Citibank Loan Form

What is the Citibank Loan Form

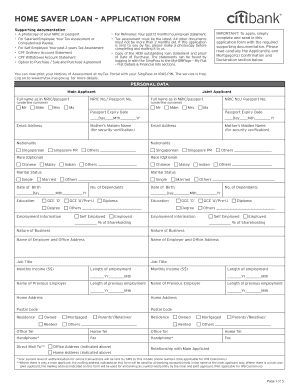

The Citibank loan form is a crucial document used by individuals seeking to apply for personal loans through Citibank. This form collects essential information about the applicant, including personal details, financial status, and the purpose of the loan. It serves as the foundation for the loan application process, allowing Citibank to assess the applicant's eligibility and creditworthiness. Understanding the components of this form is vital for applicants to ensure accurate and complete submissions.

How to Use the Citibank Loan Form

Using the Citibank loan form involves several steps to ensure a smooth application process. First, applicants should download the form from the official Citibank website or obtain a hard copy from a local branch. Next, it is important to read the instructions carefully to understand the information required. Applicants should fill out the form completely, providing accurate details about their income, employment, and any existing debts. Once completed, the form can be submitted online, via mail, or in person at a Citibank location, depending on the preferred method of application.

Steps to Complete the Citibank Loan Form

Completing the Citibank loan form requires attention to detail. Here are the steps to follow:

- Gather necessary documents, such as identification, proof of income, and financial statements.

- Download or acquire the Citibank loan form.

- Fill in personal information, including your name, address, and Social Security number.

- Provide details about your employment and income sources.

- Specify the amount of the loan requested and its intended use.

- Review the form for accuracy and completeness.

- Submit the form through the chosen method.

Legal Use of the Citibank Loan Form

The legal use of the Citibank loan form is governed by various regulations that ensure the protection of both the lender and the borrower. When filled out correctly, the form acts as a legally binding agreement between the applicant and Citibank, subject to the terms and conditions outlined in the loan agreement. It is essential for applicants to provide truthful information, as any discrepancies may lead to legal consequences, including loan denial or fraud charges.

Required Documents

When applying for a loan using the Citibank loan form, several documents are typically required to support the application. These may include:

- Government-issued identification (e.g., driver's license or passport)

- Proof of income (e.g., pay stubs, tax returns)

- Bank statements for the past few months

- Documentation of any existing debts or financial obligations

- Credit history or score report, if applicable

Eligibility Criteria

To qualify for a loan through the Citibank loan form, applicants must meet certain eligibility criteria. Generally, this includes being a U.S. citizen or permanent resident, having a minimum age of eighteen years, and demonstrating a stable source of income. Additionally, Citibank may consider the applicant's credit score, debt-to-income ratio, and overall financial health when determining eligibility for the loan.

Quick guide on how to complete citibank loan form

Accomplish Citibank Loan Form effortlessly on any device

Web-based document administration has become increasingly popular among organizations and individuals. It offers an impeccable eco-friendly substitute for traditional printed and signed documents, as you can obtain the appropriate format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Citibank Loan Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Citibank Loan Form with ease

- Find Citibank Loan Form and click Get Form to initiate.

- Make use of the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes moments and holds exactly the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to all your needs in document management in just a few clicks from any device you choose. Modify and eSign Citibank Loan Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the citibank loan form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city bank loan form and how can airSlate SignNow help?

The city bank loan form is a document used for applying for loans at City Bank. With airSlate SignNow, you can easily eSign and send this form digitally, streamlining the application process and ensuring it signNowes the bank promptly.

-

What are the pricing options for using airSlate SignNow for the city bank loan form?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs. You can choose a plan that provides access to essential features for managing your city bank loan form efficiently and cost-effectively.

-

What features does airSlate SignNow provide for the city bank loan form?

airSlate SignNow includes features such as secure eSigning, customizable templates, and cloud storage integration. These tools enhance the efficiency of managing your city bank loan form and help ensure timely submissions.

-

Can I integrate airSlate SignNow with other applications for the city bank loan form?

Yes, airSlate SignNow allows seamless integration with various applications like Google Drive, Dropbox, and CRMs. This enables you to manage your city bank loan form alongside other essential tools you use daily.

-

What are the benefits of using airSlate SignNow for the city bank loan form?

Using airSlate SignNow for your city bank loan form provides benefits such as reduced turnaround time and improved document security. The digital signing process ensures that your application is processed more quickly than traditional methods.

-

Is it easy to share the city bank loan form with others using airSlate SignNow?

Absolutely! airSlate SignNow allows you to easily share the city bank loan form with other stakeholders via email or a direct link. This makes collaboration straightforward and ensures everyone involved has access to the necessary documents.

-

How does airSlate SignNow ensure the security of the city bank loan form?

airSlate SignNow implements advanced security measures, including encryption and secure cloud storage, to protect your city bank loan form. Your sensitive information remains confidential and secure throughout the signing process.

Get more for Citibank Loan Form

Find out other Citibank Loan Form

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF