Is Florida Prepaid Refund Taxable Form

Understanding the Taxability of Florida Prepaid Refunds

The taxability of a Florida prepaid refund depends on various factors, including the purpose of the refund and how the funds were originally used. Generally, if the refund is issued for unused credits from the Florida Prepaid College Program, it may not be taxable. However, if the funds were used for non-qualifying expenses, the refund could be subject to taxation. It is essential to consult IRS guidelines and state regulations to determine the specific tax implications for your situation.

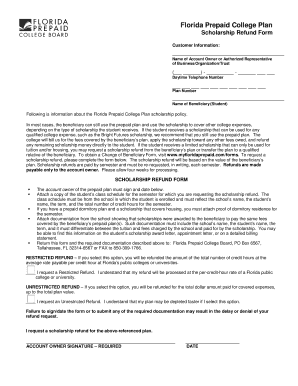

Steps to Complete the Florida Prepaid Refund Form

Completing the Florida prepaid refund form involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of payment and any relevant account information. Next, fill out the form with accurate personal details and specify the reason for the refund. It is important to review the form for completeness before submission. Once completed, you can submit the form online, by mail, or in person, depending on your preference.

Required Documents for the Florida Prepaid Refund

When applying for a Florida prepaid refund, certain documents are required to support your request. These may include:

- Proof of identity, such as a government-issued ID.

- Documentation of the prepaid plan, including account statements.

- Any correspondence related to the refund request.

Having these documents ready can expedite the processing of your refund request.

Legal Use of the Florida Prepaid Refund Form

The Florida prepaid refund form must be used in compliance with applicable laws and regulations. This includes adhering to the guidelines set forth by the Florida Prepaid College Board and the IRS. Ensuring that the form is filled out correctly and submitted in a timely manner is crucial to avoid any legal complications. It is advisable to keep copies of all submitted documents for your records.

State-Specific Rules for Florida Prepaid Refunds

Florida has specific regulations governing the prepaid college program and its refunds. Understanding these rules can help you navigate the process more effectively. For instance, refunds may be subject to different rules based on whether the funds were used for tuition, fees, or other educational expenses. Additionally, there may be deadlines for submitting refund requests, so being aware of these timelines is important.

IRS Guidelines on Taxability

The IRS provides guidelines regarding the tax implications of refunds from prepaid education plans. According to IRS rules, if the refund is for contributions made to a qualified tuition program, it may not be taxable. However, any earnings on those contributions could be subject to taxation if not used for qualified educational expenses. It is recommended to consult a tax professional for personalized advice based on your circumstances.

Quick guide on how to complete is florida prepaid refund taxable

Finalize Is Florida Prepaid Refund Taxable effortlessly on any gadget

Online document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without interruptions. Manage Is Florida Prepaid Refund Taxable on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Is Florida Prepaid Refund Taxable with ease

- Obtain Is Florida Prepaid Refund Taxable and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or mistakes that necessitate reprinting documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Is Florida Prepaid Refund Taxable and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the is florida prepaid refund taxable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Florida prepaid refund form?

The Florida prepaid refund form is a document used to request a refund for prepaid college tuition plans. It allows students or guardians to easily obtain refunds for unused credits. By utilizing the Florida prepaid refund form, you can streamline the process of receiving your funds.

-

How do I fill out the Florida prepaid refund form?

Filling out the Florida prepaid refund form involves providing accurate personal information, including your name, account number, and details regarding the prepaid plan. Make sure to follow the instructions carefully and check for any additional requirements before submission. This ensures a smooth and timely refund process.

-

Where can I find the Florida prepaid refund form?

You can find the Florida prepaid refund form on the official Florida Prepaid College Plan website. Alternatively, other educational institutions may provide access to this form. It's important to ensure you are using the most current version of the form for your refund request.

-

Is there a fee to submit the Florida prepaid refund form?

No, submitting the Florida prepaid refund form typically does not incur any fees. However, it's advisable to check if there are any associated costs or conditions outlined on the official Florida Prepaid College Plan website, as this may vary.

-

How long does it take to process the Florida prepaid refund form?

Processing the Florida prepaid refund form can take several weeks, depending on the volume of requests. After submission, you will receive notifications regarding the status of your refund. It’s important to keep track of your application to ensure everything is being handled properly.

-

Can I amend my Florida prepaid refund form after submission?

Once the Florida prepaid refund form is submitted, amending it may not be straightforward. If you identify errors or wish to change any details, it's recommended to contact the relevant office directly for guidance on how to proceed. They will be able to assist you in correcting your application.

-

What are the benefits of using the Florida prepaid refund form?

The main benefits of using the Florida prepaid refund form include streamlining the refund process and ensuring that you receive your prepaid funds efficiently. This form is designed to make your experience easier, providing clarity and support at every step. Using it can also minimize delays in receiving your refund.

Get more for Is Florida Prepaid Refund Taxable

Find out other Is Florida Prepaid Refund Taxable

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template