, which often provides a streamlined process and immediate confirmation. Alternatively, you can mail the completed form to the appropriate IRS address or submit it in person at designated IRS offices. Be sure to check the specific submission guidelines to ensure compliance.

Quick guide on how to complete form 2248

Complete Form 2248 effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents promptly without delays. Manage Form 2248 on any device using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Form 2248 without difficulty

- Obtain Form 2248 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your adjustments.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device you choose. Modify and eSign Form 2248 and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2248

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Form 2248?

The Michigan Form 2248 is a document used in the state of Michigan for specific legal purposes. Understanding this form is crucial for compliance, and airSlate SignNow makes it easy to fill, send, and eSign Michigan Form 2248 seamlessly.

-

How can airSlate SignNow help with Michigan Form 2248?

airSlate SignNow simplifies the process of managing Michigan Form 2248 by allowing users to fill, sign, and send the document online. This eliminates the hassle of paper-based processes and helps ensure that your form is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for Michigan Form 2248?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Users can easily manage and eSign Michigan Form 2248 without incurring excessive costs, providing an affordable eSigning solution.

-

What features does airSlate SignNow offer for Michigan Form 2248?

With airSlate SignNow, users can utilize features like cloud storage, customizable templates, and secure eSignature capabilities when handling Michigan Form 2248. These features enhance productivity and ensure that your documentation is well-organized and accessible.

-

Can I integrate airSlate SignNow with other software to manage Michigan Form 2248?

Yes, airSlate SignNow offers integrations with various applications, allowing users to streamline their workflows while handling Michigan Form 2248. This means you can connect it with tools you already use, enhancing efficiency and collaboration.

-

How does the signing process work for Michigan Form 2248 on airSlate SignNow?

The signing process for Michigan Form 2248 on airSlate SignNow is straightforward. Users can send the document for signature through email, and recipients can eSign securely from any device, ensuring a quick turnaround.

-

Is airSlate SignNow secure for handling sensitive information in Michigan Form 2248?

Absolutely! airSlate SignNow employs industry-standard security measures to protect sensitive information in Michigan Form 2248. This includes encryption and secure access, ensuring your documents remain confidential and secure throughout the process.

Get more for Form 2248

Find out other Form 2248

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer