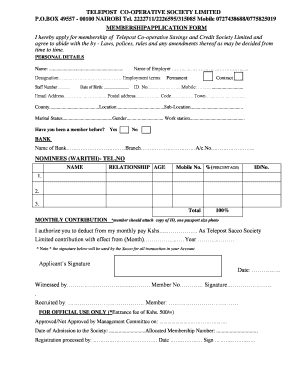

Telepost Form

What is the Telepost

The Telepost is a digital form used primarily for financial transactions, including telepost loans and applications. It streamlines the process of submitting necessary information electronically, making it easier for individuals and businesses to manage their financial needs. The Telepost is designed to be user-friendly and compliant with relevant regulations, ensuring that all submissions are secure and legally binding.

How to use the Telepost

Using the Telepost involves several straightforward steps. First, access the Telepost form through a secure digital platform. Next, fill in the required fields with accurate information, including personal identification and financial details. After completing the form, review all entries to ensure accuracy. Finally, submit the form electronically, which will initiate the processing of your request. Utilizing a reliable eSignature solution can enhance the security and validity of your submission.

Steps to complete the Telepost

Completing the Telepost involves a clear sequence of actions:

- Access the Telepost form on a secure platform.

- Fill in your personal and financial information accurately.

- Review the form for any errors or omissions.

- Sign the form electronically using a trusted eSignature tool.

- Submit the completed form for processing.

Legal use of the Telepost

The legal validity of the Telepost hinges on compliance with electronic signature laws such as the ESIGN Act and UETA. To ensure that your submission is recognized legally, it is essential to use a platform that provides a digital certificate for signers. This certificate verifies the identity of the signer and the integrity of the document, making the Telepost a secure method for completing financial transactions.

Key elements of the Telepost

Several key elements characterize the Telepost, making it an effective tool for digital transactions:

- Personal Identification: Accurate identification information is crucial for processing.

- Financial Details: Clear and precise financial data ensures proper evaluation of the request.

- Electronic Signature: A valid eSignature is necessary for legal recognition.

- Compliance: Adherence to relevant laws and regulations is essential for legitimacy.

Examples of using the Telepost

The Telepost can be utilized in various scenarios, including:

- Applying for telepost loans to secure funding for personal or business needs.

- Submitting financial aid applications for educational purposes.

- Requesting withdrawals from accounts, such as the Exodus sacco online withdrawal form.

Quick guide on how to complete telepost sacco

Complete telepost sacco seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage telepost örneği on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and eSign telepost formu easily

- Obtain telepost loans and click on Get Form to initiate.

- Employ the tools we offer to fill out your form.

- Mark important sections of your documents or mask sensitive details with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you want to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign telepost and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to telepost formu

Create this form in 5 minutes!

How to create an eSignature for the telepost loans

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask telepost sacco

-

What are telepost loans?

Telepost loans are a type of financing designed to help businesses manage short-term cash needs effectively. This solution allows for quick access to funds, enabling you to invest in opportunities or cover expenses. With airSlate SignNow, applying for telepost loans is streamlined, making the process straightforward and efficient.

-

How do telepost loans work?

Telepost loans operate by providing businesses with a predetermined sum of money that can be repaid over time with interest. Upon approval, funds are deposited directly into your account, allowing for immediate use. This method ensures that organizations can maintain cash flow and address urgent financial needs without delay.

-

What are the benefits of choosing telepost loans?

One of the key benefits of telepost loans is their quick approval process, which can often be completed within minutes. Additionally, they offer flexible repayment options tailored to your business's cash flow. These loans can be an essential tool for maintaining operational efficiency and seizing new business opportunities.

-

What are the eligibility requirements for telepost loans?

Eligibility for telepost loans varies, but generally, businesses should have a consistent revenue stream and a valid business account. Minimal paperwork is required, and the application can usually be completed online. It’s designed to be accessible for a wide range of businesses, making financing easier for everyone.

-

Are there any fees associated with telepost loans?

Yes, telepost loans may involve fees such as origination fees or interest rates that vary based on the loan amount and repayment terms. With airSlate SignNow, all costs are transparently outlined during the application process, ensuring that you fully understand your financial commitment before proceeding.

-

How can I apply for telepost loans through airSlate SignNow?

Applying for telepost loans via airSlate SignNow is simple and user-friendly. You can complete the application entirely online, with real-time capturing of necessary documents, allowing for a swift approval process. Just visit our website, fill out the required information, and submit your application to get started.

-

What documents are needed for telepost loans?

When applying for telepost loans, you typically need to provide financial statements, proof of revenue, and identification documents. airSlate SignNow simplifies the document upload process, so you can quickly submit your files and get on with your business. This ensures that your loan application is processed as efficiently as possible.

Get more for teleposta sacco

- Alan j rechter md orthopaedic associates form

- Monica mccrary form

- State occupational therapy regulatory authority contact form

- Individual cardiac treatment plan bkcrab bnetbbcomb form

- Dhs forms

- 12 things you didnt know about the dependent care fsa form

- 22nd annual interdisciplinary stroke course stroke rehabilitation new science and classic foundations sponsored by www ric form

- Community healthcare center clinic form

Find out other exodus sacco online withdrawal form

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service