Model Opgaaf Loonheffingen English Form

What is the Model Opgaaf Loonheffingen English

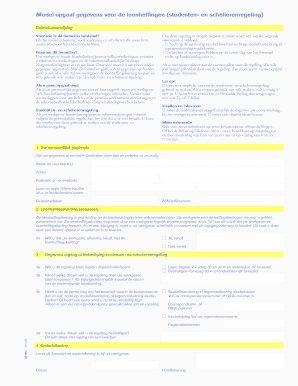

The Model Opgaaf Loonheffingen, often referred to as the loonheffingsformulier, is a tax form used in the Netherlands for reporting income tax and social security contributions. This form is essential for employees and employers alike, as it helps determine the applicable tax credits and deductions. The English version of this form is particularly useful for expatriates and non-Dutch speakers who need to comply with Dutch tax regulations. Understanding the purpose and requirements of this form is crucial for accurate tax reporting.

Steps to Complete the Model Opgaaf Loonheffingen English

Completing the Model Opgaaf Loonheffingen requires careful attention to detail. Here are the key steps:

- Gather necessary personal information, including your full name, address, and social security number.

- Collect your income details, such as salary, bonuses, and any other taxable income.

- Fill in the relevant sections of the form accurately, ensuring all figures are correct.

- Review the form for completeness and accuracy before submission.

- Submit the completed form to your employer or the tax authority as required.

Legal Use of the Model Opgaaf Loonheffingen English

The legal use of the Model Opgaaf Loonheffingen is governed by Dutch tax law. To ensure that your submission is valid, it is important to comply with specific regulations regarding e-signatures and document submissions. The form must be completed truthfully, as providing false information can result in penalties. Utilizing a reliable digital platform for e-signatures can enhance the legal standing of your submission, ensuring it meets all necessary compliance standards.

Key Elements of the Model Opgaaf Loonheffingen English

Understanding the key elements of the Model Opgaaf Loonheffingen is essential for effective completion. The main components include:

- Personal Information: Details about the taxpayer, including name and address.

- Income Details: A breakdown of all income sources to be reported.

- Tax Credits: Information on any applicable tax credits, such as the loonheffingskorting.

- Signatures: Required signatures to validate the form, which can be facilitated through digital platforms.

How to Obtain the Model Opgaaf Loonheffingen English

The Model Opgaaf Loonheffingen can be obtained through various channels. It is often available directly from the Dutch tax authority's website. Additionally, employers may provide this form to their employees during the tax reporting period. For those who prefer a digital format, many online platforms offer downloadable versions of the form, making it easier to complete and submit electronically.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Model Opgaaf Loonheffingen can be done through several methods, depending on your preference and the requirements of the tax authority:

- Online Submission: Many tax authorities allow for electronic submission through secure portals.

- Mail: You can print the completed form and send it via postal service to the appropriate tax office.

- In-Person: Submitting the form in person at a local tax office may also be an option for those who prefer direct interaction.

Quick guide on how to complete model opgaaf loonheffingen english

Prepare Model Opgaaf Loonheffingen English effortlessly on any gadget

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents rapidly without delays. Manage Model Opgaaf Loonheffingen English on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The simplest way to modify and eSign Model Opgaaf Loonheffingen English effortlessly

- Find Model Opgaaf Loonheffingen English and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Modify and eSign Model Opgaaf Loonheffingen English and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the model opgaaf loonheffingen english

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loonheffingsformulier?

A loonheffingsformulier is a tax withholding form used in the Netherlands, crucial for both employers and employees to declare income tax and social security contributions. Understanding how to fill out this document accurately is essential for compliance with Dutch tax regulations. With airSlate SignNow, you can easily manage and eSign your loonheffingsformulier to streamline your tax processes.

-

How can airSlate SignNow help with my loonheffingsformulier?

airSlate SignNow offers an intuitive platform that allows you to fill out and eSign your loonheffingsformulier quickly. The document management features ensure that you can store, share, and access your forms anytime, making tax filing more efficient. By using airSlate SignNow, you can simplify your tax workflow and ensure accuracy in your submissions.

-

Is there a cost associated with using airSlate SignNow for loonheffingsformulier?

airSlate SignNow provides a cost-effective solution for managing your loonheffingsformulier and other documents. Our pricing plans are designed to cater to various business needs, whether you're a small business or a large enterprise. You can select a plan that fits your budget while gaining access to essential features for eSigning documents.

-

What features does airSlate SignNow offer for managing loonheffingsformulier?

airSlate SignNow includes features like customizable templates, secure eSigning, and document tracking specifically for managing your loonheffingsformulier. You can also collaborate with team members in real-time, making the preparation and submission of tax documents easier than ever. These features are designed to enhance your document workflow efficiently.

-

Can airSlate SignNow integrate with other software for loonheffingsformulier?

Yes, airSlate SignNow offers seamless integrations with popular accounting and HR software, making it easier to handle your loonheffingsformulier. This integration allows for a smooth transfer of data and minimizes the chances of errors when filling out tax documents. With this capability, you can efficiently align your tax processes with other business operations.

-

What are the benefits of using airSlate SignNow for loonheffingsformulier?

Using airSlate SignNow for your loonheffingsformulier offers multiple benefits, including increased speed and accuracy in document management. Our platform reduces the hassle of traditional paperwork, allowing you to focus more on your business. Additionally, eSigning enhances security, ensuring your sensitive tax information remains protected.

-

Is it easy to use airSlate SignNow for loonheffingsformulier?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, allowing anyone to navigate the platform effortlessly. You don’t need prior experience to fill out and eSign your loonheffingsformulier effectively. Our straightforward interface ensures that even users with minimal tech skills can manage their documents with ease.

Get more for Model Opgaaf Loonheffingen English

- Ncaa bracket fill form

- Kansas affidavit exempt status form

- Bullet background paper template form

- St 455 6 5 the south carolina department of revenue sctax form

- Business certificate blumberg legal forms online

- Statement of the terms and conditions of employment of an overseas ukba homeoffice gov form

- Af910 fillable form

- 50 2 2 form

Find out other Model Opgaaf Loonheffingen English

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service