Return Senior 2002

What is the Return Senior

The Return Senior is a crucial document used primarily for the reporting of income and deductions related to senior citizens. It serves as a means for individuals aged sixty-five and older to declare their financial information to the Internal Revenue Service (IRS). This form is particularly important for ensuring that seniors receive any applicable tax benefits or credits available to them, thereby supporting their financial well-being.

How to use the Return Senior

Using the Return Senior involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements, previous tax returns, and any relevant deduction information. Next, fill out the form carefully, ensuring that all data is accurate and complete. Once completed, the Return Senior can be submitted electronically or via traditional mail, depending on the preference of the filer. Utilizing a digital platform can streamline this process, making it easier to manage and submit the form securely.

Steps to complete the Return Senior

Completing the Return Senior requires attention to detail. Follow these steps:

- Collect all necessary financial documents, including W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring no income is overlooked.

- Include any eligible deductions or credits, such as medical expenses or property taxes.

- Review the form for accuracy before submission.

Legal use of the Return Senior

The Return Senior is legally binding when completed correctly and submitted according to IRS guidelines. It is essential to ensure compliance with all tax laws to avoid penalties. The form must be signed and dated, affirming that the information provided is true and accurate. Electronic signatures are acceptable under the ESIGN Act, provided that the digital platform used complies with legal standards for eSignatures.

Filing Deadlines / Important Dates

Filing deadlines for the Return Senior typically align with the standard tax filing dates set by the IRS. For most taxpayers, the deadline is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Seniors should be aware of any specific changes or extensions that may apply to their situation, ensuring timely submission to avoid penalties.

Required Documents

To complete the Return Senior accurately, several documents are required:

- Income statements such as W-2s and 1099s.

- Previous year’s tax return for reference.

- Documentation for deductions, including receipts for medical expenses.

- Any relevant information regarding tax credits.

Who Issues the Form

The Return Senior is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. This form is part of the IRS's effort to provide specific tax reporting options tailored to the needs of senior citizens, ensuring they have access to the benefits designed for their demographic.

Quick guide on how to complete return senior

Complete Return Senior effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and safely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Return Senior on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Return Senior without hassle

- Locate Return Senior and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Return Senior and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct return senior

Create this form in 5 minutes!

How to create an eSignature for the return senior

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

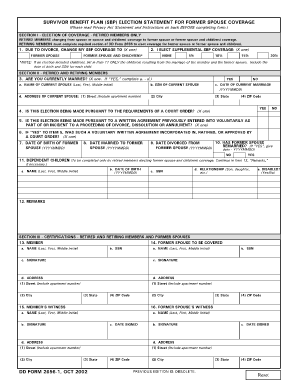

What is a DD Form 2656 1?

The DD Form 2656 1 is an essential document used by military personnel to apply for retired pay and to designate beneficiaries. Understanding this form is crucial for service members nearing retirement, ensuring that their retirement benefits are processed correctly.

-

How can airSlate SignNow help with the DD Form 2656 1?

airSlate SignNow simplifies the process of completing and signing the DD Form 2656 1 by offering an intuitive, user-friendly platform. You can fill out the form digitally, eSign it, and store it securely, all within our seamless workflow.

-

Is there a cost associated with using airSlate SignNow for DD Form 2656 1?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs, including features for managing documents like the DD Form 2656 1. You can choose from several pricing tiers depending on your usage and required features.

-

What features does airSlate SignNow offer for managing the DD Form 2656 1?

airSlate SignNow provides a variety of features to enhance your experience with the DD Form 2656 1, including customized templates, automated workflows, and secure storage. These features help streamline the document management process, ensuring efficiency and security.

-

Can I integrate airSlate SignNow with other tools for the DD Form 2656 1?

Absolutely! airSlate SignNow supports integrations with various applications such as Google Drive, Dropbox, and CRM systems. This means you can easily manage and access your DD Form 2656 1 alongside other critical documents.

-

What are the benefits of using airSlate SignNow for the DD Form 2656 1?

Using airSlate SignNow for the DD Form 2656 1 increases productivity and ensures accuracy in your document submissions. With features like real-time tracking and reminders, you can stay organized and compliant throughout the process.

-

How secure is my information when using airSlate SignNow for the DD Form 2656 1?

airSlate SignNow prioritizes your data security, employing advanced encryption standards to protect your information. When you fill out and submit the DD Form 2656 1, your details remain confidential and secure within our platform.

Get more for Return Senior

- Genworth broker dealer change form

- Lincoln financial distribution request form

- Lincoln vulcv lincoln financial group form

- Chicago title north carolina form

- Litter application form american dog breeders association

- Excavator training ppt form

- Oshacampuscom form

- Objection huron county probate and juvenile court form

Find out other Return Senior

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA