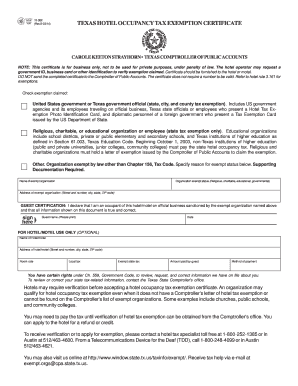

Texas Hotel Occupancy Tax Exemption Certificate Form

What is the Texas Hotel Occupancy Tax Exemption Certificate

The Texas Hotel Occupancy Tax Exemption Certificate is a crucial document that allows certain individuals and organizations to be exempt from paying hotel occupancy taxes in Texas. This exemption typically applies to government entities, educational institutions, and non-profit organizations. By presenting this certificate at the time of booking or check-in, eligible guests can avoid the additional tax charges that hotels usually impose on their guests.

How to use the Texas Hotel Occupancy Tax Exemption Certificate

To utilize the Texas Hotel Occupancy Tax Exemption Certificate, eligible individuals must present the completed form to the hotel at the time of check-in. This ensures that the hotel recognizes the exemption and does not charge the occupancy tax. It is essential to ensure that the certificate is filled out correctly, including the name of the organization, the purpose of the stay, and the signature of an authorized representative. This helps prevent any misunderstandings regarding the tax exemption.

Steps to complete the Texas Hotel Occupancy Tax Exemption Certificate

Completing the Texas Hotel Occupancy Tax Exemption Certificate involves several straightforward steps:

- Obtain the form from a reliable source, such as the Texas Comptroller's website or directly from the hotel.

- Fill in the required fields, including the name of the organization, the address, and the purpose of the stay.

- Include the dates of the stay and the name of the hotel where the exemption is being claimed.

- Ensure that the form is signed by an authorized representative of the organization.

- Review the completed form for accuracy before presenting it to the hotel.

Legal use of the Texas Hotel Occupancy Tax Exemption Certificate

The legal use of the Texas Hotel Occupancy Tax Exemption Certificate is governed by state laws that define eligibility criteria and proper usage. To be considered valid, the certificate must be accurately filled out and presented at the time of check-in. Misuse of the certificate, such as using it when not eligible, can lead to penalties or legal repercussions. Therefore, it is important for users to understand the specific guidelines and ensure compliance with Texas tax laws.

Eligibility Criteria

Eligibility for the Texas Hotel Occupancy Tax Exemption Certificate is generally limited to specific groups, including:

- Government entities, including state and federal agencies.

- Educational institutions, such as public schools and universities.

- Non-profit organizations that meet certain criteria.

Individuals traveling for personal reasons or those not representing an eligible organization do not qualify for this exemption. It is essential to verify eligibility before attempting to use the certificate.

Required Documents

When applying for or using the Texas Hotel Occupancy Tax Exemption Certificate, certain documents may be required to substantiate the claim. These can include:

- A completed Texas Hotel Occupancy Tax Exemption Certificate.

- Proof of the organization's tax-exempt status, such as a 501(c)(3) letter for non-profits.

- Identification of the authorized representative signing the certificate.

Having these documents ready can facilitate a smoother check-in process and help avoid any potential issues regarding the tax exemption.

Quick guide on how to complete texas hotel occupancy tax exemption certificate

Effortlessly Prepare Texas Hotel Occupancy Tax Exemption Certificate on Any Device

Online document administration has gained traction among businesses and individuals alike. It offers an optimal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents rapidly without any delays. Handle Texas Hotel Occupancy Tax Exemption Certificate on any device through airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and eSign Texas Hotel Occupancy Tax Exemption Certificate with Ease

- Locate Texas Hotel Occupancy Tax Exemption Certificate and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Edit and eSign Texas Hotel Occupancy Tax Exemption Certificate and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas hotel occupancy tax exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas hotel tax exempt form?

The Texas hotel tax exempt form is a document that allows eligible organizations, such as government entities and non-profits, to claim an exemption from paying hotel occupancy taxes in Texas. By using this form, guests can save money on their lodging expenses while enjoying compliance with state tax laws.

-

How do I obtain a Texas hotel tax exempt form?

You can obtain the Texas hotel tax exempt form from the Texas Comptroller's website or your hotel may provide it upon request. It's essential to fill out the form accurately to ensure it is accepted by hotels and the state without issues.

-

How can airSlate SignNow help with the Texas hotel tax exempt form?

airSlate SignNow streamlines the process of completing and signing the Texas hotel tax exempt form electronically. This allows users to manage their documents efficiently, reducing the need for physical paperwork and enabling faster submission to hotels.

-

Is there a cost associated with using airSlate SignNow to handle the Texas hotel tax exempt form?

While airSlate SignNow offers various pricing plans, many users find that the cost is justified by the convenience and efficiency it provides for managing forms like the Texas hotel tax exempt form. Review the pricing page to find a plan that suits your needs.

-

Can I integrate airSlate SignNow with other applications for the Texas hotel tax exempt form?

Yes, airSlate SignNow offers integrations with various applications that can help manage documents, including CRMs and workflow tools. This simplifies adding the Texas hotel tax exempt form into your existing processes.

-

What features does airSlate SignNow offer for managing the Texas hotel tax exempt form?

airSlate SignNow includes features such as electronic signatures, document templates, and secure storage, all of which can streamline your experience with the Texas hotel tax exempt form. These features enhance efficiency, ensuring your form is signed and submitted quickly.

-

How secure is my information when using the Texas hotel tax exempt form with airSlate SignNow?

airSlate SignNow prioritizes security and compliance, employing advanced encryption technologies to protect your information while using the Texas hotel tax exempt form. Your documents are safe from unauthorized access, ensuring peace of mind.

Get more for Texas Hotel Occupancy Tax Exemption Certificate

Find out other Texas Hotel Occupancy Tax Exemption Certificate

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure