Change Corporate Address with Dept Revenue Mn Form

What is the Change Corporate Address With Dept Revenue Mn Form

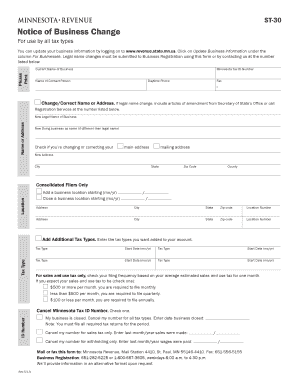

The Change Corporate Address With Dept Revenue Mn Form is a legal document used by businesses in Minnesota to officially update their registered address with the Department of Revenue. This form is essential for maintaining accurate records and ensuring that the state can reach the business for tax-related matters. Businesses must complete this form whenever they relocate to a new physical address, as it helps in the proper administration of tax obligations and compliance with state regulations.

How to use the Change Corporate Address With Dept Revenue Mn Form

To use the Change Corporate Address With Dept Revenue Mn Form, businesses should first obtain the form from the Minnesota Department of Revenue's website or through authorized channels. After acquiring the form, carefully fill it out with the new address details, ensuring that all information is accurate and up to date. Once completed, the form must be submitted according to the specified submission methods, which may include online, mail, or in-person options. It is crucial to keep a copy of the submitted form for your records.

Steps to complete the Change Corporate Address With Dept Revenue Mn Form

Completing the Change Corporate Address With Dept Revenue Mn Form involves several key steps:

- Obtain the form from the Minnesota Department of Revenue.

- Fill in the required fields, including the current and new address.

- Provide any additional information requested, such as the business name and identification number.

- Review the completed form for accuracy.

- Submit the form through the preferred method (online, mail, or in-person).

Key elements of the Change Corporate Address With Dept Revenue Mn Form

Important elements of the Change Corporate Address With Dept Revenue Mn Form include:

- Business Information: This includes the name of the business and its identification number.

- Current Address: The address currently on file with the Department of Revenue.

- New Address: The updated address where the business will operate.

- Signature: A signature is often required to validate the changes being made.

Legal use of the Change Corporate Address With Dept Revenue Mn Form

The Change Corporate Address With Dept Revenue Mn Form is legally binding once submitted and accepted by the Minnesota Department of Revenue. It serves as an official notification of the address change, which is crucial for compliance with state tax laws. Failure to update the address may result in missed communications regarding tax obligations, leading to potential penalties or legal issues.

Form Submission Methods

Businesses have several options for submitting the Change Corporate Address With Dept Revenue Mn Form:

- Online: Many businesses opt to submit the form electronically through the Minnesota Department of Revenue's online portal.

- Mail: The completed form can be mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Businesses may also choose to deliver the form in person at designated Department of Revenue offices.

Quick guide on how to complete change corporate address with dept revenue mn form

Effortlessly Prepare Change Corporate Address With Dept Revenue Mn Form on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the right format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Change Corporate Address With Dept Revenue Mn Form across any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Modify and eSign Change Corporate Address With Dept Revenue Mn Form with Ease

- Locate Change Corporate Address With Dept Revenue Mn Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors necessitating reprints. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign Change Corporate Address With Dept Revenue Mn Form and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the change corporate address with dept revenue mn form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Change Corporate Address With Dept Revenue Mn Form using airSlate SignNow?

To Change Corporate Address With Dept Revenue Mn Form using airSlate SignNow, start by uploading the required document onto our platform. Follow the prompts to fill in necessary details, and use our eSignature feature to finalize your submission. Our user-friendly interface makes this process straightforward, ensuring compliance with state guidelines.

-

Is there a cost associated with Changing Corporate Address With Dept Revenue Mn Form?

Yes, airSlate SignNow offers various pricing plans that include the capability to Change Corporate Address With Dept Revenue Mn Form. Our plans are designed to accommodate businesses of all sizes, providing a cost-effective solution for all your eSigning needs. Choose the plan that best fits your business requirements for optimal value.

-

What features does airSlate SignNow provide for Changing Corporate Addresses?

airSlate SignNow includes essential features such as template creation, document tracking, and secure eSigning, all crucial for Changing Corporate Address With Dept Revenue Mn Form. These features streamline the process, allowing you to send documents for signature and track their status in real-time. Plus, our platform ensures that all documents are stored securely for easy future access.

-

Can I integrate airSlate SignNow with other tools for address change documentation?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to Change Corporate Address With Dept Revenue Mn Form. You can connect with CRM, Google Workspace, and document storage solutions to create a more cohesive workflow. These integrations allow you to manage your documents efficiently and effectively.

-

What are the benefits of using airSlate SignNow for corporate address changes?

Using airSlate SignNow to Change Corporate Address With Dept Revenue Mn Form offers numerous benefits, including time-saving automation and enhanced accuracy. The platform reduces the risk of human error during data entry and allows for easy tracking of document status. This can speed up the entire process, ensuring that your corporate documents are updated promptly.

-

Is airSlate SignNow user-friendly for non-technical users?

Yes, one of the standout features of airSlate SignNow is its user-friendly interface, designed for both technical and non-technical users. When you're looking to Change Corporate Address With Dept Revenue Mn Form, you'll find the process intuitive and straightforward. The platform includes helpful tutorials and resources to assist users at all levels.

-

How secure is the information when Changing Corporate Addresses with airSlate SignNow?

Security is a top priority at airSlate SignNow. When you Change Corporate Address With Dept Revenue Mn Form, your information is protected with industry-leading encryption and secure data storage. We comply with top security standards to ensure that your documents remain confidential and secure throughout the signing process.

Get more for Change Corporate Address With Dept Revenue Mn Form

Find out other Change Corporate Address With Dept Revenue Mn Form

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe