Va4 Form

What is the Va4

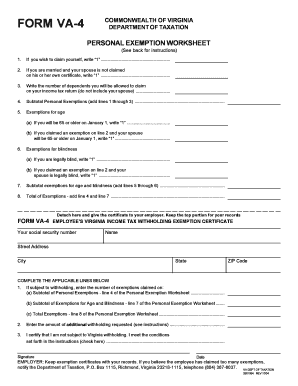

The Va4 form is a crucial document used primarily in the context of veterans' benefits. It serves as a request for information or benefits related to the Department of Veterans Affairs. This form is designed to streamline the process for veterans seeking assistance, ensuring they receive the necessary support and resources. Understanding the purpose of the Va4 is essential for veterans navigating the benefits system.

How to use the Va4

Using the Va4 form involves several steps to ensure that the information is accurately provided and submitted. First, gather all necessary personal information, including your service details and any relevant documentation. Next, fill out the form carefully, ensuring that all fields are completed as required. After completing the form, review it for accuracy before submission. The completed Va4 can be submitted online, by mail, or in person at designated locations, depending on the specific requirements set by the Department of Veterans Affairs.

Steps to complete the Va4

Completing the Va4 form involves a systematic approach to ensure all necessary information is provided. Follow these steps:

- Gather personal information, including your Social Security number, service dates, and any relevant medical records.

- Access the Va4 form through the official Department of Veterans Affairs website or obtain a physical copy.

- Fill out the form, ensuring clarity and accuracy in each section.

- Review the completed form for any errors or omissions.

- Submit the form through your preferred method: online, by mail, or in person.

Legal use of the Va4

The legal use of the Va4 form is governed by specific regulations set forth by the Department of Veterans Affairs. To ensure that the form is legally binding, it must be filled out accurately and submitted according to the guidelines provided. This includes adhering to deadlines and providing truthful information. Misrepresentation or failure to comply with the legal requirements can result in penalties, including denial of benefits.

Key elements of the Va4

Several key elements are essential when completing the Va4 form. These include:

- Personal Information: Accurate details about the veteran, including name, address, and Social Security number.

- Service Information: Dates of service, branch of service, and discharge status.

- Benefit Information: Specific benefits being requested or information being sought.

- Signature: A signature is required to certify the accuracy of the information provided.

Who Issues the Form

The Va4 form is issued by the Department of Veterans Affairs. This federal agency is responsible for providing various services and benefits to veterans, including healthcare, education, and financial assistance. The issuance of the Va4 ensures that veterans have a standardized method to request information and benefits, facilitating a smoother process for accessing necessary resources.

Quick guide on how to complete va4

Effortlessly prepare Va4 on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without delays. Manage Va4 on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to alter and eSign Va4 effortlessly

- Find Va4 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, cumbersome form retrieval, or mistakes necessitating new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Adjust and eSign Va4 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the va4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is va4 and how can it benefit my business?

The va4 is an advanced feature of airSlate SignNow that streamlines document signing and management. By utilizing va4, businesses can enhance their efficiency and reduce turnaround times for important documents. This solution is designed to simplify workflows, allowing teams to focus on core tasks while ensuring compliance and security.

-

How much does airSlate SignNow's va4 feature cost?

AirSlate SignNow offers competitive pricing plans that include access to the va4 feature. The pricing is designed to fit businesses of various sizes, ensuring that even small companies can leverage this powerful tool without breaking the bank. For specific pricing details and tailored plans, it's best to visit our pricing page.

-

What are the key features of the va4 integration?

The va4 integration comes with numerous features, such as customizable templates, automatic reminders, and secure storage. These features work together to enhance the document signing process and ensure that your team stays on track with deadlines. Additionally, the va4 integration allows for easy collaboration, making document management a breeze.

-

Can I integrate va4 with other software tools?

Yes, airSlate SignNow's va4 can seamlessly integrate with various software tools such as CRMs, ERPs, and project management applications. This integration helps you centralize your workflow, ensuring that all your tools work harmoniously. By connecting va4 with your existing systems, you can improve overall productivity and streamline operations.

-

Is va4 secure for sensitive documents?

Absolutely! The va4 feature is designed with security in mind, providing advanced encryption protocols to protect your sensitive documents. AirSlate SignNow also complies with global security standards, ensuring that your data is safe from unauthorized access. You can trust va4 to keep your documents secure while you focus on business growth.

-

How does va4 enhance collaboration among team members?

Va4 enhances collaboration by allowing multiple users to sign and comment on documents in real-time. This feature reduces the need for back-and-forth emails, speeding up the review and approval processes. By using va4, your team can work more efficiently together, ensuring everyone is on the same page.

-

What industries can benefit from the va4 features?

The va4 features of airSlate SignNow can benefit a wide range of industries, including real estate, legal, healthcare, and finance. Businesses in these sectors often require secure and efficient document signing solutions, and va4 meets these demands effectively. Regardless of your industry, va4 can help streamline your document workflows.

Get more for Va4

Find out other Va4

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement