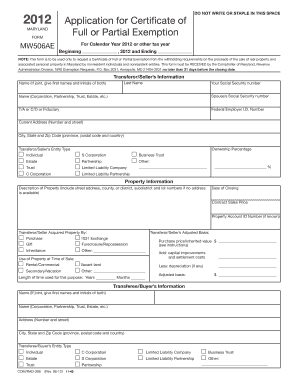

Mw506ae Form

What is the Mw506ae Form

The Mw506ae Form is a specific document used in the United States for tax purposes, particularly related to the reporting of certain income and tax credits. This form is essential for individuals and businesses to accurately report their financial activities to the Internal Revenue Service (IRS). Understanding the Mw506ae Form is crucial for compliance with federal tax regulations and for ensuring that all eligible deductions and credits are claimed appropriately.

How to use the Mw506ae Form

Using the Mw506ae Form involves several key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, accurately fill out the form, ensuring that all information is complete and correct. It is important to follow the instructions provided with the form to avoid errors that could lead to delays or penalties. After completing the form, it can be submitted electronically or by mail, depending on your preference and the guidelines set by the IRS.

Steps to complete the Mw506ae Form

Completing the Mw506ae Form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documentation, including W-2s, 1099s, and any other income records.

- Download the Mw506ae Form from the official IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring that all figures match your supporting documents.

- Calculate any applicable deductions or credits based on your financial situation.

- Review the completed form for accuracy and completeness before submission.

- Submit the form electronically or by mailing it to the appropriate IRS address.

Legal use of the Mw506ae Form

The Mw506ae Form is legally binding when completed and submitted in accordance with IRS regulations. To ensure its legal validity, it is important to use accurate and truthful information. The form must be signed and dated by the taxpayer, and any discrepancies or false information could lead to penalties or legal repercussions. Utilizing digital tools for e-signatures can enhance the security and legitimacy of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Mw506ae Form are critical to ensure compliance with tax regulations. Typically, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any specific state deadlines that may apply, as these can vary. Keeping track of these important dates helps avoid late fees and penalties.

Who Issues the Form

The Mw506ae Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary information to fulfill their tax obligations. It is important to refer to the IRS website or official publications for the most current version of the form and any updates to filing requirements.

Quick guide on how to complete mw506ae form

Effortlessly prepare Mw506ae Form on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Mw506ae Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to alter and eSign Mw506ae Form with ease

- Obtain Mw506ae Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark relevant parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you'd like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Modify and eSign Mw506ae Form and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mw506ae form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mw506ae Form used for?

The Mw506ae Form is utilized for specific tax reporting requirements in Maryland. It serves as an important document for businesses needing to report certain types of income and withholdings. Understanding its purpose is crucial for compliance and proper record-keeping.

-

How can airSlate SignNow help with the Mw506ae Form?

airSlate SignNow offers a streamlined process for preparing and signing your Mw506ae Form digitally. With our user-friendly platform, you can easily fill out, sign, and send this form, ensuring that you meet your deadlines efficiently. Our solution enhances productivity by eliminating paperwork and facilitating quick document management.

-

Is airSlate SignNow cost-effective for managing the Mw506ae Form?

Yes, airSlate SignNow provides a cost-effective solution for managing the Mw506ae Form. Our competitive pricing plans cater to businesses of all sizes, allowing you to save on traditional printing and mailing costs. Explore our various subscription options to find the best fit for your needs.

-

What features does airSlate SignNow offer for the Mw506ae Form?

airSlate SignNow includes a range of features that enhance the submission and management of the Mw506ae Form. Key functionalities include reusable templates, advanced security measures, and the ability to track document status in real time. These features ensure that your forms are efficiently handled from start to finish.

-

Can I automate the Mw506ae Form process with airSlate SignNow?

Absolutely! airSlate SignNow allows you to automate your Mw506ae Form processes through integration with other tools and software. Automation helps reduce manual errors and speeds up the workflow, which is essential for timely submissions. Utilize workflows and triggers to optimize your operations.

-

How secure is my data when using airSlate SignNow for the Mw506ae Form?

Data security is a top priority at airSlate SignNow. When handling the Mw506ae Form, we employ end-to-end encryption and adhere to strict compliance standards to protect your information. You can trust our platform to keep your sensitive data secure throughout the signing process.

-

Can I access the Mw506ae Form from mobile devices with airSlate SignNow?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing you to access the Mw506ae Form from any device. Whether you’re in the office or on the go, you can easily manage and sign your forms from your smartphone or tablet. This flexibility enhances your ability to complete tasks promptly.

Get more for Mw506ae Form

- Massachusetts letter rent form

- Letter tenant notice rent 497309686 form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase massachusetts form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant massachusetts form

- Insurer notification of termination for workers compensation massachusetts form

- Massachusetts tenant form

- Letter tenant landlord 497309691 form

- Temporary lease agreement to prospective buyer of residence prior to closing massachusetts form

Find out other Mw506ae Form

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile