Pit X Form

What is the Pit X Form

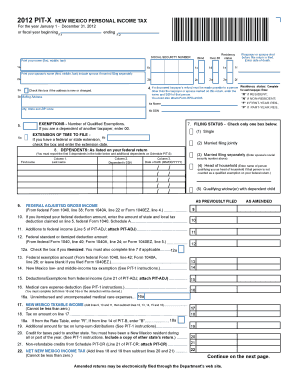

The Pit X Form is a specific document used for various purposes, primarily relating to tax reporting and compliance. It is essential for individuals and businesses to accurately complete this form to ensure proper documentation of financial activities. The form may include sections for reporting income, deductions, and other relevant financial information, making it a crucial tool for maintaining compliance with federal and state tax regulations.

How to use the Pit X Form

Using the Pit X Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, such as income statements and receipts. Review the form carefully to understand each section and the information required. Complete the form by entering the relevant data, ensuring that all figures are accurate and reflect your financial situation. Finally, review the completed form for errors before submission.

Steps to complete the Pit X Form

Completing the Pit X Form requires attention to detail. Follow these steps for effective completion:

- Gather all necessary financial documents, including income records and expense receipts.

- Read through the form to understand the required sections and instructions.

- Fill in your personal information accurately, including your name, address, and taxpayer identification number.

- Report your income and deductions as specified, ensuring all figures are correctly calculated.

- Double-check your entries for accuracy and completeness.

- Sign and date the form where required.

Legal use of the Pit X Form

The legal use of the Pit X Form hinges on its compliance with relevant tax laws and regulations. When completed accurately, the form serves as a legitimate document for reporting income and expenses to the Internal Revenue Service (IRS) or state tax authorities. It is important to adhere to all legal requirements, including filing deadlines and proper documentation, to avoid penalties or legal complications.

Examples of using the Pit X Form

There are various scenarios in which individuals or businesses may need to use the Pit X Form. For instance, a self-employed individual may use this form to report income earned from freelance work. Additionally, a small business owner might complete the form to document business expenses and deductions. Each example underscores the importance of accurate reporting for compliance and financial management.

Filing Deadlines / Important Dates

Filing deadlines for the Pit X Form can vary depending on the specific tax year and the individual’s or business's filing status. Generally, the form must be submitted by April 15 for individuals, while businesses may have different deadlines based on their fiscal year. It is crucial to stay informed about these dates to ensure timely submission and avoid penalties.

Who Issues the Form

The Pit X Form is typically issued by the Internal Revenue Service (IRS) or relevant state tax authorities. These agencies provide the necessary guidelines and instructions for completing the form, ensuring that taxpayers have access to the required resources for compliance. Always refer to the official IRS website or your state’s tax authority for the most current version of the form and any updates regarding its use.

Quick guide on how to complete pit x form

Complete Pit X Form effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly without interruptions. Manage Pit X Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Pit X Form with no hassle

- Obtain Pit X Form and click on Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only a few seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Pit X Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pit x form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Pit X Form and how does it work?

The Pit X Form is a versatile digital document designed for businesses to streamline their signing processes. It allows users to fill out, sign, and send documents electronically, making it a hassle-free solution for obtaining signatures. Utilizing the airSlate SignNow platform, the Pit X Form improves efficiency and reduces turnaround times for critical paperwork.

-

How can I integrate the Pit X Form with my existing tools?

Integrating the Pit X Form with your existing applications is simple with airSlate SignNow. Our platform offers a variety of API integrations and pre-built connectors for tools like Google Drive, Salesforce, and more. This ensures that your document management processes remain seamless and efficient, providing a smooth user experience.

-

Is there a free trial available for the Pit X Form?

Yes, airSlate SignNow offers a free trial allowing users to explore the features of the Pit X Form without any commitment. This trial enables you to test the functionality, ease of use, and overall benefits of the Pit X Form in your business workflow before making a purchase decision. Sign up today and see how it can transform your document management.

-

What are the pricing options for using the Pit X Form?

airSlate SignNow offers various pricing plans tailored to fit different business needs regarding the Pit X Form. Our plans cater to individuals, small businesses, and large enterprises, ensuring you have the right features at an affordable price. Visit our pricing page for detailed information and choose the plan that best suits your requirements.

-

What security measures are in place for the Pit X Form?

The Pit X Form comes with robust security features to protect your sensitive information, including SSL encryption and compliance with GDPR and HIPAA regulations. airSlate SignNow ensures that all documents signed through our platform are stored securely and accessed only by authorized users. You can trust that your data is safe and secure.

-

Can the Pit X Form be customized to suit my business needs?

Absolutely! The Pit X Form allows for extensive customization to meet specific business requirements. You can modify fields, branding, and even workflow settings to ensure it aligns with your organizational processes. This flexibility helps businesses create documents that reflect their brand and operational needs.

-

What are the main benefits of using the Pit X Form for eSigning?

Using the Pit X Form for eSigning offers numerous benefits, including enhanced efficiency, reduced paper usage, and improved document tracking. With seamless integration and the ability to sign from any device, it simplifies the signing process and accelerates business operations. Experience these advantages and see how the Pit X Form can boost your productivity.

Get more for Pit X Form

Find out other Pit X Form

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online