Demonstration Insurance 2020-2026

What is the Demonstration Insurance

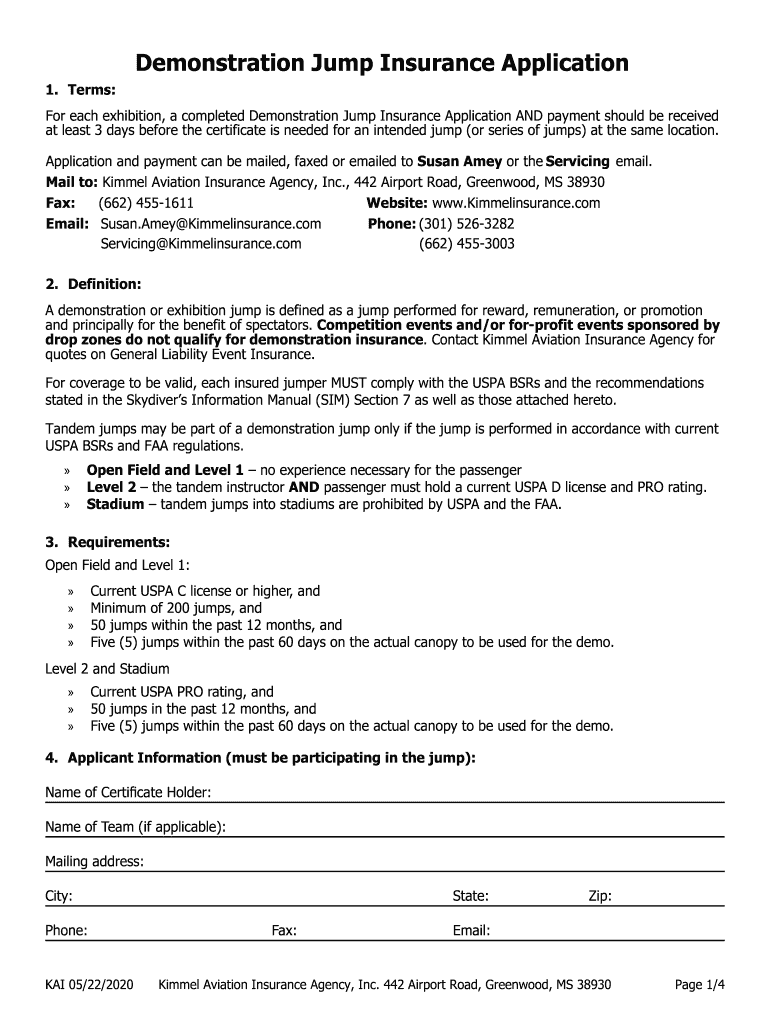

Demonstration insurance is a specialized type of coverage designed for individuals or organizations participating in demonstrations or events where activities may involve risks. This insurance protects against potential liabilities that could arise from accidents, injuries, or damages occurring during such events. It is particularly relevant for those involved in activities like public demonstrations, exhibitions, or performances, where the likelihood of unforeseen incidents is heightened.

How to use the Demonstration Insurance

Using demonstration insurance involves understanding the specific coverage it provides and how to activate it when needed. Typically, policyholders must notify their insurance provider prior to the event, detailing the nature of the demonstration and the expected number of participants. In case of an incident, the insured party should promptly report the event to the insurance company, providing necessary documentation and evidence to support any claims.

Steps to complete the Demonstration Insurance

Completing the demonstration insurance application involves several key steps:

- Gather necessary information about the event, including date, location, and expected attendance.

- Review the specific coverage options available for demonstration insurance.

- Fill out the application form accurately, providing all requested details.

- Submit the application along with any required documentation, such as event permits or safety plans.

- Await confirmation from the insurance provider regarding coverage approval.

Legal use of the Demonstration Insurance

For demonstration insurance to be legally binding, it must comply with relevant state and federal regulations. This includes ensuring that the coverage meets the minimum legal requirements for liability protection. Additionally, the policyholder should maintain accurate records of the insurance policy and any communications with the insurer, as these may be necessary in the event of a claim or legal dispute.

Key elements of the Demonstration Insurance

Key elements of demonstration insurance include:

- Coverage Limits: The maximum amount the insurance company will pay for claims.

- Deductibles: The amount the policyholder must pay out-of-pocket before the insurance kicks in.

- Exclusions: Specific situations or conditions that are not covered by the policy.

- Duration of Coverage: The time frame during which the insurance is valid, typically covering the event duration.

Who Issues the Form

The demonstration insurance form is typically issued by insurance companies that specialize in event coverage. These insurers may offer tailored policies based on the nature of the demonstration and the associated risks. It is advisable to choose a reputable provider with experience in handling similar events to ensure adequate protection.

Quick guide on how to complete demonstration insurance

Complete Demonstration Insurance effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, enabling you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Demonstration Insurance on any platform using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Demonstration Insurance without hassle

- Acquire Demonstration Insurance and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Spotlight relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in several clicks from any device of your choice. Edit and eSign Demonstration Insurance to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct demonstration insurance

Create this form in 5 minutes!

How to create an eSignature for the demonstration insurance

How to create an eSignature for your PDF document in the online mode

How to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is Demonstration Insurance and how does it work?

Demonstration Insurance is designed to provide coverage for businesses showcasing products or services during demonstrations. With airSlate SignNow, you can easily sign and manage documents related to your Demonstration Insurance, ensuring that all necessary agreements are legally binding and securely stored.

-

How much does Demonstration Insurance cost?

The cost of Demonstration Insurance varies based on factors such as the type of demonstration and the coverage limits you choose. To get a personalized quote, you can utilize our airSlate SignNow platform to streamline the process of signing documents and agreements related to your insurance needs.

-

What features does airSlate SignNow offer for managing Demonstration Insurance documents?

airSlate SignNow offers a variety of features tailored for managing Demonstration Insurance documents, including eSigning, document templates, and secure storage. These features make it simple to create, send, and track your insurance contracts, ensuring you have everything in order for your demonstrations.

-

Can I integrate airSlate SignNow with my existing insurance management software for Demonstration Insurance?

Yes, airSlate SignNow can seamlessly integrate with various insurance management software solutions. This allows you to streamline your processes for managing Demonstration Insurance, facilitating easy access to all necessary documents and ensuring your workflow remains efficient.

-

What are the benefits of using airSlate SignNow for my Demonstration Insurance needs?

Using airSlate SignNow for your Demonstration Insurance needs provides several benefits, including increased efficiency in document management, enhanced security for your sensitive information, and the ability to track the status of your agreements in real-time. This ensures you can focus on your demonstrations while knowing your insurance documentation is handled securely.

-

Is airSlate SignNow user-friendly for signing Demonstration Insurance contracts?

Absolutely! airSlate SignNow is designed with user experience in mind, making it incredibly easy to sign Demonstration Insurance contracts online. Users can quickly navigate the platform, ensuring that even those with minimal technical skills can manage their documents effortlessly.

-

What types of documents can I manage related to Demonstration Insurance?

With airSlate SignNow, you can manage various documents related to Demonstration Insurance, including policy agreements, liability waivers, and client contracts. The platform allows you to create, sign, and store these documents securely, ensuring your insurance needs are fully met.

Get more for Demonstration Insurance

- Tax alaska 6967271 form

- Pennsylvania petition form

- Florida supreme court approved family law form 12982g final judgment of change of name family 0218 florida supreme court

- Pr1811 form

- Laciv 096 form

- Application for publication los angeles superior court form

- Los angeles lawyer november 2014 pdf online free publishing form

- Full text of quotcalifornia heraldquot internet archive form

Find out other Demonstration Insurance

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT