Pearl River County Homestead Exemption Form

What is the Pearl River County Homestead Exemption

The Pearl River County Homestead Exemption is a property tax reduction program designed to assist homeowners in Pearl River County, Mississippi. This exemption allows qualifying homeowners to reduce their property taxes on their primary residence. By applying for this exemption, eligible individuals can benefit from a decrease in the assessed value of their property, resulting in lower annual property tax bills. It is essential for homeowners to understand the specific criteria and benefits associated with this exemption to maximize their savings.

Eligibility Criteria

To qualify for the Pearl River County Homestead Exemption, applicants must meet certain criteria, including:

- Ownership of the property as of January first of the tax year.

- Occupying the property as the primary residence.

- Meeting income limits set by the state, if applicable.

- Being a U.S. citizen or legal resident.

Homeowners should verify their eligibility before applying to ensure compliance with local regulations.

Steps to Complete the Pearl River County Homestead Exemption

Filing for the Pearl River County Homestead Exemption involves several steps:

- Gather necessary documentation, including proof of ownership and residency.

- Complete the homestead exemption application form, ensuring all information is accurate.

- Submit the application to the Pearl River County Tax Assessor's office by the designated deadline.

- Await confirmation of approval or any requests for additional information from the tax office.

Following these steps can help streamline the application process and ensure timely filing.

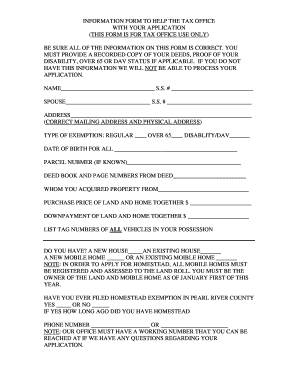

Required Documents

When applying for the Pearl River County Homestead Exemption, homeowners typically need to provide the following documents:

- Proof of identity, such as a driver's license or state ID.

- Documentation of property ownership, such as a deed or tax statement.

- Evidence of residency, like utility bills or bank statements.

- Any additional forms required by the Pearl River County Tax Assessor.

Having these documents ready can facilitate a smooth application process.

Form Submission Methods

Homeowners can submit their Pearl River County Homestead Exemption application through various methods:

- Online submission via the Pearl River County Tax Assessor's website.

- Mailing the completed form to the Tax Assessor's office.

- In-person submission at the Tax Assessor's office during business hours.

Each method offers different advantages, so homeowners should choose the one that best fits their needs.

Penalties for Non-Compliance

Failure to comply with the requirements of the Pearl River County Homestead Exemption can result in penalties. Homeowners may face increased property taxes, loss of the exemption for future years, or additional fines. It is crucial for applicants to understand the obligations associated with the exemption to avoid these consequences.

Quick guide on how to complete pearl river county homestead exemption

Complete Pearl River County Homestead Exemption effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers a truly eco-friendly substitute for conventional printed and signed papers, allowing you to find the right template and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without interruptions. Handle Pearl River County Homestead Exemption on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and eSign Pearl River County Homestead Exemption with ease

- Find Pearl River County Homestead Exemption and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your needs in document management in just a few clicks from any device you prefer. Modify and eSign Pearl River County Homestead Exemption and guarantee excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pearl river county homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's role in managing Pearl River County property tax documents?

airSlate SignNow simplifies the management of Pearl River County property tax documents by allowing users to electronically sign and send documents securely. This ensures that your tax-related paperwork is organized and timely, which is crucial for meeting local deadlines. With a user-friendly interface, it makes the process effortless for both property owners and tax assessors.

-

How does airSlate SignNow help in reducing processing time for Pearl River County property tax filings?

By utilizing airSlate SignNow, users can signNowly reduce the processing time for Pearl River County property tax filings. The platform enables instant document sharing and electronic signatures, eliminating delays associated with traditional mailing. This efficiency ensures that property tax submissions are handled swiftly and without unnecessary back-and-forth.

-

Are there any costs associated with using airSlate SignNow for Pearl River County property tax documents?

airSlate SignNow offers affordable pricing plans to help you manage your Pearl River County property tax documents without breaking the bank. Subscription options are flexible and cater to different business sizes and needs. This allows you to choose a plan that best fits your budget while benefiting from our comprehensive features.

-

What features does airSlate SignNow provide that are beneficial for managing Pearl River County property tax?

airSlate SignNow includes features such as customizable templates, bulk sending, and secure cloud storage to enhance your experience with Pearl River County property tax documents. These tools streamline the signing and filing process, ensuring that all necessary documentation is handled efficiently and securely. Additionally, real-time tracking helps in keeping tabs on document status.

-

How does airSlate SignNow ensure the security of my Pearl River County property tax documents?

airSlate SignNow prioritizes security with advanced encryption and authentication measures, ensuring that all Pearl River County property tax documents are protected. Our platform complies with industry standards to safeguard your sensitive information during the signing and filing processes. You can trust that your documents remain confidential and secure.

-

Can I integrate airSlate SignNow with other tools for managing Pearl River County property tax?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing its functionality for managing Pearl River County property tax. Whether you use CRMs, document storage services, or accounting software, you can connect these tools to streamline your workflow. This integration allows for a more efficient approach to handling property tax-related tasks.

-

What advantages does airSlate SignNow offer over traditional methods for Pearl River County property tax?

Using airSlate SignNow for Pearl River County property tax provides numerous advantages over traditional methods, including time savings, enhanced organization, and reduced paperwork. The ability to eSign documents eliminates the need for physical signatures, making the process faster and more convenient. This modern approach helps users stay compliant with local regulations more effectively.

Get more for Pearl River County Homestead Exemption

Find out other Pearl River County Homestead Exemption

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online