Consumer Loan Application Form

What is the Consumer Loan Application Form

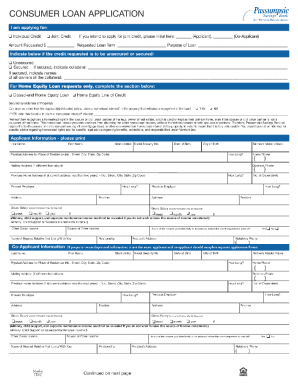

The Consumer Loan Application Form is a document used by individuals seeking to borrow money from financial institutions. This form collects essential personal and financial information to evaluate the applicant's creditworthiness and ability to repay the loan. It typically includes sections for personal identification, income details, employment history, and the purpose of the loan. Understanding this form is crucial for anyone looking to secure a consumer loan, as it lays the groundwork for the lending decision.

How to use the Consumer Loan Application Form

Using the Consumer Loan Application Form involves several key steps to ensure that all necessary information is accurately provided. Begin by gathering personal information, including your full name, address, Social Security number, and contact details. Next, compile financial information such as income, expenses, and existing debts. Once you have all the required details, fill out the form carefully, ensuring that each section is complete. After completing the form, review it for accuracy before submitting it to the lender, either online or in person.

Steps to complete the Consumer Loan Application Form

Completing the Consumer Loan Application Form can be straightforward if you follow these steps:

- Gather necessary documents, including proof of income, identification, and credit history.

- Fill out personal information accurately, ensuring your name and address match official records.

- Provide detailed financial information, such as monthly income, expenses, and any outstanding debts.

- Clearly state the purpose of the loan and the amount you wish to borrow.

- Review the form for any errors or omissions before submission.

Legal use of the Consumer Loan Application Form

The legal use of the Consumer Loan Application Form is governed by various regulations that ensure the protection of both the lender and the borrower. For the application to be legally valid, it must comply with federal and state laws regarding lending practices. This includes providing truthful information, as misrepresentation can lead to legal consequences. Additionally, the form must be signed by the applicant, and electronic signatures are accepted as long as they meet the requirements set forth by the ESIGN Act and UETA.

Key elements of the Consumer Loan Application Form

Several key elements are essential to the Consumer Loan Application Form. These typically include:

- Personal Information: Name, address, Social Security number, and contact details.

- Employment Details: Current employer, job title, and length of employment.

- Financial Information: Monthly income, expenses, and outstanding debts.

- Loan Details: Amount requested and intended use of the loan.

- Consent and Signature: Acknowledgment of the information provided and agreement to the terms.

Required Documents

When completing the Consumer Loan Application Form, certain documents are typically required to support your application. These may include:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, like a driver’s license or passport.

- Bank statements to verify financial stability.

- Credit report, which may be requested by the lender.

Quick guide on how to complete consumer loan application form 100058174

Easily Prepare Consumer Loan Application Form on Any Device

Digital document management has gained popularity among both organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Manage Consumer Loan Application Form on any device through the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign Consumer Loan Application Form Effortlessly

- Locate Consumer Loan Application Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Consumer Loan Application Form and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the consumer loan application form 100058174

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Consumer Loan Application Form?

A Consumer Loan Application Form is a standardized document used by lenders to gather important personal and financial information from applicants seeking a loan. This form helps streamline the loan approval process, ensuring that all necessary data is accurately collected. airSlate SignNow offers a user-friendly way to create, send, and eSign your Consumer Loan Application Form.

-

How does airSlate SignNow enhance the Consumer Loan Application Form process?

airSlate SignNow enhances the Consumer Loan Application Form process by providing an intuitive platform that allows for easy document creation and electronic signing. This reduces turnaround time and increases efficiency, as applicants can sign from anywhere, at any time. Additionally, the platform automatically stores completed forms securely for easy access.

-

What are the features of the Consumer Loan Application Form with airSlate SignNow?

The Consumer Loan Application Form with airSlate SignNow includes features such as customizable templates, a secure eSignature option, and real-time tracking of document status. These features facilitate a seamless process for both lenders and borrowers, ensuring that all steps are clear and efficient. Plus, automation options allow for reduced manual handling of paperwork.

-

Is there a cost associated with using the Consumer Loan Application Form on airSlate SignNow?

Yes, airSlate SignNow operates on a subscription-based pricing model, which varies depending on the features you need. The pricing is designed to be cost-effective for businesses of all sizes looking to utilize the Consumer Loan Application Form. You can explore different plans to find the one that suits your needs.

-

What benefits does the Consumer Loan Application Form provide for lenders?

The Consumer Loan Application Form offers signNow benefits for lenders, including reduced processing times and improved accuracy in data collection. By using airSlate SignNow, lenders can easily manage incoming applications and ensure that all necessary information is captured without errors. This ultimately leads to better decision-making and customer satisfaction.

-

Can the Consumer Loan Application Form be integrated with other software?

Yes, airSlate SignNow supports various integrations with popular software tools, enhancing the functionality of the Consumer Loan Application Form. You can connect it with CRM systems, payment processors, and other applications for seamless data flow. This integration capability allows lenders to automate workflows and increase productivity.

-

How secure is the Consumer Loan Application Form when using airSlate SignNow?

When you use airSlate SignNow for your Consumer Loan Application Form, security is a top priority. The platform employs advanced encryption and complies with industry standards to protect sensitive information. This ensures that all documents and signatures are handled securely, giving both lenders and borrowers peace of mind.

Get more for Consumer Loan Application Form

- Utilizaci n de formatos abiertos en la difusi n de informaci n uoc

- This notice is for those who did not homeschool in maine during the previous school year maine form

- Game development contract template form

- Game developer contract template form

- Garbage collection contract template form

- Garden contract template form

- Garden maintenance contract template form

- Garden service contract template form

Find out other Consumer Loan Application Form

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer