12 Things You Didn't Know About the Dependent Care FSA Form

What is the Dependent Care FSA?

The Dependent Care Flexible Spending Account (FSA) is a tax-advantaged financial account that allows employees to set aside pre-tax dollars for eligible dependent care expenses. This can include costs related to childcare for children under the age of thirteen or care for dependents who are physically or mentally incapable of self-care. By using a Dependent Care FSA, individuals can reduce their taxable income, leading to potential tax savings. It is a valuable tool for working parents and caregivers looking to manage their expenses effectively.

Eligibility Criteria for the Dependent Care FSA

To qualify for a Dependent Care FSA, employees must meet specific eligibility requirements. Typically, the employee must be enrolled in a qualifying employer-sponsored health plan. Additionally, the dependent receiving care must be a qualifying individual, such as a child under thirteen or a spouse or relative who is unable to care for themselves. Employees should also be aware of the contribution limits set by the IRS, which can vary based on their tax filing status and the number of dependents.

Steps to Complete the Dependent Care FSA

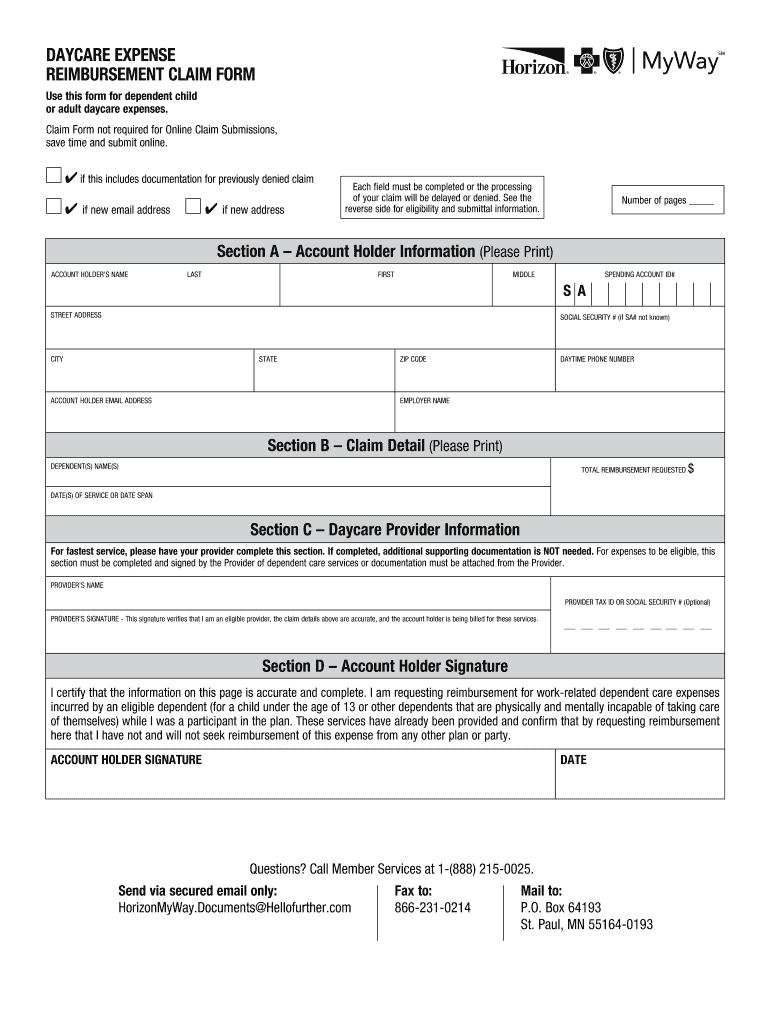

Completing the Dependent Care FSA involves several straightforward steps. First, employees should determine their eligible expenses and the amount they wish to contribute. Next, they need to fill out the necessary enrollment forms provided by their employer, ensuring all required information is accurately entered. After enrollment, employees can submit claims for reimbursement by providing documentation of their dependent care expenses, such as receipts or invoices. It is essential to keep track of all submissions and maintain records for tax purposes.

IRS Guidelines for the Dependent Care FSA

The IRS has established guidelines that govern the use of the Dependent Care FSA. These guidelines outline what constitutes eligible expenses, contribution limits, and the tax implications of using the account. For the current tax year, the maximum contribution limit is typically set at five thousand dollars for married couples filing jointly or two thousand five hundred dollars for single filers. Employees should familiarize themselves with IRS Publication 503, which provides detailed information on the tax benefits and responsibilities associated with the Dependent Care FSA.

Form Submission Methods for the Dependent Care FSA

Submitting claims for the Dependent Care FSA can be done through various methods, depending on the employer's policies. Most employers offer online submission through their benefits portal, allowing for quick and efficient processing. Alternatively, some employers may accept claims via mail or in-person submission. It is important for employees to follow their employer's specific guidelines for submission to ensure timely reimbursement.

Key Elements of the Dependent Care FSA

Several key elements define the functionality and benefits of the Dependent Care FSA. These include the pre-tax contribution mechanism, which reduces taxable income; the eligibility of expenses, which must relate to dependent care; and the reimbursement process, which requires documentation of expenses. Additionally, understanding the contribution limits and the importance of using the funds within the plan year is crucial for maximizing the benefits of the account.

Examples of Using the Dependent Care FSA

Using the Dependent Care FSA can significantly ease the financial burden of childcare and dependent care expenses. For example, a working parent may use the account to cover costs associated with daycare, after-school programs, or summer camps for their children. Similarly, caregivers can utilize the funds for services like adult daycare or in-home care for an elderly relative. These examples illustrate how the Dependent Care FSA can provide financial relief while ensuring that dependents receive the necessary care.

Quick guide on how to complete 12 things you didnt know about the dependent care fsa

Accomplish 12 Things You Didn't Know About The Dependent Care FSA effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers a fantastic eco-friendly substitute to traditional printed and signed documents, as you can obtain the appropriate form and securely keep it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle 12 Things You Didn't Know About The Dependent Care FSA on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

The easiest method to modify and electronically sign 12 Things You Didn't Know About The Dependent Care FSA with ease

- Acquire 12 Things You Didn't Know About The Dependent Care FSA and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign 12 Things You Didn't Know About The Dependent Care FSA and guarantee seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Dependent Care FSA?

The Dependent Care FSA (Flexible Spending Account) allows employees to set aside pre-tax dollars to pay for eligible dependent care expenses. It's one of the '12 Things You Didn't Know About The Dependent Care FSA' that can help you save money on childcare costs, making it a valuable benefit for working families.

-

How can I enroll in a Dependent Care FSA?

Enrollment in a Dependent Care FSA typically occurs during your employer's open enrollment period. To learn more about this and other '12 Things You Didn't Know About The Dependent Care FSA,' check with your HR department to ensure you're making the most of this opportunity.

-

What types of expenses are eligible under the Dependent Care FSA?

Eligible expenses for the Dependent Care FSA include daycare, preschool, and summer day camp costs for children under 13. Understanding these '12 Things You Didn't Know About The Dependent Care FSA' can help you maximize your savings and ensure you're compliant with IRS regulations.

-

Is there a limit to how much I can contribute to the Dependent Care FSA?

Yes, the IRS sets contribution limits for the Dependent Care FSA, which can change yearly. Currently, individual employees can contribute up to $5,000 if filing jointly. This is one of the '12 Things You Didn't Know About The Dependent Care FSA' that can impact your overall savings and tax situation.

-

What happens to unused funds in a Dependent Care FSA?

Unlike some other FSAs, unused funds in a Dependent Care FSA do not carry over into the next year and typically are forfeited. Being informed about this crucial detail is among the '12 Things You Didn't Know About The Dependent Care FSA' that can help you plan your contributions more wisely.

-

Can I use the Dependent Care FSA if both parents work part-time?

Yes, both parents can use the Dependent Care FSA even if they work part-time, but the total contributions are still subject to the IRS limit. Taking advantage of the '12 Things You Didn't Know About The Dependent Care FSA' can be especially beneficial for dual-income households managing childcare expenses.

-

Are there any tax benefits associated with the Dependent Care FSA?

Yes, contributions to the Dependent Care FSA are made pre-tax, reducing your taxable income and potentially lowering your tax bill. Understanding the '12 Things You Didn't Know About The Dependent Care FSA' can help you maximize these tax advantages while managing childcare costs efficiently.

Get more for 12 Things You Didn't Know About The Dependent Care FSA

Find out other 12 Things You Didn't Know About The Dependent Care FSA

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament