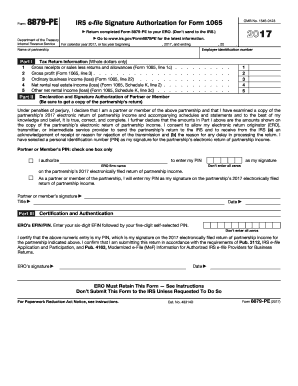

Dont Send to the IRS Form

What is the Dont Send To The IRS

The Dont Send To The IRS form is a specific document used by individuals and businesses in the United States to communicate certain information without submitting it directly to the Internal Revenue Service (IRS). This form serves various purposes, including reporting income, claiming deductions, or providing necessary information for tax compliance. Understanding the nature of this form is crucial for ensuring proper handling and compliance with U.S. tax laws.

How to use the Dont Send To The IRS

Using the Dont Send To The IRS form involves several steps to ensure that all information is accurately captured and submitted correctly. First, gather all relevant financial documents and information that pertain to the purpose of the form. Next, fill out the form carefully, ensuring that all required fields are completed. Once the form is filled out, it is essential to review it for accuracy before deciding on the submission method. This form can often be completed electronically, which simplifies the process and enhances efficiency.

Steps to complete the Dont Send To The IRS

Completing the Dont Send To The IRS form involves a systematic approach:

- Gather necessary documents: Collect all relevant financial statements, previous tax returns, and any other documents that support the information you will provide.

- Fill out the form: Carefully input all required information, ensuring accuracy and completeness.

- Review the form: Double-check all entries for errors or omissions.

- Choose a submission method: Decide whether to submit the form electronically or by mail, based on your preference and the requirements of the form.

- Submit the form: Follow the chosen method to ensure that the form is sent to the appropriate entity.

Legal use of the Dont Send To The IRS

The legal use of the Dont Send To The IRS form is governed by various regulations and guidelines set forth by the IRS and applicable state laws. It is important to ensure that the information provided on the form is truthful and accurate, as any discrepancies can lead to penalties or legal issues. Additionally, utilizing a reliable electronic signature solution, like signNow, can help ensure that the document is legally binding, provided it meets the necessary legal standards for electronic signatures.

Key elements of the Dont Send To The IRS

Several key elements are essential for the proper completion and submission of the Dont Send To The IRS form:

- Accurate information: All data entered must be correct and reflect your financial situation.

- Signatures: Depending on the form, signatures may be required to validate the information provided.

- Submission guidelines: Follow the specific instructions for submitting the form, whether electronically or by mail.

- Compliance: Ensure that the form complies with relevant tax laws and regulations to avoid potential penalties.

Examples of using the Dont Send To The IRS

There are various scenarios in which the Dont Send To The IRS form may be utilized. For instance, a self-employed individual might use this form to report income from freelance work without submitting it directly to the IRS. Similarly, a business may use it to document deductions for expenses incurred during the tax year. Each example highlights the versatility of the form and its importance in maintaining accurate financial records while adhering to legal requirements.

Quick guide on how to complete dont send to the irs

Complete Dont Send To The IRS effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, as you can obtain the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Dont Send To The IRS on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The simplest way to modify and eSign Dont Send To The IRS effortlessly

- Find Dont Send To The IRS and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Choose how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from any device. Modify and eSign Dont Send To The IRS and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dont send to the irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to 'Dont Send To The IRS' with airSlate SignNow?

The phrase 'Dont Send To The IRS' refers to the capability of airSlate SignNow to simplify document management, allowing users to eSign and send important forms without the need for physical mailing. This means you can securely manage tax documents online and avoid unnecessary delays associated with traditional mailing.

-

How does airSlate SignNow ensure document security when users 'Dont Send To The IRS'?

airSlate SignNow prioritizes your document security by employing advanced encryption methods and secure data storage. When you choose to 'Dont Send To The IRS,' you can eSign documents with confidence, knowing that sensitive information is protected throughout the signing process.

-

What are the pricing options available if I want to 'Dont Send To The IRS'?

airSlate SignNow offers a range of pricing plans to suit businesses of all sizes. By selecting the plan that best fits your needs, you can enjoy the convenience of eSigning and document management without needing to 'Dont Send To The IRS' through traditional means, ensuring cost-effectiveness.

-

Can I integrate airSlate SignNow with other software to streamline 'Dont Send To The IRS' processes?

Yes, airSlate SignNow offers robust integrations with numerous popular software tools. This allows you to seamlessly connect your existing workflows and enhance the efficiency of document management when you 'Dont Send To The IRS', ensuring a smooth experience across platforms.

-

What features does airSlate SignNow provide to help with document management if I 'Dont Send To The IRS'?

airSlate SignNow includes features like templates, automated workflows, and detailed tracking to enhance your document management. These features support you in avoiding physical mailing, thus enabling a more efficient 'Dont Send To The IRS' approach.

-

Is there a free trial available for airSlate SignNow for those looking to 'Dont Send To The IRS'?

Yes, airSlate SignNow offers a free trial so that you can explore its features without any obligation. During this trial period, you can experience the benefits of eSigning documents and learn how to effectively 'Dont Send To The IRS' while improving your business processes.

-

How can airSlate SignNow improve my business efficiency while I 'Dont Send To The IRS'?

By utilizing airSlate SignNow, businesses can signNowly reduce turnaround times for document signing. This efficiency allows you to focus on core operations rather than handling paperwork traditionally, aligning perfectly with the goal to 'Dont Send To The IRS'.

Get more for Dont Send To The IRS

- Molina healthcare doctors note form

- Oklahoma operators security verification form

- Access lynx eligibility application for form

- Application colorado application for gas and form

- California notice of intent to lien form zlien

- Calcasieu urgent care application for employment form

- Downloadable pre printed puppy registered form

- Personal property insurance plan notice of loss form adams50

Find out other Dont Send To The IRS

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe