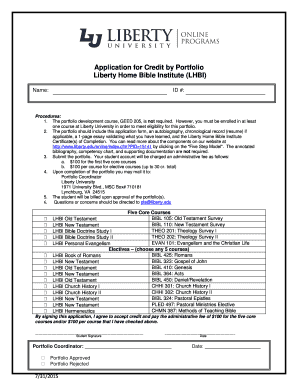

Application for Credit by Portfolio 2015-2026

What is the application for credit by portfolio?

The application for credit by portfolio is a formal document used by individuals or businesses seeking to obtain credit based on their portfolio of assets. This form allows lenders to evaluate the creditworthiness of the applicant by reviewing their financial history, assets, and liabilities. It is essential for those who may not have traditional credit scores but possess valuable assets that can serve as collateral for a loan. The application typically requires detailed information about the applicant's financial situation, including income, expenses, and the nature of the assets being offered as security.

Steps to complete the application for credit by portfolio

Completing the application for credit by portfolio involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including bank statements, tax returns, and asset valuations. Next, fill out the application form carefully, providing all requested information to avoid delays. It is crucial to review the form for completeness before submission. After filling out the application, submit it through the designated method, whether online, by mail, or in person, depending on the lender's requirements. Finally, keep copies of all submitted documents for your records.

Legal use of the application for credit by portfolio

The legal use of the application for credit by portfolio is governed by various regulations that ensure the protection of both the lender and the borrower. To be considered legally binding, the application must be completed accurately and submitted in accordance with applicable laws. This includes compliance with federal and state regulations regarding lending practices. Electronic submissions of the application are valid as long as they meet the requirements set forth by the ESIGN Act and UETA, which recognize electronic signatures and documents as legally enforceable.

Key elements of the application for credit by portfolio

Key elements of the application for credit by portfolio include personal identification information, financial history, and details about the assets being offered as collateral. Applicants must provide their name, address, Social Security number, and employment information. Additionally, the application will require a comprehensive overview of the applicant's financial situation, including income sources, outstanding debts, and asset valuations. Clear and accurate representation of these elements is vital for the lender to assess the risk and make an informed decision regarding credit approval.

Eligibility criteria

Eligibility criteria for the application for credit by portfolio typically include age, residency, and financial stability. Applicants must be at least eighteen years old and a legal resident of the United States. Lenders often require proof of income and a satisfactory credit history, although those with substantial assets may still qualify even with limited credit history. Additionally, the value and type of assets being offered as collateral play a significant role in determining eligibility, as lenders assess the risk associated with the loan.

Form submission methods

The application for credit by portfolio can be submitted through various methods, depending on the lender's preferences. Common submission methods include online platforms, where applicants can fill out and submit the form electronically, ensuring a faster processing time. Alternatively, applicants may choose to print the form, complete it manually, and send it via mail. In-person submissions are also an option for those who prefer direct interaction with the lender. Regardless of the method chosen, it is essential to follow the lender's specific instructions for submission to avoid any complications.

Quick guide on how to complete application for credit by portfolio

Effortlessly Prepare Application For Credit By Portfolio on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily find the right form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your documents without hindrances. Manage Application For Credit By Portfolio on any device using the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

Steps to Modify and eSign Application For Credit By Portfolio with Ease

- Find Application For Credit By Portfolio and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight signNow sections of the documents or obscure sensitive information with specialized tools offered by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you would like to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Application For Credit By Portfolio to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for credit by portfolio

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is the application credit lhbi and how does it work?

The application credit lhbi is a financial tool that helps streamline the documentation process for credit applications. By using airSlate SignNow, businesses can easily create, send, and eSign credit applications, enhancing efficiency and reducing turnaround times.

-

How much does it cost to use the application credit lhbi feature?

The pricing for using the application credit lhbi feature depends on the chosen plan with airSlate SignNow. Generally, our plans are designed to be cost-effective, ensuring you get the most value from your investment while enabling seamless document management.

-

What are the key features of the application credit lhbi?

The application credit lhbi offers features such as customizable templates, secure eSigning, and real-time tracking of document status. These features ensure that users can efficiently manage credit applications while maintaining a high level of security.

-

Can the application credit lhbi integrate with other software?

Yes, the application credit lhbi can seamlessly integrate with various third-party applications such as CRM and accounting software. This flexibility allows businesses to maintain their existing workflows while enhancing document management through airSlate SignNow.

-

What are the benefits of using airSlate SignNow for application credit lhbi?

Using airSlate SignNow for application credit lhbi provides several benefits, including faster processing times and reduced paperwork. Businesses can enhance their operational efficiency and improve customer experience by simplifying the application process.

-

Is the application credit lhbi solution secure?

Absolutely, the application credit lhbi solution is built with security in mind. airSlate SignNow employs advanced security measures to ensure that all documents are protected and comply with industry standards for data protection.

-

Who can benefit from the application credit lhbi?

Businesses of all sizes, from startups to large enterprises, can benefit from the application credit lhbi. It is particularly useful for financial institutions, lenders, and businesses that frequently process credit applications.

Get more for Application For Credit By Portfolio

Find out other Application For Credit By Portfolio

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement